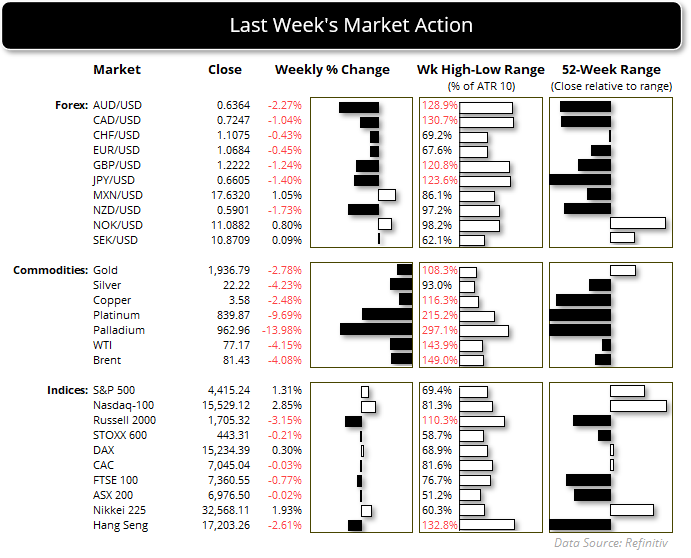

Market Summary:

- Moody’s ratings agency downgraded their credit rating for the US to negative from stable, due to large fiscal deficits and weakening debt affordability

- Market pricing in early Asian trade has taken the downgrade within its stride

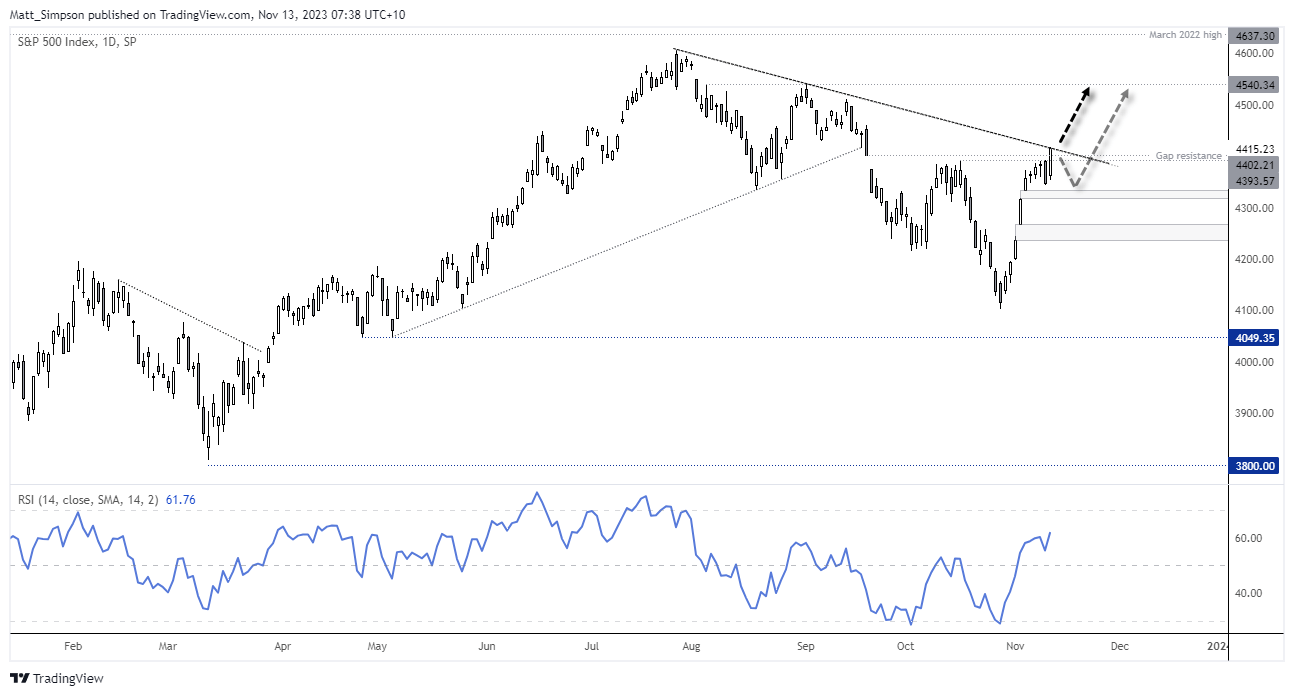

- The Nasdaq 100 has posted gains over the past 18 Mondays (and the S&P 500 have posted gains 17 of the past 18). With no immediate explanation as to why, we now wait to see if it can add to the impressive winning streak

- Joe Biden says he wants the US and China to re-establish military ties, ahead of their face to face meeting on Wednesday

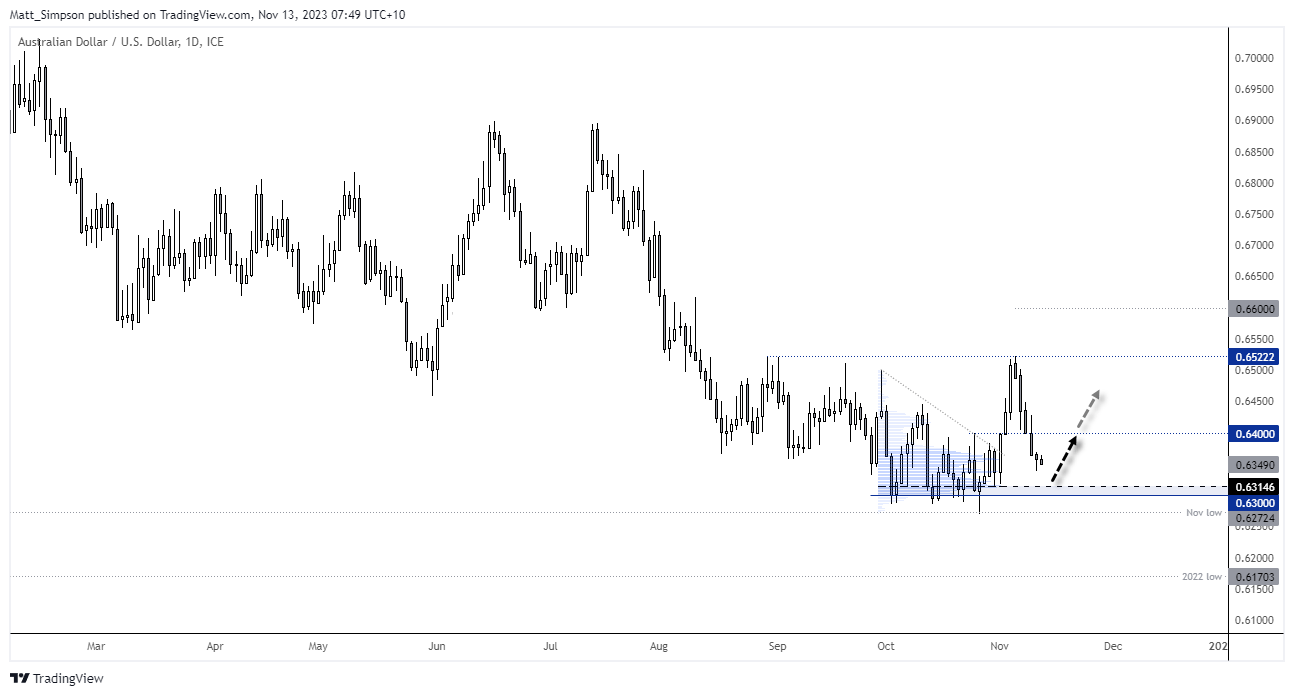

- The Australian dollar was the weakest forex major last week, following a less-hawkish than expected RBA hike. The Aussie also fell for five consecutive days and closed beneath 64c

- WTI crude oil enjoyed its best day of the week on Friday after finding support at $75 (one of my bearish targets). It also formed a 3-day bullish reversal pattern called a morning star formation. As it has now fallen for three weeks and in a relatively straight line, I’m happy to step aside and stay flat.

- Gold fell for a second consecutive week and closed beneath the September high, although the 38.2% Fibonacci ratio between the October high and low is acting as support.

Events in focus (AEDT):

- Publish holiday in Singapore (Diwali)

- 08:30 – New Zealand Performance of Services index

- 10:50 – Japan producer prices

- 17:00 – Japan machine tool orders

- 19:00 – China new loans, outstanding loan growth, total social financing, M2 money supply

- 22:55 – BOE Breeden speaks

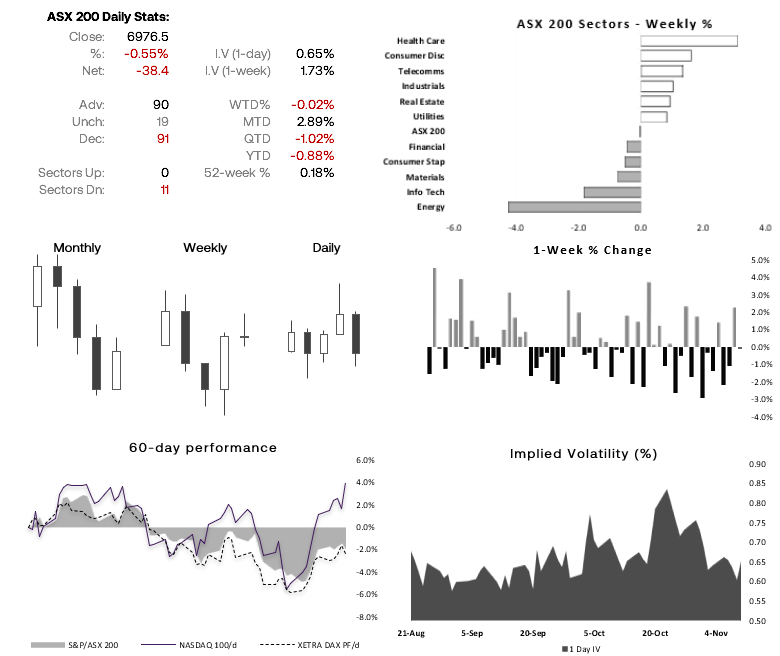

ASX 200 at a glance:

- The ASX 200 posted a minor loss last week, and spent most of the week meandering around 7,000

- SPI futures and Wall Street’s gains on Friday suggest a positive open for the ASX cash index today

- Yet its indecision around the 7,000 area make it a difficult market to have a bias on, particularly as the daily ranges have been smaller than usual

- Therefore, my bias is neutral until volatility returns and momentum tips its hand

S&P 500 technical analysis (daily chart):

The S&P 500 has risen over 7% since the late-October low, and in it has done so in a relatively straight line. There was a slight consolidation last week, although Friday’s strong bullish candle suggests its ready for its next leg higher. Whilst the S&P 500 closed above gap resistance, the trendline capped its upside. Therefore, bulls can either with for a break above Friday’s high to assume bullish continuation, or wait to see if prices pull back and respect a support level before seeking to buy the dip (in anticipation of a breakout).

AUD/USD technical analysis (daily chart):

This is on the scrappy side, but AUD/USD’s ability to hold above the 63c area despite data and headlines suggesting it should have broken lower already should not be ignored. A small bullish hammer formed on Friday, and as it has fallen for five consecutive days then odds suggest we maybe nearing an up day. Any pullbacks towards 63c / 0.6314 (the most traded prices during the prior consolidation) will pique my bullish interest for a initial move to 64c. A break above which brings 0.6450 into focus.

View the full economic calendar

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.