We’re on the lookout for any hawkish undertone in today’s RBA minutes - given the RBA’s statement was deemed to be less hawkish than expected. Failure to do so could see AUD/USD hand back some of it’s gains. The Nasdaq is also following its seasonal tendency to rise into Thanksgiving.

By :Matt Simpson, Market Analyst

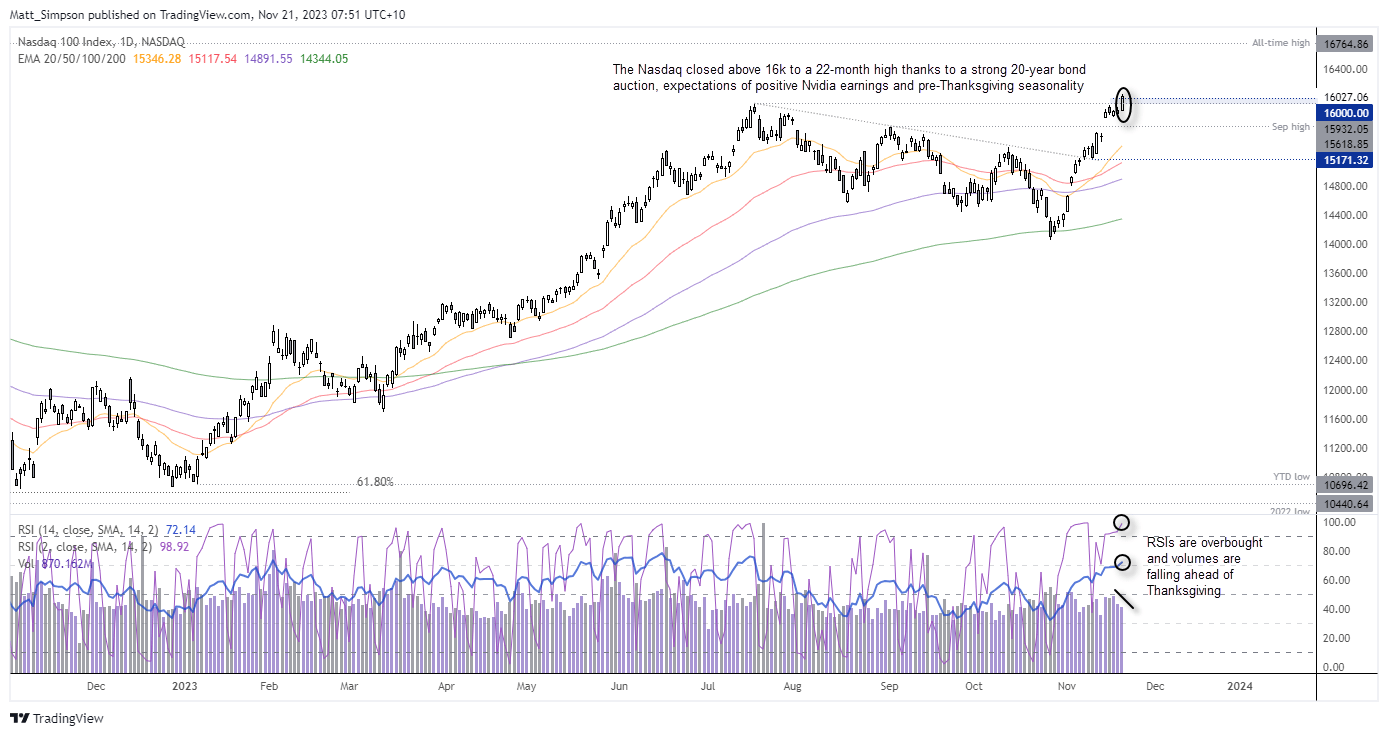

The Nasdaq 100 closed above 16,000 and at a 22-month high, which places it on track for its best month in 16 and fourth consecutive up wee. A combination of factors helped the tech sector rally, including expectations of positive earnings from Nvidia, a strong 20-year bond auction (which lowered yields) and the seasonal tendency for the Nasdaq to rally heading into Thanksgiving.

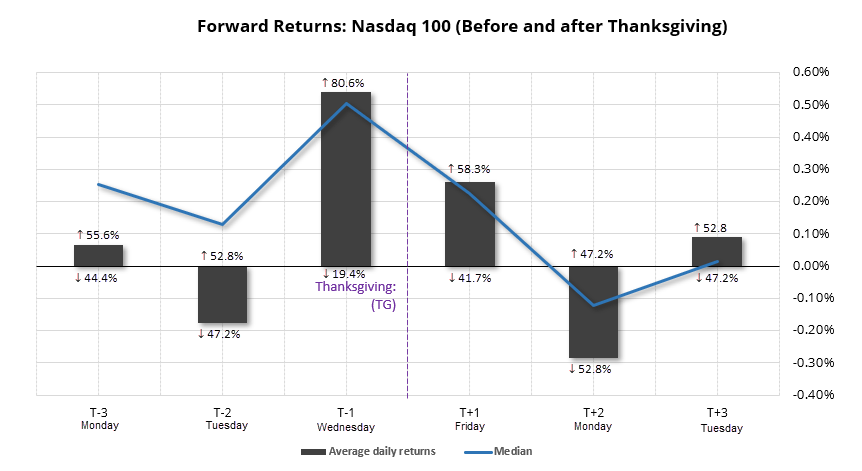

This chart shows average returns for the Nasdaq 100 in the three days either side of Thanksgiving. The most notable takeaway is that Wednesday – the day prior to Thanksgiving – has averaged the strongest returns with an 80.6% win rate, and Friday is the second best day for bulls in terms of average returns and win rate. Yet the subsequent Monday, traders appear to book their pre-holiday hype to send the Nasdaq lower 52.8% of the time with an average return of -0.29%.

If history is to repeat, perhaps we’ll see a down day on the Nasdaq on Tuesday. Yet whilst average returns are slightly negative, it has a win rate of 52.8% - which explains why median returns (or typical returns) are positive at 0.13%.

Nasdaq 100 technical analysis (daily chart):

The Nasdaq has been on a great run and, as noted in yesterday’s COT report, asset managers have piled back into longs and trimmed short exposure to send net long exposure to a 6-yer high. These are hardly the signs of concerned investors. The daily char shows the Nasdaq closed just above 16k, and unless we see broad risk on continue on Tuesday then I suspect e may see a lower volatility candle or inside day form around the cycle highs – if the Thanksgiving seasonal patterns are anything to go by. Wednesday is generally the most bullish day, so perhaps there is another burst of energy waiting to happen.

However, take note that RSI (14) and RSI (2) are overbought and daily trading volume is diminishing despite the Nasdaq pushing higher. And with the potential for profit taking after Thanksgiving alongside overbought RSI’s, bulls may want to tread with caution over the near-term.

Market Summary:

- The US dollar index flirted with a break of its 200-day MA before closing narrowly beneath it, and this has kept EUR/USD beneath the August 30 high (for now). Keep in mind that the US dollar has generally produced down days on the Monday, Tuesday and Wednesday heading into Thanksgiving before reversing course. So this is keeping us on guard for a potential bounce with the US dollar from Friday or next week.

- Crude oil rose for a second day as expectations continue to grow that OPEC will announce further oil production cuts next week.

- Gold fell in line with expectations yesterday after forming a Doji around 1985 resistance on Friday. Yet strong support levels around 1965 and the 10-day EMA saw prices rebound and recoup most of the day’s earlier losses.

Events in focus (AEDT):

Today’s RBA minutes will be released at 11:30 AEDT / 0.1:30 GMT today and are worthy of a look. The RBA hiked by 25bp in November but the statement was not perceived as hawkish enough to warrant the priced-in expectations of a hawkish hike, which sent AUD/USD lower and the ASX 200 higher on the day. Yet if the prior meeting is anything to go by, the statement may provide the hawkish tone that the statement lacked.

Whilst governor Bullock is to speak ahead of the minute being released, the title does not imply it will be an opportunity to talk monetary policy. For that we may need to wait until Wednesday at 19:35 AEDT when she speaks on “A Monetary Policy Fit for the Future” at the ABE Annual Dinner, Sydney.

- 08:45 – New Zealand trade balance

- 10:00 – RBA governor Bullock speaks (no comments on monetary policy expected)

- 11:15 – BOE governor Bailey speaks

- 11:30 – RBA minutes (we’re on the lookout for a hawkish tone)

- 13:00 – New Zealand credit card spending

- 20:05 – BOE MPC member Pill speaks

- 21:15 – BOE MPC member Mann speaks

- 21:15 – MPC Member Ramsden speaks

- 21:15 – MPC member Haskel speaks

- 00:30 – Canada CPI (looking for further evidence that inflation continues to soften and keep the BOC in pause mode)

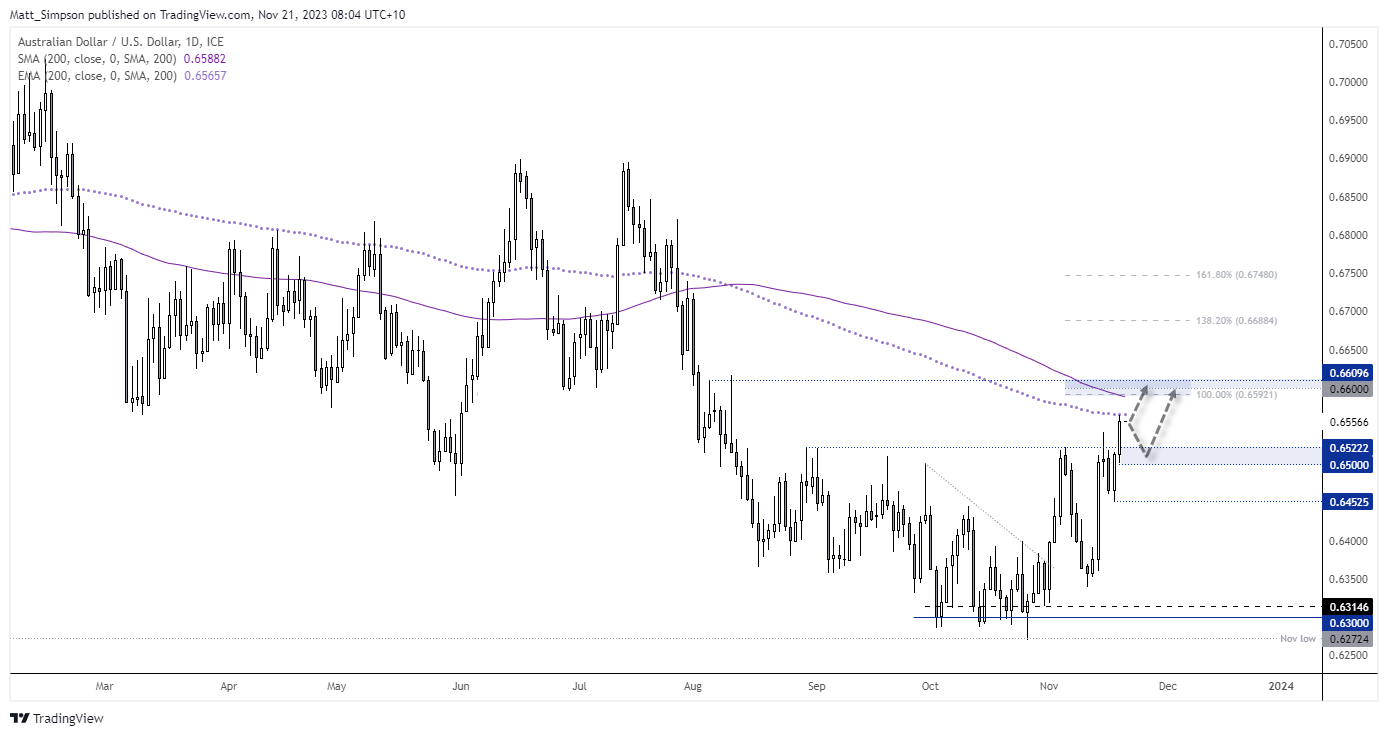

AUD/USD technical analysis (chart):

We finally saw the break we have all been waiting for on AUD/USD, which was helped higher buy a combination of a weaker US dollar and stronger yuan. Yet the 200-day EMA provided resistance, and it may require hawkish RBA minutes and another lower USD/CNH to help it move directly towards the 0.66 target.

Hopefully we’ll see a pullback ahead of the minutes to improve the potential reward to risk ratio for bulls. If the minutes turn into a nothing burgher, bulls could seek evidence of a swing low around the 0.6500 – 0.6522 zone in anticipation of its next leg higher.

View the full economic calendar

– Written by Matt Simpson

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.