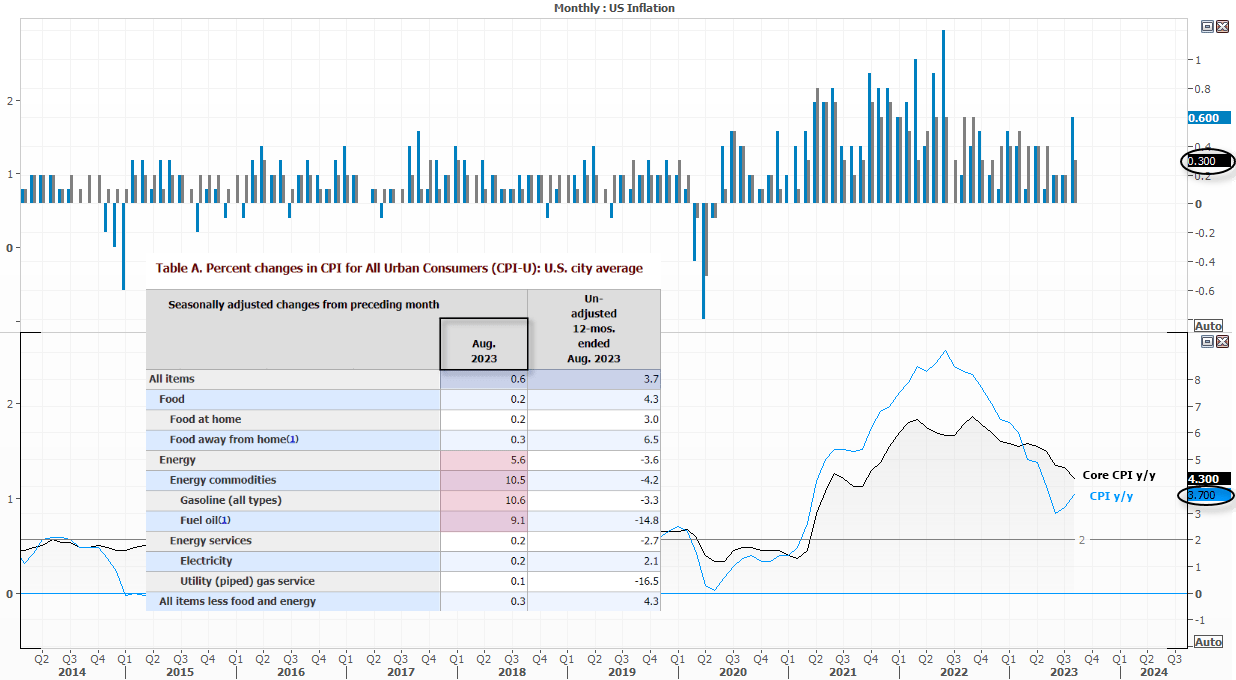

Gasoline prices pumped up US inflation to 3.7% y/y, above the 3.6% expected and the monthly read matched the relatively high estimate of 0.6% m/m. For context, that’s twice the 12-month average of 0.3% and now clearly trending the wrong way, which keeps the potential for another Fed hike in their November of December meeting alive. Perhaps more worryingly is that core CPI rose 0.3%, above the 0.2% estimated and remains more than twice the Fed’s target at 4.3% y/y.

If the Cleveland Fed’s Nowcast model is correct, CPI should pull back to 3.6% m/m next month, although that is still above its long-term average of 2.9% m/m.

The Fed are still expected to hold rates steady next week, but they’re applying around 40% chance of a hike at their November or December meetings. But a lot can change in the coming weeks with other key data points such as PCE inflation to absorb.

- FX markets were generally within their average daily ranges. And with the likes of gold, DXY etc essentially overlapping Tuesday’s range it suggests much of the gloom of higher inflation was priced in.

- Gold has pulled back to a 3-week low and closed beneath the 200-day EMA. However, the daily range was not particularly large for a ‘bearish’ day I would not be too surprised to see at least a bit of a bounce, given spot prices are holding above $1900.

- WTI crude oil formed a small bearish hammer just beneath the $90 target after a surprise rise in stockpiles.

- Wall Street took the inflation report within stride, with the S&P 500 and Nasdaq posting minor gains

Events in focus (AEDT):

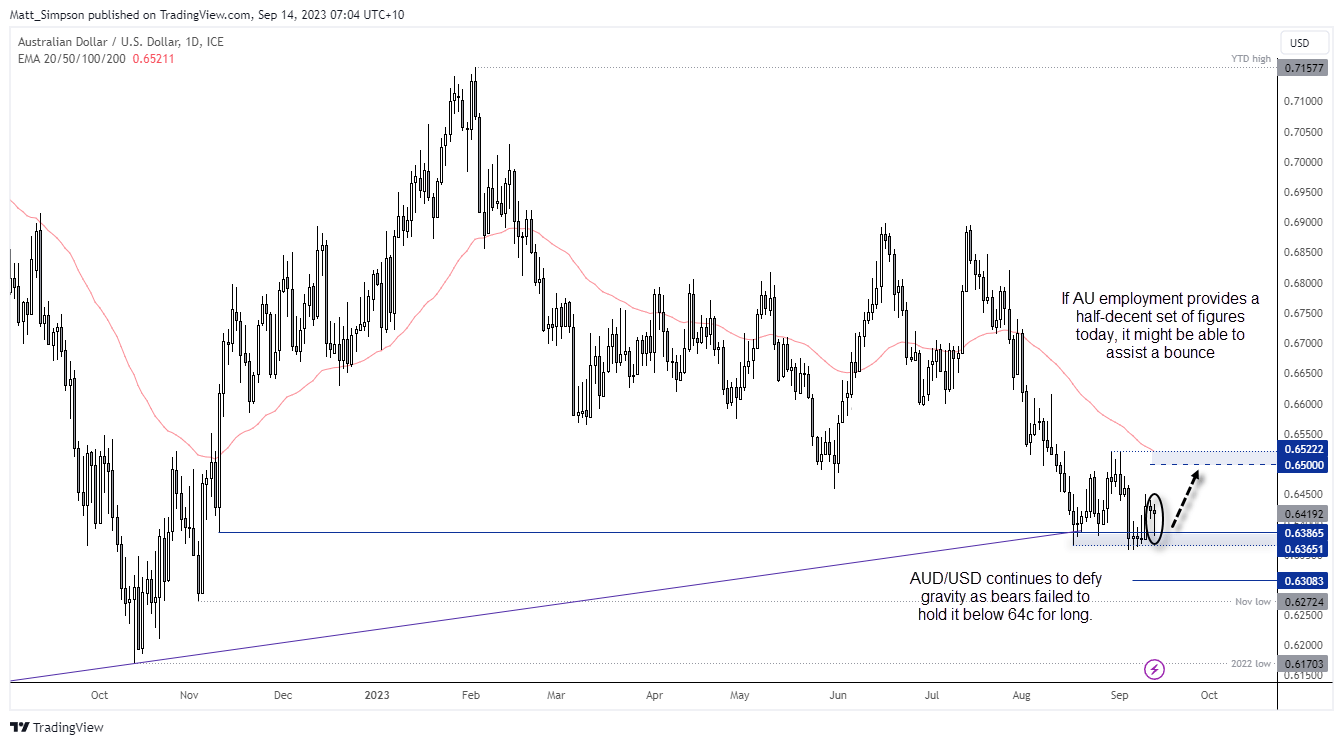

The Australian labour force report more or less confirmed that the RBA had reached their terminal rate at 4.1%, with a trifecta of bad news; higher unemployment, lower participation rate and negative job growth. Today we get to find out if that was just a blip in the trend, as a strong report could bring the case of a peak rate into slight doubt (and perhaps provide the Aussie with a slight bounce above a key support zone). Of course, if the cracks continue to widen then it further builds the case of the RBA’s relatively low peak rate. But whether it can see the Aussie break beneath the September lows, given its resilience to bad data of late, remains to be seen.

- 11:00 – Australian inflation expectations (Westpac-Melbourne Institute)

- 11:30 – Australian employment report

- 14:30 – Japan’s industrial production

- 22:15 – ECB monetary policy statement, interest rate decision

- 22:30 – US jobless claims data, producer prices, retail sales

- 22:45 – ECB press conference

- 00:15 – ECB President Lagarde speaks

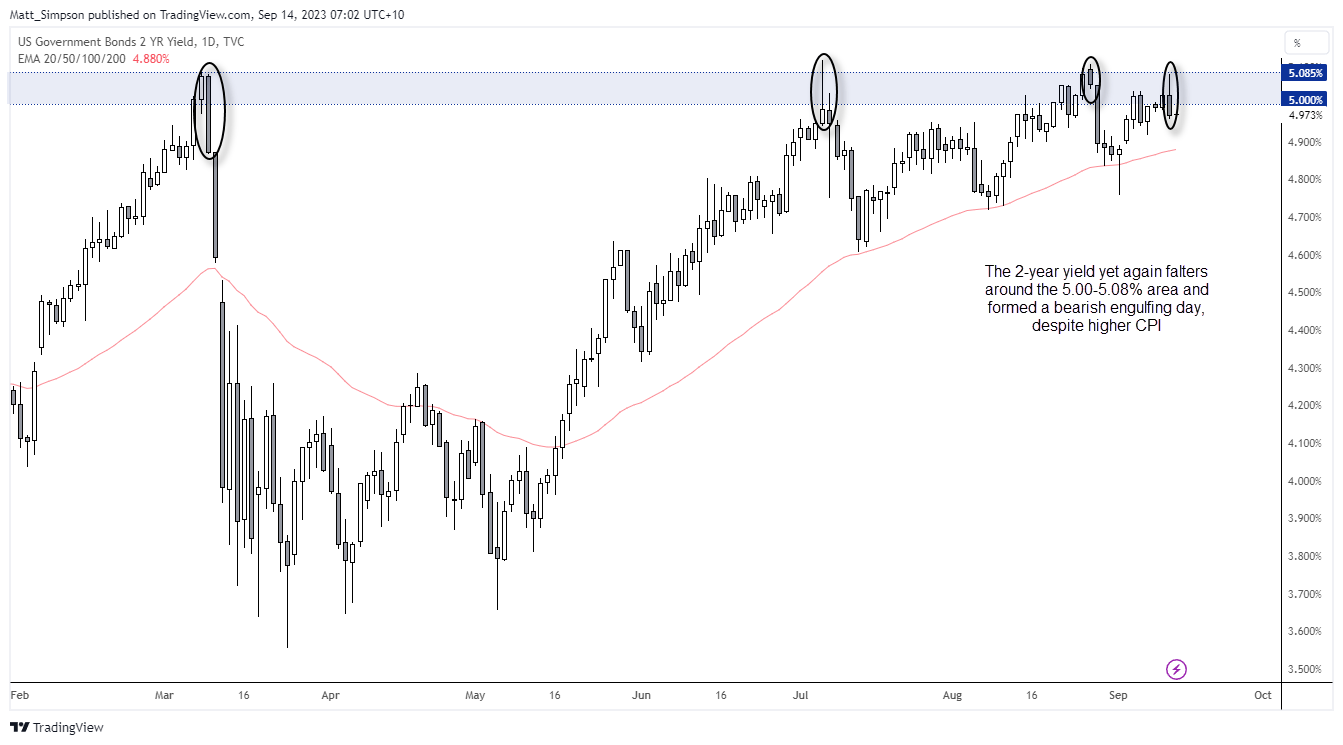

US 2-year bond yield technical analysis (daily chart):

I’ve been keeping a close eye on yields given the 2-year’s tendency to pull back around the 5% level. Yesterday we saw US bond yields between the 2 – 30-year pull back after the US inflation report, presumably as the hotter print is deemed as more recessionary than a ‘soft landing’. Still, if the 2-year pulls back, the US dollar may continue to lose some of its steam. And as a gentle reminder, it has already rallied for 8 weeks so we’re probably closer to an inflection point than some may think. And if the US dollar pulls back, that could help the Australian dollar bounce from the key support levels it has so far resisted the urge to break.

AUD/USD technical analysis (daily chart):

AUD/USD has continued to defy gravity and shake out bears with each false break below 64c. What it is missing is a bullish catalyst to really help it bounce. Whether today’s employment report benefits the Australian dollar remains to be seen, but it might take a particularly weak et of figures to drive this below 64c given its resilience so far. And as we have seen a bullish hammer on the daily chart with a higher low, and low volatility pullbacks within yesterday’s lower wick might be tempting for dip buyers. The near-term bullish bias remains intact whilst prices remain above the cycle lows, with targets simply at the 0.6450 and 0.6500 levels.