Chinese markets, the yuan, commodities and Fed cut bets have powered AUD/USD and NZD/USD higher, breaking key downtrends. The question now is whether local data and technicals can keep the momentum alive.

By : David Scutt, Market Analyst

- China optimism, commodities, Fed cut bets drive gains

- Fed pricing near exhaustion without US recession

- Aussie breaks 2021 downtrend, support now in play

- Kiwi lags but bias remains to the upside

Summary

The Australian and New Zealand dollars are powering higher against the greenback, fuelled by technicals, narrowing yield differentials, and a newfound fondness for Chinese markets. In the case of the Aussie, the move is significant, breaking the downtrend from the 2021 highs. After a rough few years for the Antipodean currencies, longer-term directional risks may now be skewing higher.

China, Cuts, Commodities

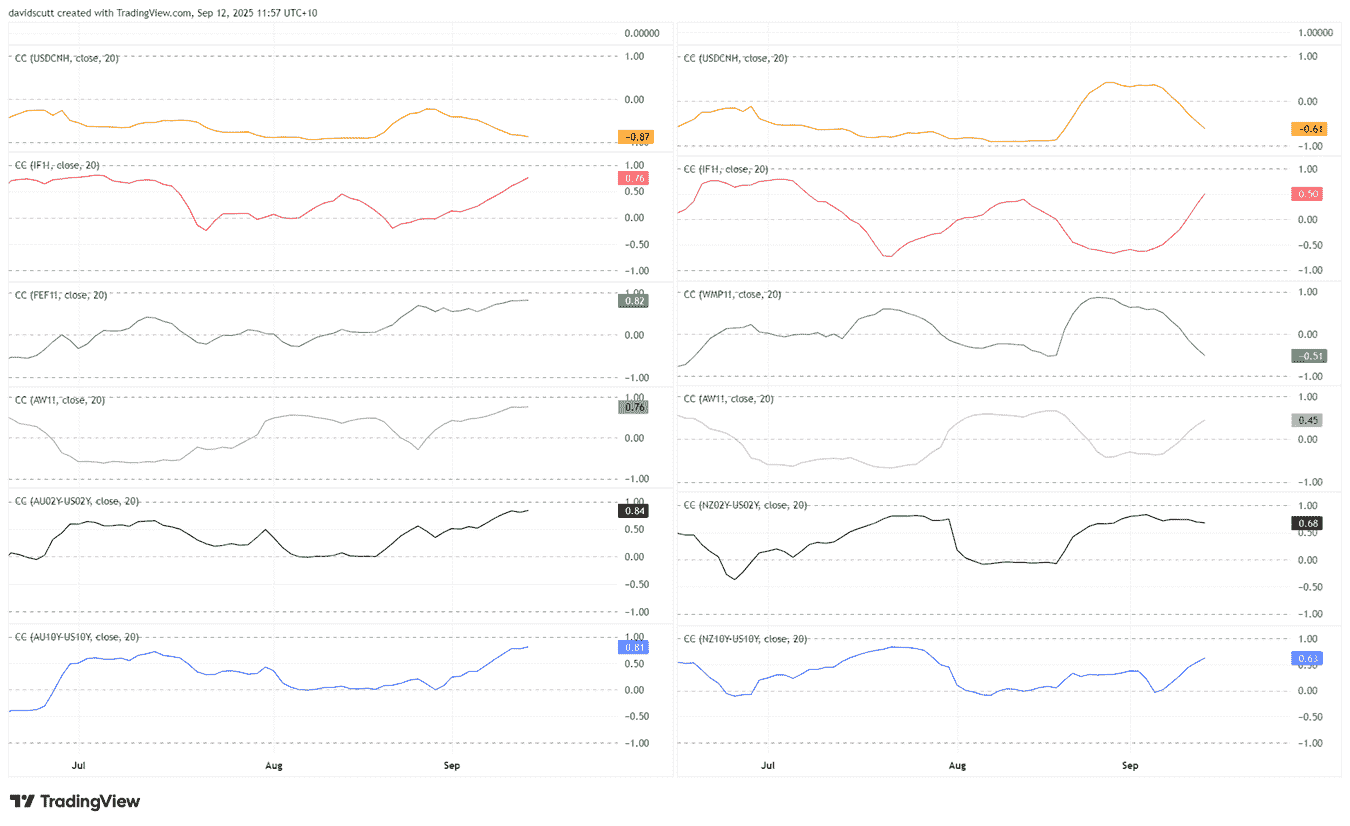

The first chart provides insight into what’s been influencing AUD/USD and NZD/USD movements recently beyond technical factors, tracking the rolling 20-day correlation coefficient scores with indicators that hold close economic or market ties to both Australia and New Zealand.

Source: TradingView

In yellow is USD/CNH, CSI 300 futures in red, Bloomberg commodity index futures in grey, along with two- and 10-year yield differentials with the United States in black and blue respectively. In green, we have SGX iron ore futures for the AUD with whole milk powder futures for the Kiwi. For those not familiar, a correlation coefficient is a number between -1 and +1 that shows how strongly two things move together: +1 means they move the same way, -1 means opposite ways, and 0 means no relationship.

So, what’s the message? In short, given the strength of the relationships seen over the past month—especially for the Aussie—it’s been a combination of improved sentiment towards Chinese markets and yuan, stronger commodity prices, along with ballooning pricing for rate cuts from the Federal Reserve over the next year, with more than five now priced into the curve.

It’s been rare in recent decades to see improved sentiment towards Chinese markets coexist with sizeable Fed rate cut pricing, helping explain the bullish price action in AUD/USD and NZD/USD. To be sure, it’s not the same scenario, but you could argue we’ve not had anything remotely similar since the early 2010s coming out of the GFC.

Click the website link below to Check Out Our FREE “How to Trade AUD/USD” Guide

https://www.forex.com/en-us/whitepapers/

Fed Tailwinds Near Exhaustion

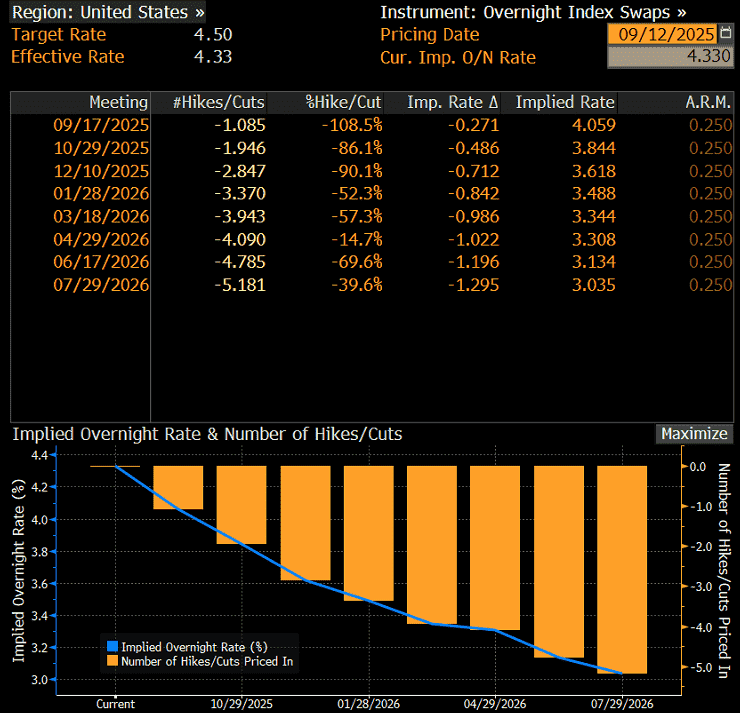

While it’s difficult to judge when sentiment towards Chinese markets will turn, the other major influence on the Aussie and Kiwi—expectations for what the Fed will do with interest rates—looks stretched without a U.S. recession.

Source: Bloomberg

Around 130 basis points of cuts are priced out to July next year, according to swaps, including a small risk of a 50-point move when the Fed meets next week. That suggests some knee-jerk USD buying if the FOMC only goes 25, though the impact may be offset by the updated dot plot, which is likely to add at least another cut to the profile for 2025 and 2026, shifting from four to five. That would imply 125bp of cuts, almost identical to current market pricing.

The read-through for traders is that tailwinds for the Aussie and Kiwi from Fed rate cut pricing are arguably close to exhaustion. Any additional cuts beyond those already priced would likely fan fears of a looming U.S. downturn—a scenario where both currencies typically struggle. Put bluntly, if the Aussie and Kiwi are to run higher, it may need to come from drivers other than the U.S. interest rate outlook.

That leaves local calendars in focus next week, with New Zealand Q2 GDP on Wednesday and Australian employment data on Thursday taking on greater significance. Technicals are another candidate.

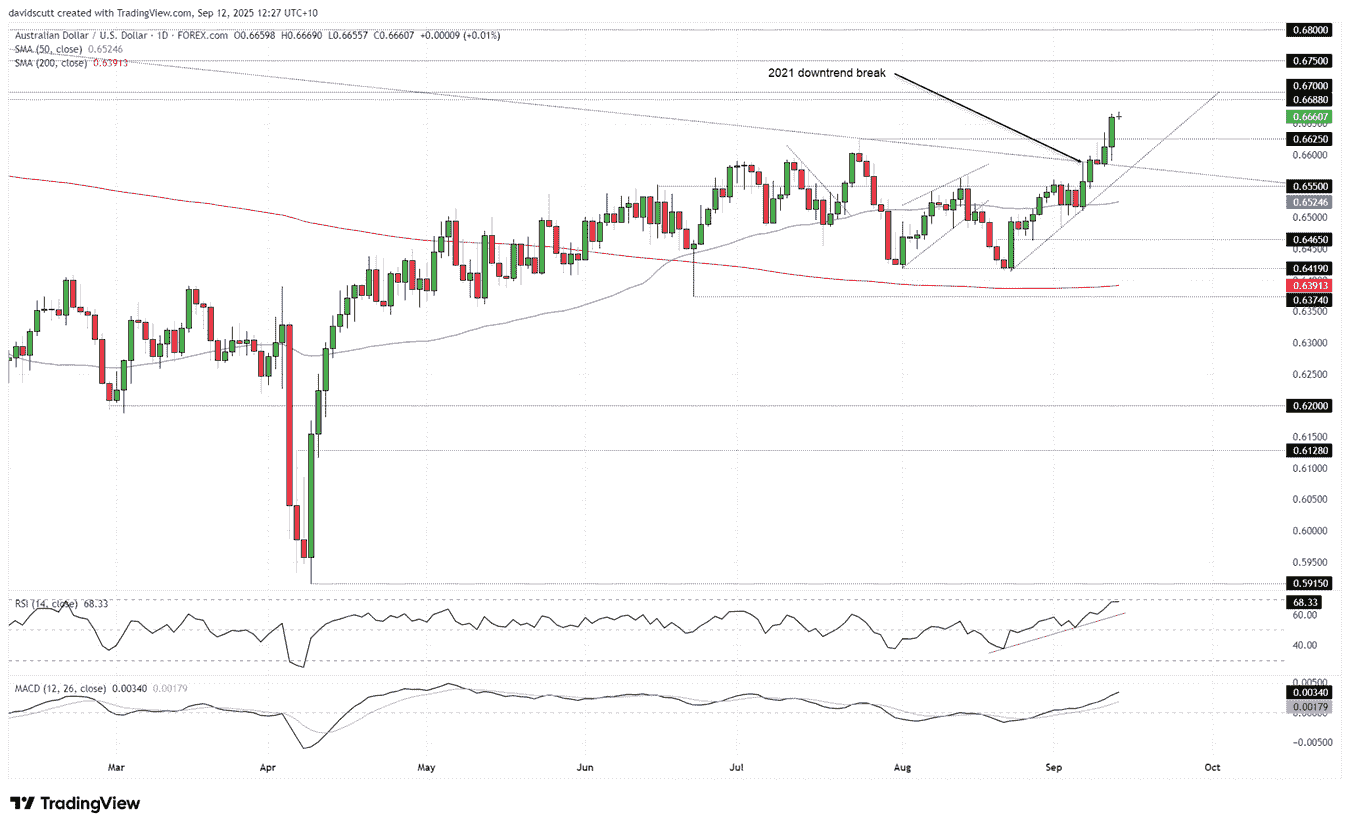

AUD/USD Breaks Out

Source: TradingView

It’s been an important week for AUD/USD with the pair breaking above the downtrend from the 2021 highs, pointing to the risk that directional bias is now skewing sideways to higher. The break, backtest, and bounce from the level over the past three days suggests it may act as a support zone for bulls, allowing long positions to be built around it with a stop beneath for protection.

For those contemplating longs, .6688 was the high set in November, making it the first topside level of note. .6700, .6750, and .6800 are located just above—all saw plenty of action either side during the second half of last year. A break above the latter would put the September 2024 swing high of .6944 in play for a retest.

On the downside, .6625 may now revert to support rather than resistance, with the 2021 downtrend located beneath around .6585 today. If the price were to reverse and hold beneath the latter, the false breakout signal would require reassessment as to whether longs remain the right play in AUD/USD.

RSI (14) and MACD are showing strengthening bullish momentum, clearly favouring a similar directional bias. With the 50- and 200-day moving averages also starting to turn higher, buying dips and bullish breaks looks far more appealing than trying to play the short side in the near-term.

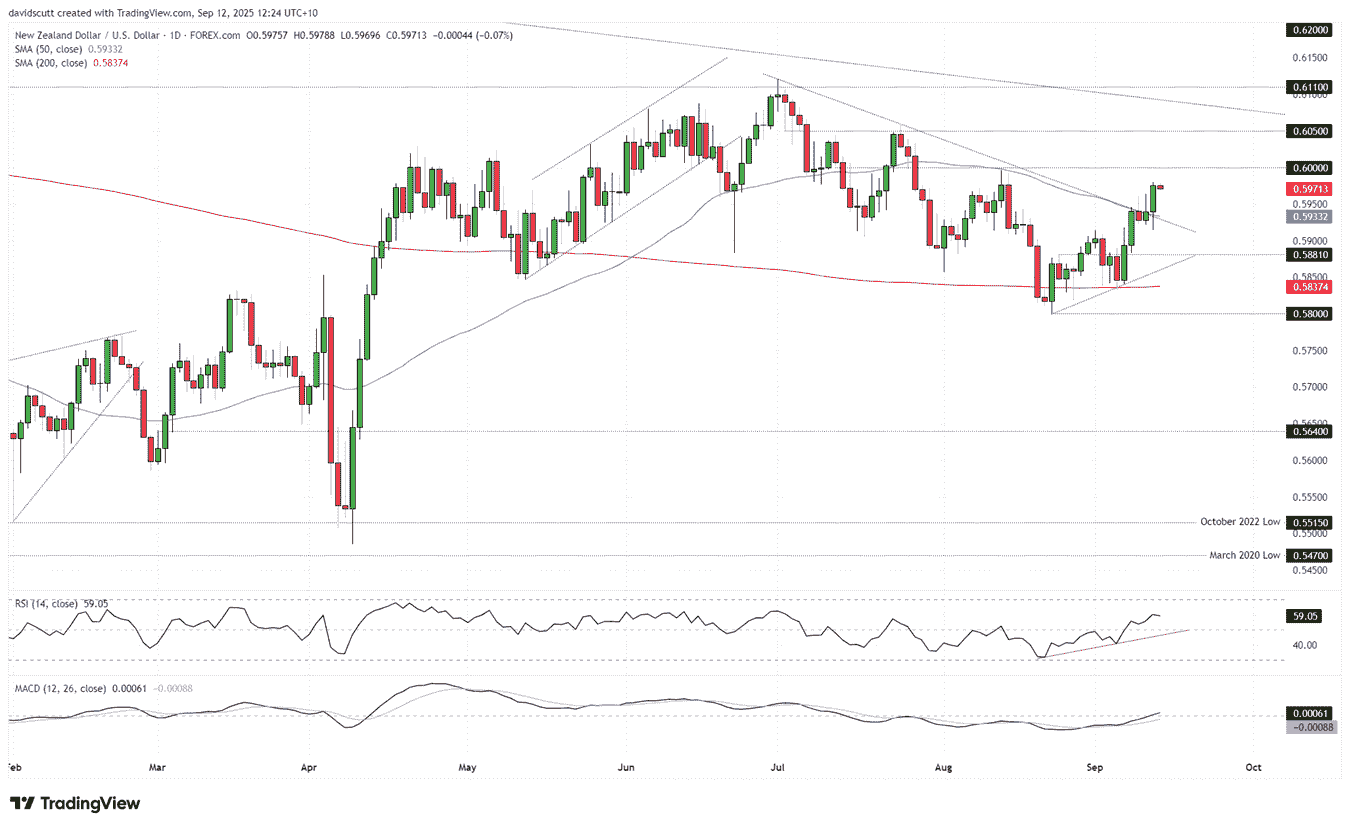

NZD/USD Lags, Bulls Gaining Ascendency

Source: TradingView

The technical picture for NZD/USD looks less convincing than AUD/USD for the bulls, although upside remains favoured following the break of downtrend resistance and the 50-day moving average earlier this week. Those levels around .5930 may now act as a platform for longs, targeting topside levels like .6000, .6050, and a key resistance zone comprising the 2021 downtrend just beneath .6100 and horizontal resistance at .6111.

Momentum indicators are tilting bullish, with RSI (14) trending higher and above 50 while MACD has ventured into positive territory after staging a crossover of the signal line in early September. Playing Kiwi from the long-side is therefore favoured.

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.