All eyes are on how China responds to Trump’s 104% tariff. With the numbers already becoming meaningless, the Australian dollar could get dragged a lot lower with a yuan devaluation, with AUD/CHF leading the bearish stampede amid Swiss franc strength.

By : Matt Simpson, Market Analyst

All eyes are on how China responds to Trump’s 104% tariff. With the numbers already becoming meaningless, the Australian dollar could get dragged a lot lower with a yuan devaluation, with AUD/CHF leading the bearish stampede amid Swiss franc strength.

Any hopes of a ‘Turnaround Tuesday’ were dashed when President Trump announced a 104% tariff on Chinese goods, citing China’s failure to remove its 34% retaliatory tariff on US exports. The triple-digit levy is set to take effect from midnight Wednesday, alongside new tariffs of up to 50% on goods from all other countries. The administration has shifted focus to continued negotiations with other trading partners. All eyes are now on China, which on Tuesday vowed to “fight to the end.” Their response today will be telling.

Assuming China skips the pointless route of throwing large numbers back at the US, they could go straight to currency devaluation.

View related analysis:

- AUD/USD weekly outlook: Bears Eye Sustainable Move to the 50s Amid Tariff Turmoil

- 2025 could be one heck of a ride if bearish AUD/JPY clues are correct

- Traders Placed Bets Against VIX and Swiss Franc Ahead of Tariffs: COT Report

- CHF Beats Yen for Safety as Tariffs Take Second Quarter to the Slaughter

- If Consumers Don’t Consume, a Recession Could be Presumed

All eyes on China’s yuan fix today

Traders are already betting on a devaluation of China’s currency by shorting the offshore yuan (CNH), pushing USD/CNH up 1.2% to a record high on Tuesday. USD/CNH shares a tight correlation with AUD/USD, which has now slipped further into the 50–60 cent range—a level typically associated with financial and economic crises.

Put simply, a sustained move higher in USD/CNY spells trouble for the Australian dollar and the RBA. It effectively imports inflation—the very thing the RBA has been trying to contain post-COVID. The central bank may soon face a tough choice: intervene to support the currency, or risk worsening inflation by cutting rates to support growth.

Click the website link below to read our exclusive Guide to AUD/USD trading in 2025

https://www.forex.com/en-us/market-outlooks-2025/FY-aud-usd-outlook/

Australian dollar analysis: A bearish cash cow?

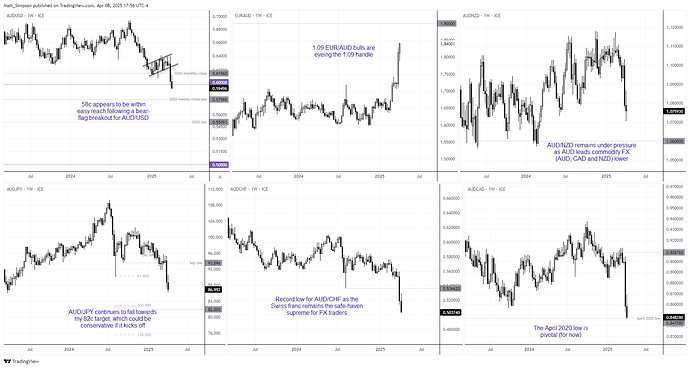

- AUD/USD is testing Monday’s low and sits just a day’s range away from 59c (by recent standards), with the 2020 weekly close low (~58c) looking increasingly attractive to bears.

- EUR/AUD is probing Monday’s high, on the verge of setting a fresh 5-year high, with 1.59 now firmly in focus for euro bulls.

- AUD/NZD continues to buckle under its own weight, with AUD/USD leading the move lower in the commodity FX space compared to NZD/USD and CAD/USD. 1.06 anyone?

- AUD/JPY is continuing toward my 82 target, which could prove conservative if yuan depreciation deepens in the coming weeks.

- AUD/CHF has hit a fresh record low, with the Swiss franc remaining the go-to safety play amid Trump’s escalating trade war.

- AUD/CAD sliced through my bearish 87 target with ease and now trades at a 5-year low, as the Australian dollar feels more heat from a weakening yuan than the Canadian dollar has from Trump’s tariffs. It clings to the April 2020 low, which seems like a pivotal level over the near term.

Click the website link below to read our exclusive Guide to gold trading in 2025

https://www.forex.com/en-us/market-outlooks-2025/FY-gold-outlook/

Implied volatility is elevated

Perhaps not too surprisingly, the 1-day implied volatility band has more than doubled for AUD/USD and the closely intertwined NZD/USD. This provides a potential move of 52 pips in either direction (104 total) spanning the 0.5899 – 0.6603 area. Note that the Swiss franc is also expected to have higher levels of volatility, with the 1-day IV for USD/CHF rising to 241% of its 20-day average (52 pips up or down, or 104 total).

Economic events in focus (AEDT)

- 11:15 – PBOC announces the yuan fix

- 11:30 – Australian building approvals

- 12:00 – RBNZ interest rate decision

- 15:00 – Japanese household confidence

- 16:00 – Japanese machine tool orders

- 02:30 – FOMC member Barkin speaks

- 03:00 – US 10-year treasury auction

- 04:00 – FOMC meeting minutes

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.