- AUD/USD has fallen over 100 pips in less than 24 hours, threatening to break to fresh lows

- Neutral comments from RBA Governor Michele Bullock and tumbling US stock futures are behind the move

- RBA November rate hike odds have been slashed in halt to around 30%.

Tumbling US stock futures and neutral language from RBA Governor Michele Bullock has seen AUD/USD plunge in early Asian trade, continuing the sizeable reversal seen on Wednesday following the release of Australia’s Q3 hot inflation report. The pair is now threatening to push to fresh 2023 lows as money markets pare back expectations for a November RBA rate hike, slicing the odds from around 60% before Bullock started her appearance before parliamentarians in Canberra.

AUD/USD reversing at speed

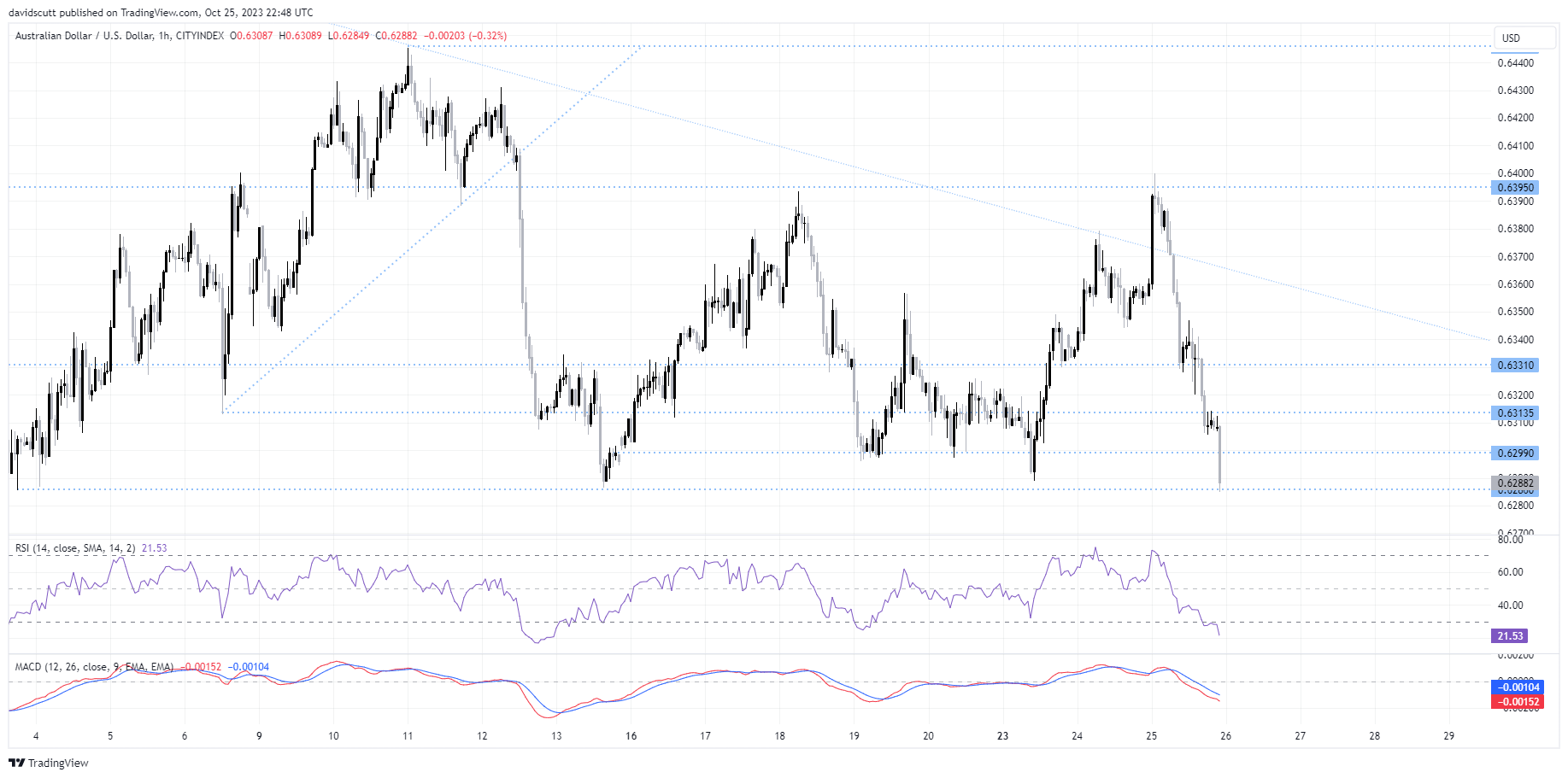

You can see the scale of the reversal on the hourly chart below, seeing AUD/USD fall around 115 pips from the highs hit a little over 24 hours ago. A break of .6286 opens the door for a move back to 2022 low of .6170 with only minor support around .6220 evident on the charts.

While MACD suggest momentum of the reversal remains strong, RSI is oversold on the hourly, pointing to the risk of a near-term squeeze higher. .6300, .6314 and .6331 are first layers of topside resistance.

RBA, China markets like to dictate AUD/USD direction

Bullock will continue answering questions for the remainder of the morning, creating the potential for headline-driven movements. Given the AUD is acting like a barometer of sentiment towards China, the performance of the USD/CNH and Chinese stock indices may be influential later in the session.

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.