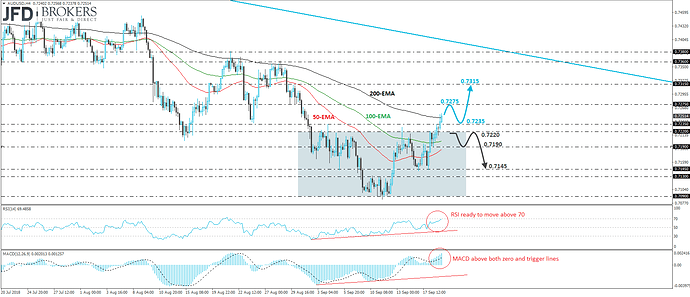

AUD/USD traded higher on Wednesday, breaking above the 0.7235 resistance (now turned into support) barrier, defined by the peak of the 4th of September, which is also slightly below the inside swing low of the 24th of August. In our view, although the pair continues to trade below the downtrend line drawn from the peak of the 16th of February, on the 4-hour chart, it has completed an inverted head and shoulders formation. Thus, we would expect the current recovery to continue for a while more.

We expect the bulls to stay in the driver’s seat and perhaps challenge the 0.7275 zone soon, defined by the inside swing low of the 29th of August. If they prove strong enough to overcome that hurdle, then we may experience extensions towards the peak of the next day, at around 0.7315.

Looking at our short-term oscillators, we see that the RSI edged higher and now appears ready to cross above its 70 line, while the MACD lies above both its zero and trigger lines, pointing up as well. These indicators detect strong upside speed and support the case for the pair to continue drifting north for a while more. That said, given that the RSI appears ready to enter its extreme positive zone, we would stay cautious of a possible return move after the pair hits the 0.7275 resistance, perhaps for a test at the 0.7235 barrier as a support this time.

However, in order to abandon the bullish case, we would like to see a clear and decisive dip back below 0.7220. Such a move would bring the rate back within the sideways range where the head and shoulders was formed and may cancel the short-term reversal. The bears may be encouraged to push the battle towards the 0.7190 level, the break of which could open the path for our next support of 0.7145, near the lows of Monday and Tuesday.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.