I got out at 7085. Are you trading on the daily?

And the news hit and now it’s crazy candle time!

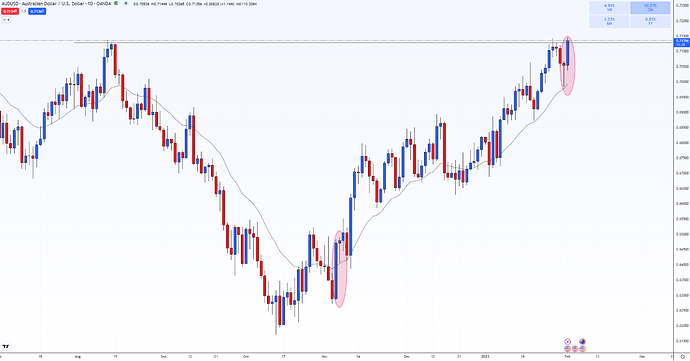

Sorry for jumping in late as this is now hindsight, but I just saw this post. But to add to the bullish pin bar, price also bounced off the 20MA, which is a fairly popular trend trading strategy in itself.

Good work. Profit is profit.

Lower time-frames are not my field.

Maybe someone can assist?

Interesting. Does the TF matter? I guess the higher maybe the more…reliable?

Fed raises interest rate 0.25% to 4.75% as expected by majority of market.

Price is trying to push down.

Correct, the daily chart is usually the most reliable. There are 2 different signals you can use to enter: 1) price crosses the 20MA then comes back the next day to retest, then continues in that direction, or 2) price pulls back to the 20MA and bounces off.

Both examples here:

No surprises in the Fed’s interest rate decision and I believe the language Powell used might have been a little dovish, so the uptrend is not under threat.

The recent price action has presented several entry signals at various levels. The one I have taken is the breach of the bullish fractal high of 26/01. This is also an entry level using the Inside Bar formation printed 27/01. Each indicates a different stop-loss level, at the base of the respective patterns: my SL on the fractal entry logic is wider, using the low of 24/01.

As I’ve said, buying right ahead of the Fed announcement was too high-risk for me but for interest there are

potential buy signals I might have flagged up but which I won’t usually act on -

- successive lows in an uptrend

- recovery from swing low (I look for at least 3 “red” days, daily bars with successive lower highs and lower lows following a swing high)

- support from 20EMA (I only acknowledge this after a close below the 20, followed buy a close above)

Possibly there were also some exotic candlestick patterns I can’t bother to search for… Floundering Black Crow, Vomiting Baby, that sort of thing…

Today’s D1 printed as a blue day - higher daily high and higher daily low than 01/02, so the uptrend continues.

Might be worth noting that technically the low of the Inside Bar formation was breached so a bullish IB trade stop-loss would probably have been triggered, unless a trader allowed several pips below that pattern for volatility.

My long remains in place and I have two pyramid buy orders set overhead in blue sky territory.

Onwards and upwards.

Well there you go. As one door opens, another one slams in your face.

Well, just think of it as another buy opportunity.

That’s philosophical, thanks. But its a mistake I made to be too focused on the Fed. We live, we learn.

A week for news and not so.much tech analysis

Possibly surprisingly I still have this pair as a long-term trend-following buy.

Yesterday’s action printed a very bearish red day (lower high and lower low). However, the three key trade rules remain in place -

20EMA is above the 50

last swing point broken was a swing high

price remains above the 50EMA

In addition, most AUD pairs remain bullish relative to the 50EMA and only the last 4 weekly bars overlap.

Right now I have one of my entry points indicated on the charts, which is breach of the bullish fractal 01/02. but that is 240 pips above so most likely several days away: before when we should benefit from more favourable buy signals. Or a loss of the “buy” marker.

No positions, no orders. Bias remains bullish.

Have a great weekend.

Would nt be surprised if it dropped around 6680 ,maybe forming a “wyckoff.” There no real data Monday for either currency till news 3 am AUS.tuesday gmt

Sure. A nice thing about the reaction to the NFPR’s is that I won’t have to make a decision on whether to hold longs across the RBA announcement this week, its all academic now, they’re gone, and I’m sure to be still in cash then.

Are you still live on your trade?

I’ve just got a small/insignificant short left open, no stop.

They will probably be spike 3:30am news coming out for Aus dollar

No, my last long was stopped out after only one day on Friday. After that day’s price action I had this pair as a weak buy - actually there were no strong buys or sells on the board.

After today’s price action, with price below the 50EMA I don’t have this pair as any sort of buy. As I’m only trend-following, this doesn’t qualify as a short yet, not for a long time yet - the 20 and 50EMA’s would have to flip and the swing chart would have to go bearish, so no immediate prospects of any trades.

Ok thanks for explaining,I always take an interest in the pair rather than the other majors.

We will see how it plays out,the rest of the week

Sometimes your rules don’t say buy and they don’t say sell. That doesn’t mean they’re bad rules but the charts are showing an interesting anomaly.

AUD/USD managed to close yesterday just above the 50EMA. The 20EMA remains also above the 50 and the swing chart remains bullish until we see a close below 0.6640 (from the low, 29/11). This technically makes the pair still a buy.

However, the case is weakened by the poor match-up between the two currencies. I score AUD at 5 bullish points out of 7 this morning and USD at 2. A match-up of 5-2 is not great: 7-0 would be best, 7-1, 6-0 or 6-1 still good but there’s too little differentiation between AUD 5 and USD 2.

Added to this the weekly bar overlap is now bearish at 2. Admittedly we’re only have and one day this week so its a thin weekly diagnosis but the bearish weekly traffic light alongside 3 bullish traffic lights is not a vote of confidence.

So, staying in cash for now. No viable trend-following buy signals on the spreadsheet.