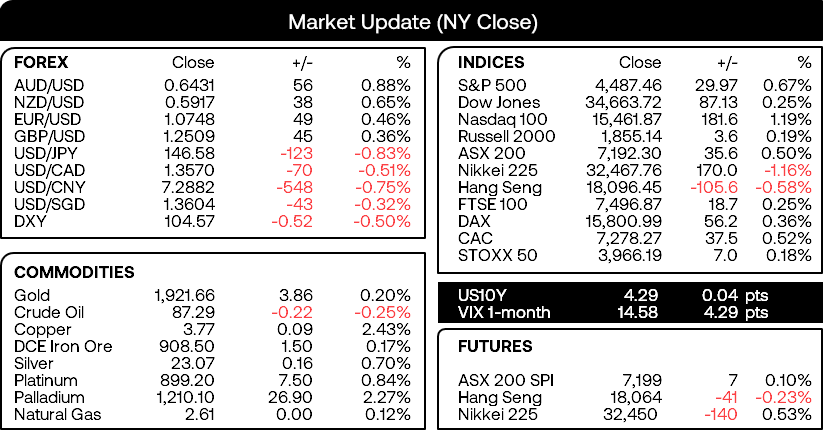

Market Summary:

- China’s loan growth in August of ¥1360 billion was nearly four times as expected, which shows a welcomed pickup in demand and a refreshing headline from China. Mortgage loans rebounded which suggests recent rate cuts are doing their bit to support the sector. Totally social financing also beat expectations, although the usual calls for more policy support are in the air.

- USD/JPY suffered its worst day in eight weeks following comments from BOJ Governor Ueda over the weekend, which suggested the central bank is laying the groundwork to raise rates (even if it remains unlikely to be this year)

- The PBOC gave the yuan its strongest fix bias on record yesterday, which saw USD/CNH fall nearly 1% during its worst session in six months

- Tesla (TSLA) rose over 10% after JP Morgan estimated a $600 billion rise in its market value, with its Dojo supercomputer likely to help productivity into robotaxis and software services

- AI optimism helped the Nasdaq 100 lead Wall Street indices higher and notch up its third daily gain.

- The US dollar pulled back from its highs during its worst session in nine, which allowed AUD/USD to finally produce a decent bounce from its cycle lows

- AUD/USD held up surprisingly well last week in the fact of stronger data from the US and weak data from China, and if we’re to be presented with a soft US inflation report on Wednesday then it could provide the likes of AUD/USD and EUR/USD fuel for a much larger bounce

- As noted in yesterday’s report, the US dollar has just notched up eight consecutive bullish weeks, which suggests we’re at or near a minor inflection point for the dollar, statistically speaking

Events in focus (AEDT):

- 10:30 – Australian consumer sentiment (Westpac)

- 11:30 – Australian business sentiment (NAB)

- 16:00 – UK employment and wages

- 17:00 – Spanish CPI

- 19:00 – ZEW economic sentiment

- 21:00 – UK GDP estimate

- 21:00 – OPEC monthly report

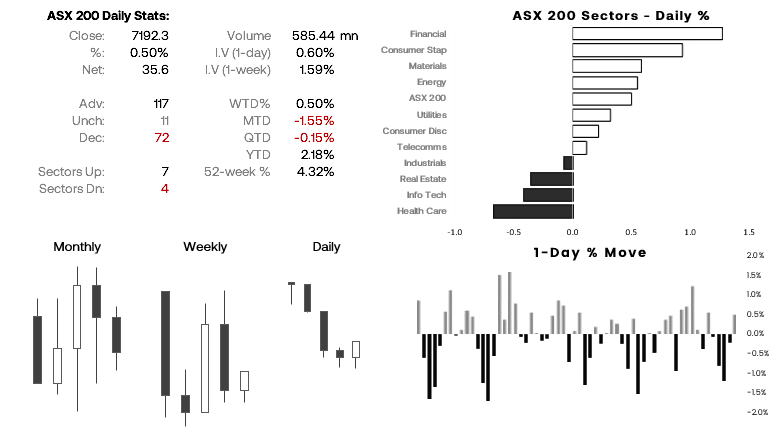

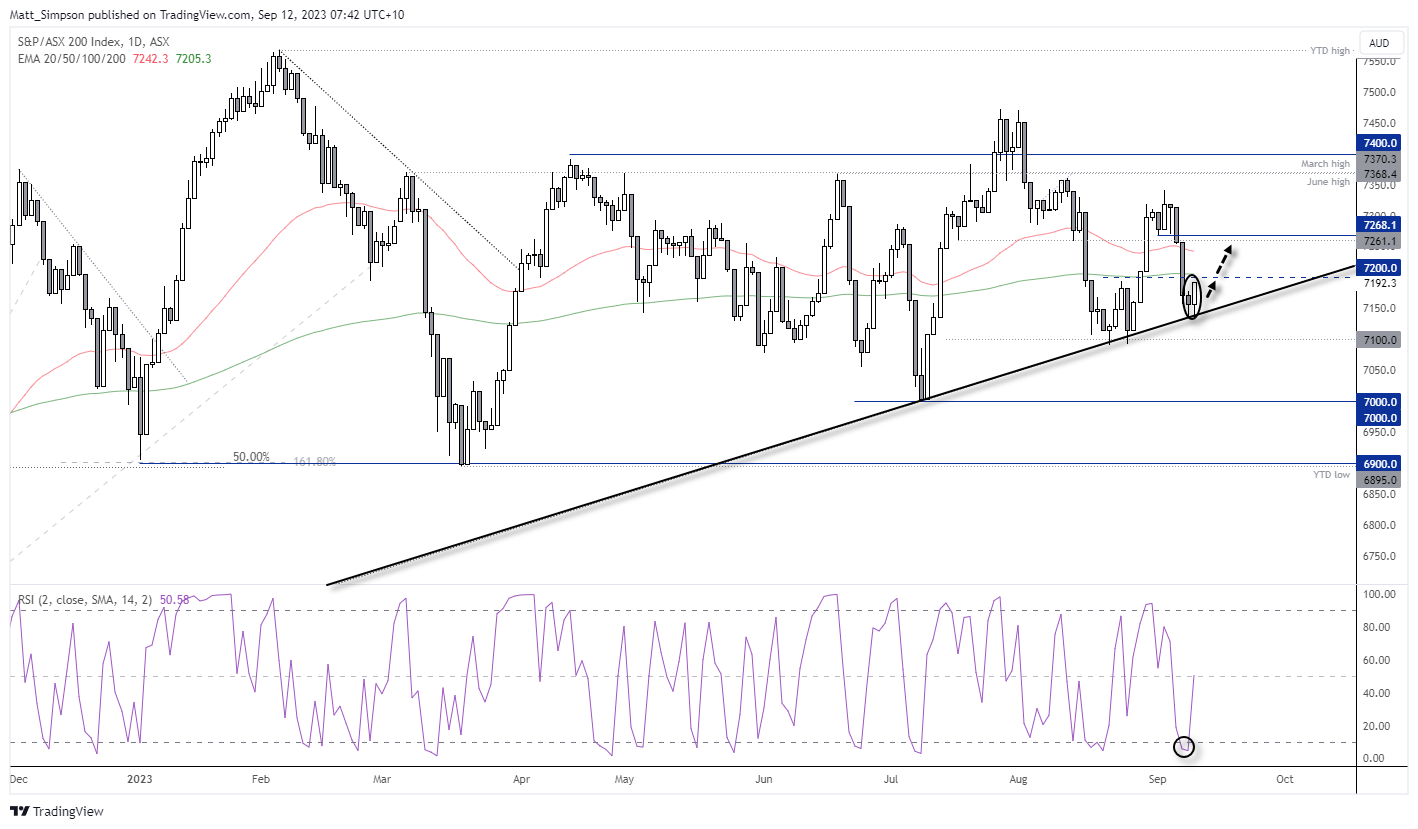

ASX 200 at a glance:

- The ASX 200 snapped a 4-day losing stream on Monday and produced a small bullish engulfing candle

- RSI (2) was oversold on Friday and prices have turned higher from the March 2020 trendline, to suggest a swing low has formed

- However, 7200 and the 200-day EMA are nearby, to bulls may either want to seek pullbacks within Monday’s range to increase the potential reward to risk, or wait for a break above the 200-day EMA

AUD/USD technical analysis (1-hour chart):

The combination of firmer loan data from China and a softer US dollar helped AUD/USD notch up its best in six weeks on Monday. Whilst prices chopped around the March 2020 trendline and effectively invalidated it, ‘the battler’ has managed to climb back above 64c. A bullish divergence has also formed with RSI (2), so perhaps the market is trying to turn the ship around. Like the ASX 200, we’d prefer to seek dips within Monday’s range to increase the potential reward to risk ratio, and use the break of the cycle lows to invalidates the near-term bullish bias. 0.6500 seems a sensible target, as it sits just beneath the 30 August high and 50-day EMA. And it is likely down to how hot (or not) US inflation data is on Wednesday as to which direction AUD/USD trades heading into the weekend.