AUD/USD falls for the third consecutive day after failing to test the November high (0.6688).

By :David Song, Strategist

Australian Dollar Outlook: AUD/USD

AUD/USD falls for the third consecutive day after failing to test the November high (0.6688), and the exchange rate may continue to give back the rebound from the monthly low (0.6455) as it carves a series of lower highs and lows.

AUD/USD Fails to Test November High Ahead of Australia CPI

AUD/USD continues to fall from a fresh yearly high (0.6625) amid a further recovery in the US Dollar, and Australia’s Consumer Price Index (CPI) may keep the exchange rate under pressure as the update is anticipated to show slowing inflation.

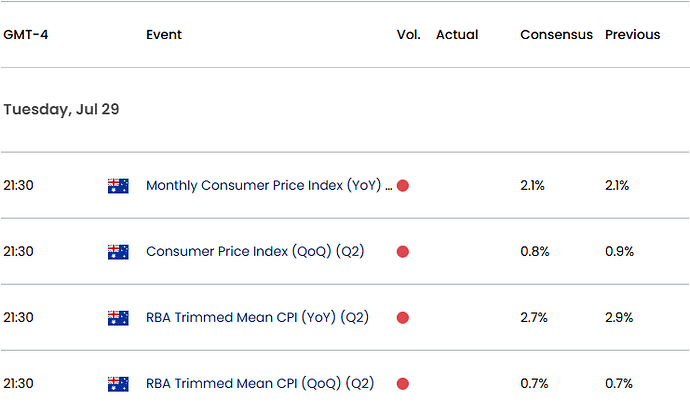

Australia Economic Calendar

Even though the monthly update is anticipated to show the CPI holding steady at 2.1% in June, the core rate of inflation is expected to print at 2.7% in the second quarter compared to the 2.9% reading from the previous period.

Evidence of slowing price growth may encourage the Reserve Bank of Australia (RBA) to further unwind its restrictive policy as ‘the Board continues to judge that the risks to inflation have become more balanced,’ and speculation for a looming rate-cut but produce headwinds for the Australian Dollar as ‘a minority of members judged that there was a case to lower the cash rate target’ at the July meeting.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

However, a higher-than-expected CPI print may generate a bullish reaction in the Australian Dollar as it raises the RBA’s scope to keep interest rates on hold, and the recent weakness in AUD/USD may turn out to be temporary should it defend the rebound from the monthly low (0.6455).

With that said, recent price action may lead to a further decline in AUD/USD as it carves a bearish price series, but the exchange rate may stage further attempts to test November high (0.6688) as it registers fresh yearly highs in July.

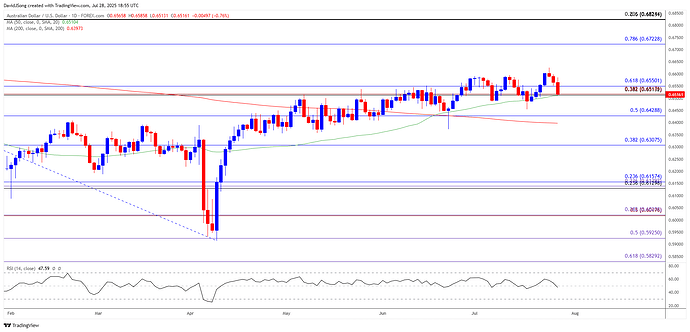

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD carves a series of lower highs and lows after failing to test the November high (0.6688), and a close below the 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement) zone may push the exchange rate toward the monthly low (0.6455).

- Failure to hold above 0.6430 (50% Fibonacci retracement) may lead to a test of the June low (0.6373), with the next area of interest coming in around 0.6310 (38.2% Fibonacci retracement).

- At the same time, AUD/USD may defend the rebound from the monthly low (0.6455) if it struggles to close below the 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement) zone, with a breach above the monthly high (0.6625) bringing the November high (0.6688) back on the radar.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Approaches Monthly High

EUR/USD Rally Unravels Ahead of Monthly High

USD/CHF Bounces Back Ahead of Monthly Low

US Dollar Forecast: USD/JPY Struggles amid Failure to Test April High

— Written by David Song, Senior Strategist

Follow on X at @DavidJSong

Click the website link below to read our Guide to central banks and interest rates in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-central-banks-outlook/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.