Commodity currencies hint towards a risk off tone, with NZD/USD leading the way lower and AUD/USD looking set to follow. USD/JPY is also in focus for today’s BOJ meeting.

By :Matt Simpson, Market Analyst

Market Summary:

- Wall Street gapped higher at the open and pushed to new record highs, although their smaller-ranged days and dubious candles outside of upper Keltner bands suggest sighs of exhaustion around current levels.

- The Nasdaq 100 closed beneath its open and nearly filled its opening gap, the S&P 500 closed the day flat with a potential island reversal day and the Dow Jones handed back most of its days, although did manage to close above its opening gap

- Commodity FX were the weakest major currencies overnight to hint at a slight risk-off tone to begin the week, with NZD leading CAD and AUD lower

- New Zealand’s services PMI contracted in December, falling -2.3 points to 48.8 and building a case for some RBNZ easing this year. As global PMIs tend to move in tandem, these early Asian reports can provide an indication of what to expect. And if European and US PMIs come in soft it could spark renewed bets of ECB and Fed easing. Australia’s PMI reports for manufacturing, services and composite are released by S&P global on Wednesday.

- Cold weather in the US and ongoing disruptions from the Red sea and war in Gaza saw crude oil prices rise as much as 4.3% on Monday. The bias remains bullish whilst prices hold above $72 and for them to head towards $77, near the 100 and 200-day EMA’s

Events in focus (AEDT):

The BOJ (Bank of Japan) announce their interest rate decision and release their quarterly report today. In all likelihood, there will be no change. Yet with the BOJ’s appetite for surprises over the years then inaction is not guaranteed. And as they have a longstanding ultra-dovish policy, any change would surely have to be hawkish. If so, that could see a surge of yen strength and send USD/JPY lower.

- 09:00 – Australian business confidence (NAB)

- 14:00 – BOJ interest rate decision, quarterly report

- 16:00 – Singapore inflation

- 02:00 – Richmond Fed manufacturing and services

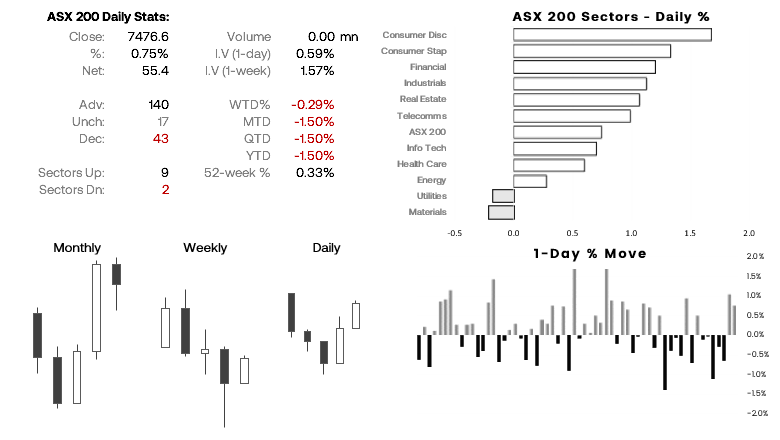

ASX 200 at a glance:

- The ASX 200 rallied for a second consecutive day on Monday for its best 2-day performance in a month

- 140 stocks advanced (70%) and 43 declined (21.5%) while 17 remained unchanged (8.5%)

- 10 of its 11 sectors rose, led by consumer discretionary and staple stocks

- The ASX 200 is expected to open higher due to the positive lead from Wall Street and rise of SPI 200 futures overnight

- Yet the reversals on Wall Street and lower levels of volatility should warn against runaway gains for the ASX today

- Take note of the positive average returns either side of Australia day, which you can read more about in the article below

ASX 200 forecast: Forward testing the ASX 200 around Australia Day

ASX 200 forecast: Forward testing the ASX 200 around Australia Day

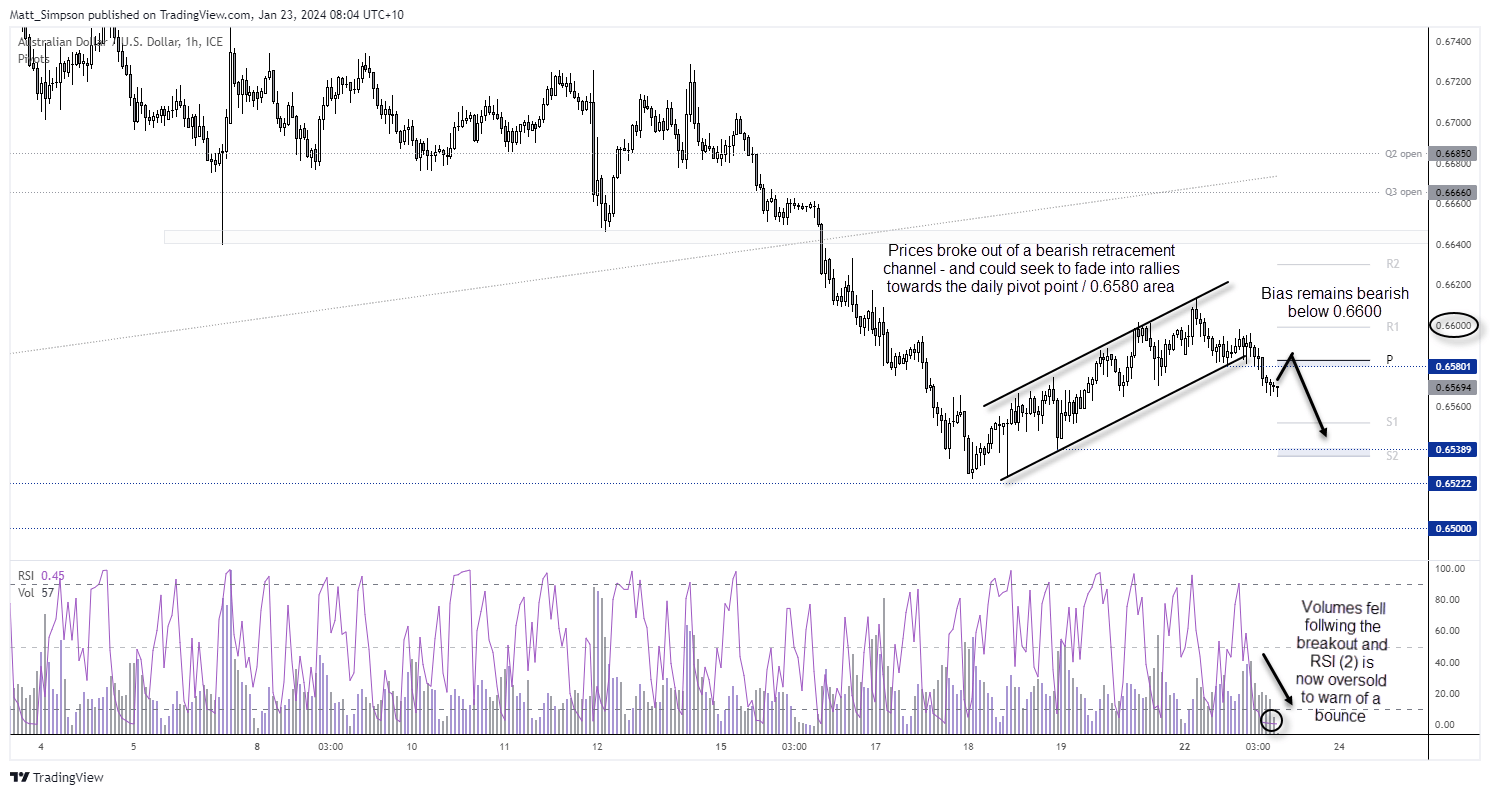

AUD/USD technical analysis (1-hour chart):

A bearish outside day formed on AUD/USD to suggest the anticipated countertrend bounce from 0.6522 is already complete. The fact that we have dubious price action at record highs on Wall Street and commodity FX were the weakest majors on Monday adds to the case for at least a minor leg lower for AUD/USD.

The 1-hour chart shows a bearish breakout from a corrective channel with momentum now realigned with the dominant bearish trend on this timeframe. However, volumes fell following the breakout and RSI (2) was oversold, to suggest a bounce from current levels could be due before its next leg lower.

Bears could seek to fade into retracements towards the daily pivot point / 0.6580 lows with a stop above the daily R1 / 0.6600 handle, and target lower daily pivot points or cycle lows.

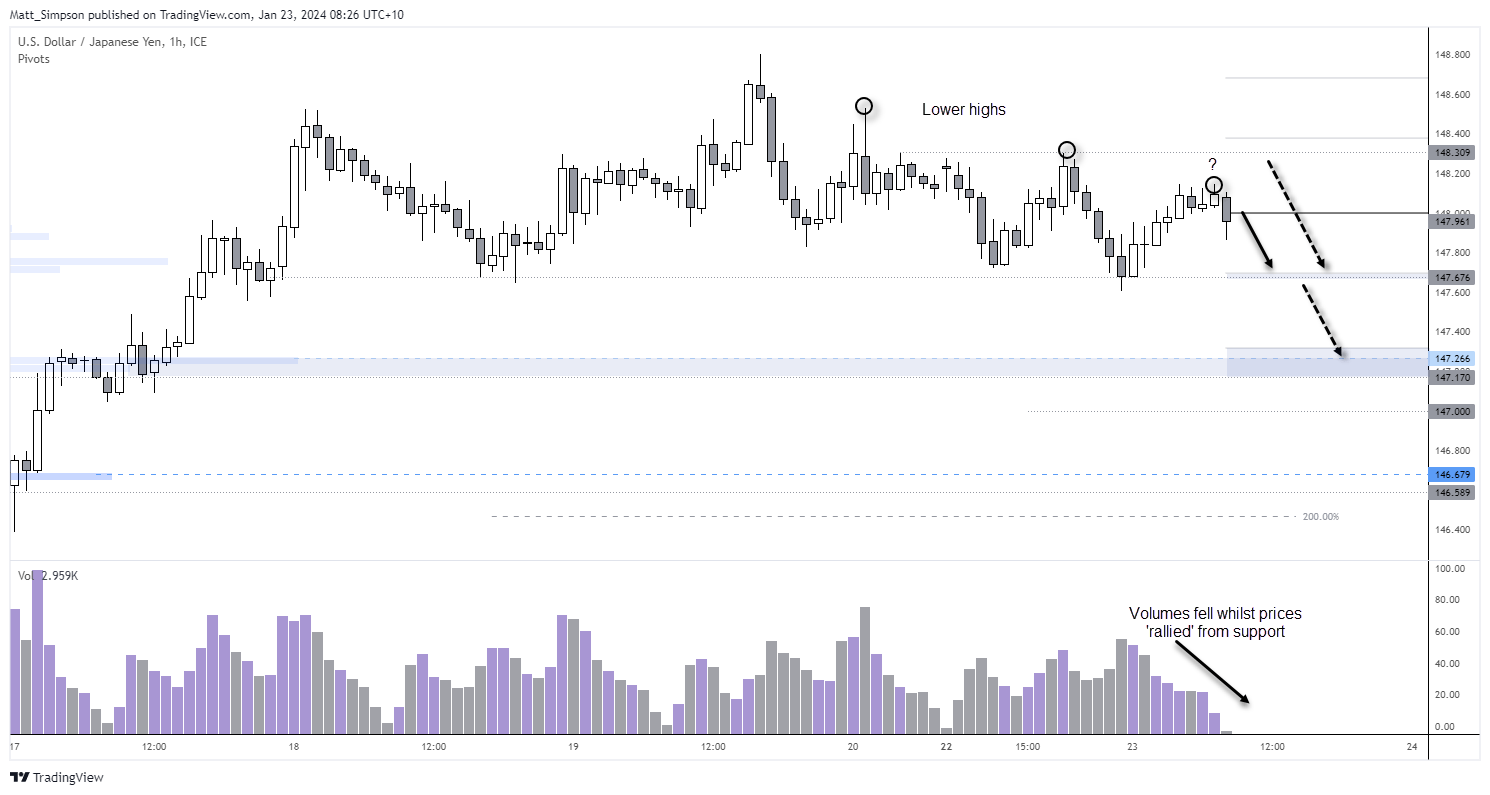

USD/JPY technical analysis (1-hour chart):

I was partly right in yesterday’s European Open report; prices did rebound from the cycle lows, but it did not break lower to confirm a head and shoulders top. However, the market is trying to form a swing high, so perhaps we’ll see another leg lower heading into today’s BOJ announcement. But fore it to break the cycle lows, a hawkish twist is likely required.

A series of lower highs have formed on the 1-hour chart, and momentum is trying to turn lower which suggests another lower high has formed. Of so, bears could short below the daily pivot point and target the cycle lows near the daily R1. If prices advance to the daily R2, it could be another area to seek bearish reversal candles.

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.