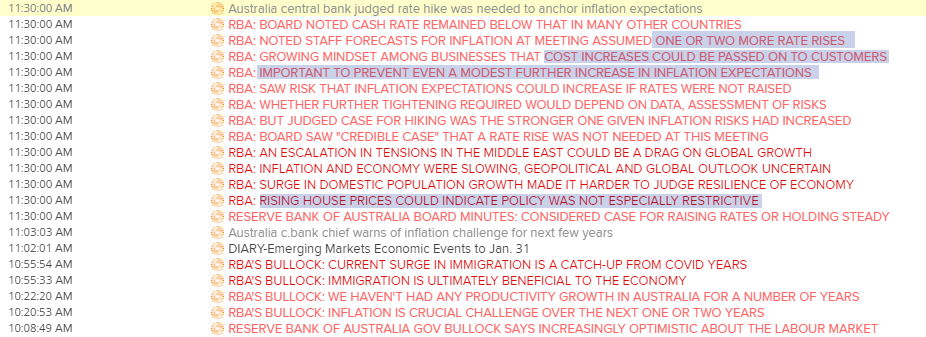

There was a risk that the RBA’s minutes were more hawkish than their November statement had let on, and this certainly seems to be the case. And hawkish minutes alongside a lower USD/CNH and USD/JPY have helped AUD/USD test a new cycle high today. Can it now gun for 66?

By :Matt Simpson, Market Analyst

There was a risk that the RBA’s minutes were more hawkish than their November statement had let on, and this certainly seems to be the case. The RBA mins read to me like they’re still sat on another rate hike – even if they’ll try not to hike if they can help it. Incoming data could decide which side of Christmas a potential hike could arrive. With no meeting in January, a hot CPI report next week could seal a 25bp Christmas present to the masses.

The RBA also upgraded their inflation forecasts in last week’s quarterly SOMP (Statement on Monetary Policy) and provided similar warnings about “upside surprises to inflation” in what was effectively a prelude to today’s minutes. And that likely explains the lacklustre response to AUD/USD which continues to trade around its 200-day EMA.

The RBA are next due to meet on December 5, and not again until February 6. And that places next week’s monthly inflation report into focus on November 29.

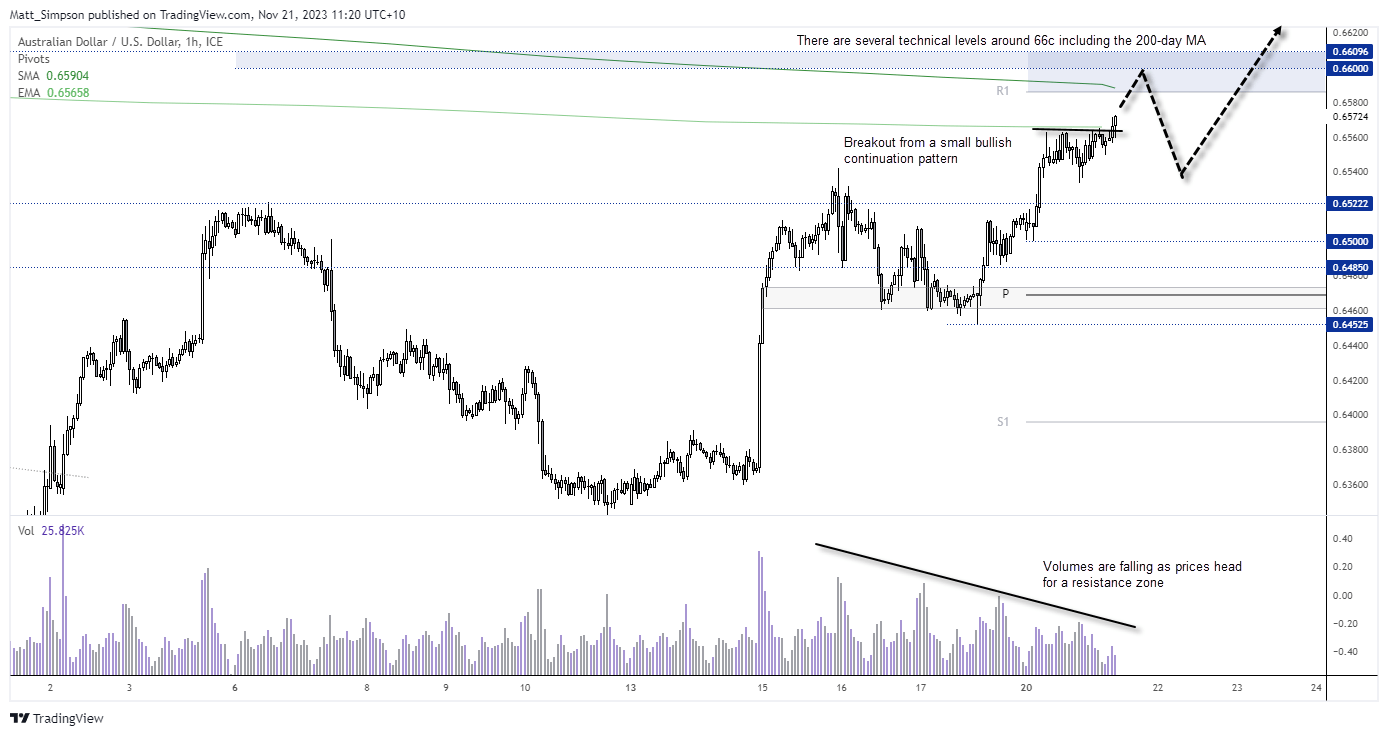

AUD/USD technical analysis (1-hour chart):

The Australian dollar is on track for a bullish engulfing month, formed a bullish engulfing week and bullish outside day on Friday – and on track for its third up day. Regular readers will know I have retained a bullish bias since it repeatedly refused to roll over below 63c, and we’re now seeing prices rise due to the relative shift away from a hawkish Fed and towards a more hawkish RBA.

A bullish trend has emerged on the 1-hour chart and, whilst the 200-day EMA caped as resistance, prices have now broken out of a small bullish continuation pattern. I suspect a minimum move towards 0.6590 is on the chards neat the weekly R1 pivot and 200-day MA, with the potential for it to tag 66c. However, with the US dollar selloff already in full swig and the potential for it to rise after Thanksgiving, I would not be too surprised to see AUD/USD retrace from 66c before attempting its next leg higher. Also note that falling volumes during the rally to suggest bulls are slowly losing steam.

The yuan continues to rise

As my colleague David Scutt recently pointed out, the Australian dollar could also be taking its cue from the stronger yuan as a weaker US dollar tends to benefit emerging markets – and the Aussie can sometimes trade like one. USD/CNH has now fallen to a 4-month low which coincided with AUD/USD’s bullish breakout of its continuation pattern.

Yet with the 200-day MA and series of cycle lows around 0.7100 nearby, USD/CNH could soon find support and place a cap on AUD/USD gains. Beyond a potential bounce from support, it could move to fresh cycle lows and send AUD/USD higher. And if the yuan continues to strengthen, it could see trade partners’ currencies such as the Japanese yen also appreciate to weigh on USD/JPY.

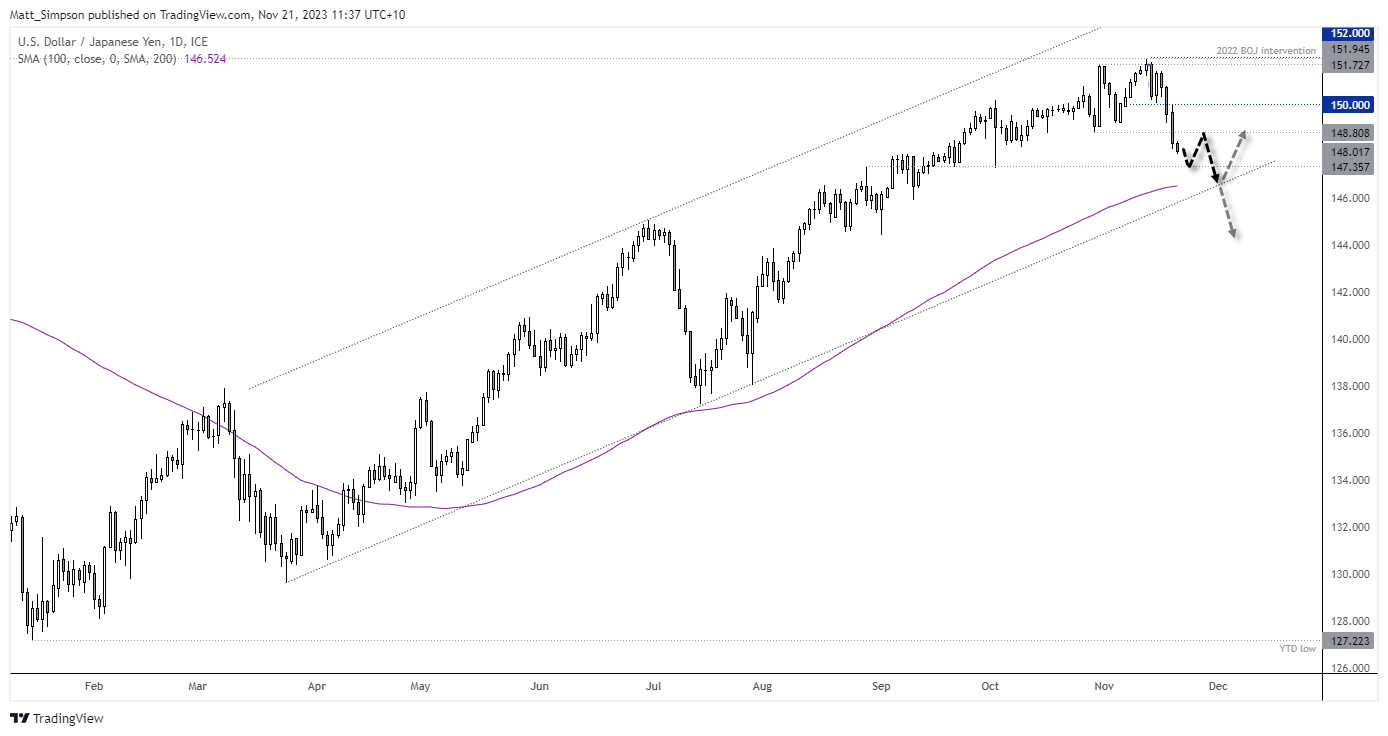

USD/JPY technical analysis (daily chart):

I noted in yesterday’s COT report that USD/JPY had formed a 2-week reversal around 150, following two small shooting star weeks. Given its strong rally and failure to break above resistance, alongside extreme net-short exposure to yen futures, the path of resistance appeared lower for USD/JPY on the weekly charts. Less than two full days into the week we see USD/JPY has broken convincingly beneath last week’s low.

The daily chart remains within a bullish channel, and prices are clinging to the 148 handle for support. A move to the pivotal level of 147.35 seems feasible, although if USD/CNH bounces from current levels then so may USD/JPY. Either way, I’d prefer to fade into minor rallies into resistance levels (such as 148.80) and target lower support levels such as the lower trendline or 148.35.

– Written by Matt Simpson

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.