AUD/USD downside has slowed despite a lot of negativity, bolstering the case for a near-term bounce ahead of key risk events later this week.

AUD/USD resilient in the face of recent negativity

China’s economic struggles, sluggish growth domestically, diminishing risks of RBA rate hikes and a resurgent US dollar. The Aussie dollar has had to navigate that tricky backdrop over the past three weeks but has ended up going nowhere, suggesting bearish sentiment may be nearing exhaustion in the near-term, pointing to the potential for a modest bounce.

While the price action on the AUD/USD daily has been terrible since July, suggesting the pair remains a sell-on-rallies prospect, its recent performance has been resilient, including on Friday when it bounced despite the Chinese yuan falling to fresh lows. Against the USD dollar, the AUD and CNH had been joined the hip for months up until that point, reflecting that many traders like to use the AUD as a China proxy given its enhanced liquidity and turnover relative to the offshore yuan.

AUD bearish sentiment near exhaustion?

The abrupt break in the correlation caught my eye, raising questions as to whether the path of least resistance for the AUD/USD may be to the upside in the immediate near-term? The US dollar is on its longest weekly winning streak in nearly a decade and almost everyone seems to be bullish on the prospects for the US economy relative to other advanced economies, including Australia.

While I agree with the assessment, it’s hard to argue it’s not already baked in the cake, suggesting the USD may be susceptible to some form of reversal ahead of US CPI on Wednesday and the ECB September policy meeting on Thursday.

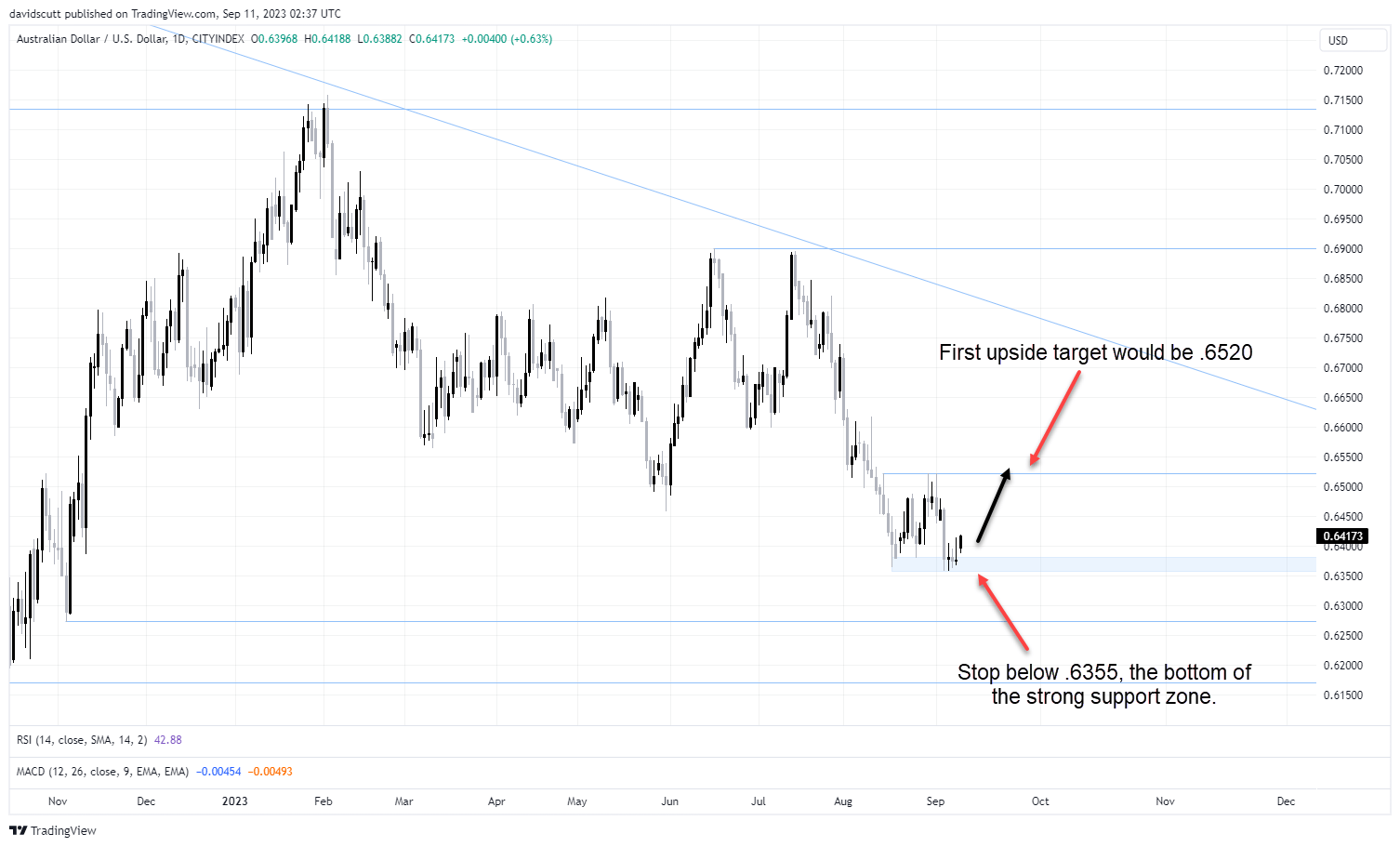

Positioning for a potential AUD/USD pop

Sitting just above .6400, pullbacks below the figure could offer decent risk-reward for a potential pop in the days ahead. .6520 is the obvious upside target, the level the last attempted bounce fizzled out at two weeks ago. On the downside, a stop below .6355 – the bottom of the support zone that held strong despite the negativity of recent weeks – would offer protection against a resumption of the prevailing bearish trend.