AUD/USD faces bearish pressure after rejecting VPOC resistance, while EUR/AUD eyes a bullish breakout from an inverted head and shoulders.

By : Matt Simpson, Market Analyst

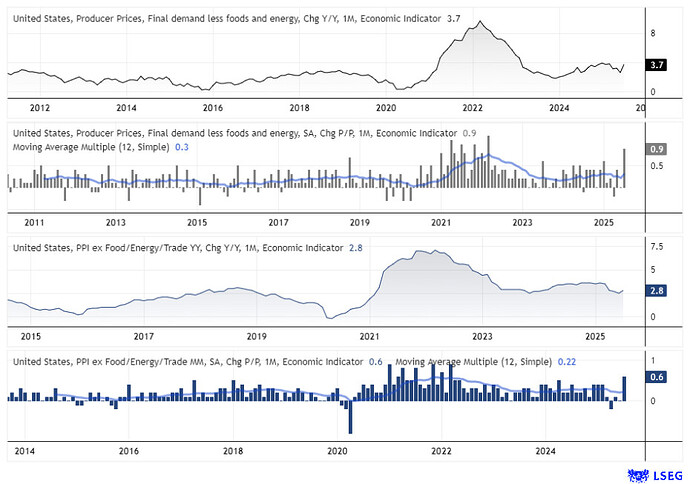

US Dollar Rises on Hot PPI, Cooling Fed Rate Cut Bets

The US dollar strengthened on Thursday after hotter-than-expected PPI data showed producer prices jumping 0.9% m/m and core PPI climbing 0.6% m/m. The data reinforced expectations that the Federal Reserve will resist aggressive rate cuts, limiting easing compared to what markets — and President Trump — have been calling for.

Fed Funds futures still price a 25bp cut in September, but odds for October have fallen to 52%, with December at 72% — down sharply from the three cuts expected after last week’s weak US nonfarm payrolls. This shift underpins further upside potential for the US Dollar Index (DXY), which is holding above a key trendline support level.

Chart prepared by Matt Simpson - data source: Bureau of Labor Statistics (LBS), London Stock Exchange Group (LSEG)

View related analysis:

- USD/JPY Rises Into US CPI, Bearish Patterns Prevail on CAD/JPY, CHF/JPY

- EUR/AUD Analysis: April’s Candle is Eerily Similar to 2008, 2020 Highs

- EUR/AUD Reversal Risk Builds as Bearish Momentum Aligns With Historical Tops

The Australian dollar remains under pressure against the US dollar after a strong rejection from July’s VPOC resistance, while the euro is testing a potential bullish breakout against the Australian dollar. With multiple high-impact economic releases on the calendar, including GDP data from Japan, China’s retail sales, and US retail figures, volatility across AUD/USD and EUR/AUD could pick up sharply in the coming sessions.

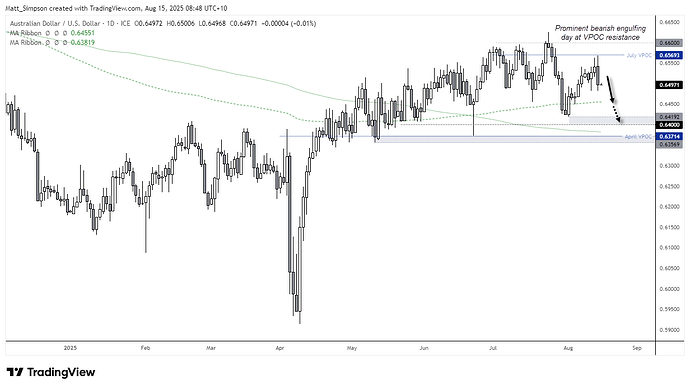

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

A prominent bearish engulfing candle has formed on the AUD/USD daily chart, with the high perfectly respecting the July VPOC (volume point of control) — a resistance level highlighted repeatedly over the past two weeks.

With the US Dollar Index holding above trend support for now, the near-term bias leans towards further upside for the greenback and potential downside for the Australian dollar. A move towards the 0.6400 support zone remains possible, depending on the Federal Reserve’s willingness to resist political pressure from the Trump administration for multiple rate cuts.

Traders should also watch the 200-day EMA near 0.6540 and the 0.6419 swing low, which could provide interim support if selling pressure resumes.

Chart analysis by Matt Simpson - data source: TradingView AUD/USD

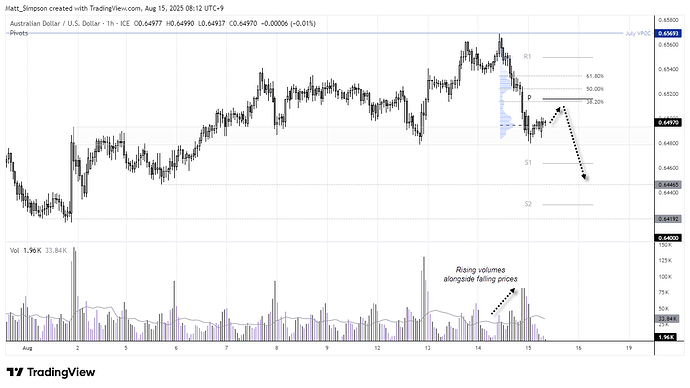

AUD/USD Technical Analysis: 1-Hour Chart

The 1-hour chart shows the fall from the VPOC was accompanied with rising volumes, which suggests bearish initiation behind the moved. Support was found around the 0.6480 lows, and while prices are trying to retrace higher they are on low volumes – which suggests the move to be a retracement.

Bears could seek to fade into moves towards the daily pivot point (0.6516) near the 38.2% Fibonacci level. Also note a HVN from the decline sits around the 50% retracement level near 0.6520, making a potential zone of resistance for bears to monitor.

A break below 0.6480 assumes bearish continuation in line with the daily timeframe.

Chart analysis by Matt Simpson - data source: TradingView AUD/USD

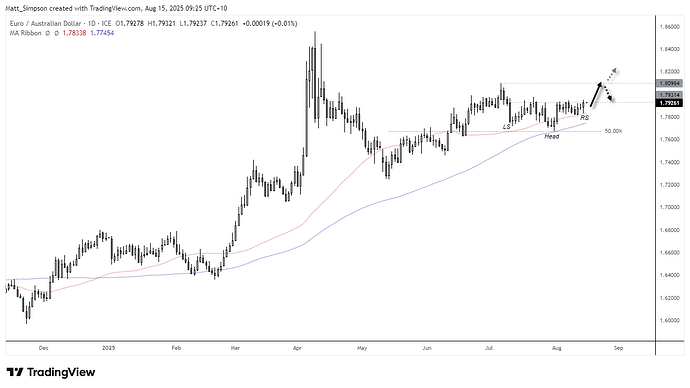

EUR/AUD Technical Analysis: Euro vs Australian Dollar

An interesting setup is emerging on the EUR/AUD daily chart. The cross is grinding higher in a slightly haphazard uptrend, and one that I suspect will eventually provide to be corrective and break to new lows. But for now an inverted head and shoulders top pattern suggests EUR/AUD may try to burst higher over the near term.

The 100-day SMA provided support in late July, but more recently prices have bounced from the 50-day SMA. Yesterday’s bounce saw a bullish outside day form at the 50-day SMA.

The 1.8 handle may prove to be tricky to break above, which works the potential reward to risk against the idea. However, should bulls be able to enter within the range of yesterday’s candle, it could improve the potential R/R for at least an anticipated move to 1.80. A break above which brings the 1.9098 high into focus.

Chart analysis by Matt Simpson - data source: TradingView EUR/AUD

Economic Events in Focus (AEST / GMT+10)

08:30 NZD Business NZ PMI (NZD/USD, AUD/NZD, NZD/JPY)

08:45 NZD External Migration & Visitors, FPI, Permanent/Long-Term Migration, Visitor Arrivals (NZD/USD, AUD/NZD, NZD/JPY)

09:50 JPY Foreigner Bond/Stock Purchases, GDP, GDP Capital Expenditure, GDP External Demand, GDP Price Index, GDP Private Consumption (USD/JPY, EUR/JPY, AUD/JPY)

11:00 AUD MI Inflation Expectations (AUD/USD, AUD/JPY, EUR/AUD)

11:30 CNY House Prices (USD/CNH, AUD/CNH, CNH/JPY)

12:00 AUD Thomson Reuters IPSOS PCSI (AUD/USD, AUD/JPY, EUR/AUD)

12:00 JPY Thomson Reuters IPSOS PCSI (USD/JPY, EUR/JPY, AUD/JPY)

12:00 CNY China Thomson Reuters IPSOS PCSI, Fixed Asset Investment, Industrial Production, Industrial Production YTD, Retail Sales, Retail Sales YTD, Unemployment Rate, NBS Press Conference (USD/CNH, AUD/CNH, CNH/JPY)

14:30 JPY Capacity Utilization, Industrial Production (USD/JPY, EUR/JPY, AUD/JPY)

17:00 CHF GDP (USD/CHF, EUR/CHF, CHF/JPY)

17:00 CNY FDI (USD/CNH, AUD/CNH, CNH/JPY)

18:30 HKD GDP (USD/HKD, EUR/HKD, AUD/HKD)

20:00 EUR ECOFIN Meetings, Reserve Assets Total (EUR/USD, EUR/JPY, EUR/GBP)

22:30 USD Core Retail Sales, Export Price Index, Import Price Index, NY Empire State Manufacturing Index, Retail Control, Retail Sales, Retail Sales Ex Gas/Autos (EUR/USD, USD/JPY, GBP/USD)

22:30 CAD Manufacturing Sales, New Motor Vehicle Sales, Wholesale Sales (USD/CAD, EUR/CAD, CAD/JPY)

23:15 USD Capacity Utilization Rate, Industrial Production, Manufacturing Production (EUR/USD, USD/JPY, GBP/USD)

00:00 USD Business Inventories, Michigan Inflation Expectations, Consumer Sentiment (EUR/USD, USD/JPY, GBP/USD)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter u/cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.