By :David Scutt, Market Analyst

- Australia’s August services PMI revealed a pickup in activity levels

- Hiring grew, demand picked up but prices to customers eased

- The services sector is the largest and most important part of the Australian economy

- Markets price three RBA rate cuts by June, the RBA only discussed hikes or holding in August

- AUD/USD rebound underpinned by improvement in risk appetite

A beautiful set of numbers

Australia’s ‘flash’ services purchasing managers index (PMI) for August hardly conveys a message of an economy in need of monetary support, raising questions over market pricing that looks for the Reserve Bank of Australia (RBA) to begin cutting rates as soon as December.

The S&P Global PMI rose 1.8 points to 52.2, indicating an acceleration in activity relative to July.

S&P Global said the improvement was underpinned by “improvements in underlying demand” which reportedly drove a “solid rise in new work”. The pickup in domestic demand boosted hiring and helped clear order backlogs.

Importantly, despite the proportion of firms seeing input prices increase lifting to 18-month-highs, the share passing higher prices to customers eased to levels not seen since January.

Stronger activity, firmer demand, ongoing hiring and fewer firms raising prices – sounds like a soft landing.

Source: S&P Global

PMIs measure business activity relative to the previous month, evaluating shifts in output, hiring, new orders, exports, delivery times, inventories and overall business sentiment. A score above 50 indicates improvement while a figure below 50 points to a decline. The further away from 50, the greater the breadth of improvement or deterioration.

The flash reading accounts for around 80 to 85% of monthly respondents, making it a accurate guide on how the final PMI will likely print one week later.

The improvement in August is important as the services sector accounts for around three-quarters of Australia’s annual economic output, and an even larger share of employment at over 80%.

Click the website link below to get our exclusive Guide to AUD/USD trading in H2 2024.

https://www.cityindex.com/en-au/market-outlooks-2024/h2-aud-usd-outlook/

RBA discusses hikes or holding, markets bet on cuts

While you shouldn’t extrapolate the details from one report to form a view on the economy, real-time signals on activity such as this makes you question the merits of markets favouring a rate cut from the RBA as soon as December.

Cash rate futures are fully priced for a cut by February and have three factored in by June. That’s despite the minutes of the RBA’s August policy meeting warning that “the risk of inflation not returning to target within a reasonable timeframe had increased” and that “their tolerance for this timeframe being pushed out further was limited.” It’s telling the only options the board discussed were to either hike of hold rates, not cut.

Data such as that received today is only likely to continue that pattern in future meetings.

Source: ASX

While narrowing relative interest rate differentials between the US and Australia have been one factor underpinning the AUD/USD rally, one look at a correlation matrix suggests the rebound in risk appetite has been a stronger overall force.

While the two are undeniably linked, those trading AUD/USD should pay close attention to signals from asset classes with a high beta to broader markets, such as bitcoin, Nasdaq 100 or similar.

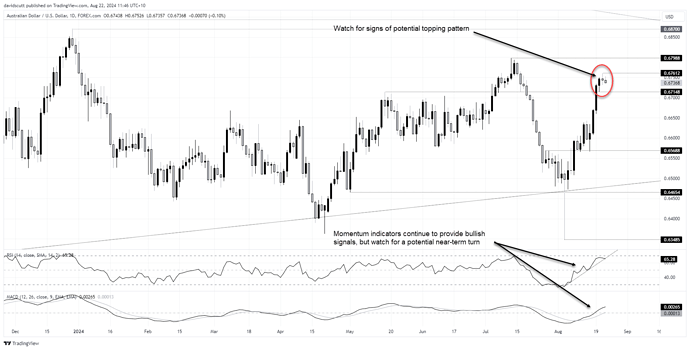

AUD/USD rally loses steam

Looking at the AUD/USD daily, the spinning top on Wednesday suggests a degree of wariness may be creeping in after the powerful rally we’ve seen following Japan’s market meltdown earlier this month. It’s too early to tell whether it’s a potential topping pattern without seeing how Thursday’s candle prints, so be alert to the close later in the session. For now, MACD and RSI (14) are providing bullish signals on momentum.

On the topside, resistance is located at .67612, .67988 and .6870. On the downside, a break of .67148 opens the door to a potential reversal towards .65688 with only minor support around .6640 found in between.

From a fundamental perspective, with markets pricing in eight cuts from the Fed by June next year, you’ll struggle to see dovish bets swell any further without sparking concern about a hard economic landing. If we were to see the number of cuts increase or decrease dramatically from these levels, it would likely create headwinds for AUD/USD.

– Written by David Scutt

Follow David on Twitter @scutty

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.