AUD/USD managed to recoup some of its post-US-election losses last week. And given it held up against the might USD strength while futures data shows volumes rising for the first week in seven, I suspect an important swing low has been seen.

By :Matt Simpson, Market Analyst

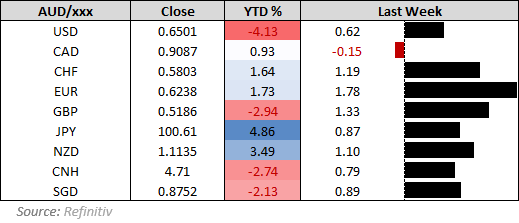

- It was a good week for Australian dollar bulls, with the local currency rising above most major currencies (except CAD)

- We may have seen an important swing low for AUD/USD, given the return of open interest alongside rising prices last week (and its defiance against a strong USD)

- Local data is light this week, but traders will keep a close eye on the monthly CPI report

- The RBNZ are expected to cut rates by 50bp this week to send their cash rate beneath the RBA’s for the first time in four years

Australia’s monthly CPI is in focus on Wednesday

We will have to wait until January until we see the RBA’s preferred quarterly figures, so for now traders will have to suffice with the monthly read. But it can shape expectations for the quarterly print and therefore impact the Australian dollar.

The monthly weighed CPI fell to a 3-year low of 2.1% in September, and any move below 2% could provide some excitement of a cut again given it would place inflation below their 2-3% band for the first time since March 2021. However, the RBA minutes once again reiterated that underlying inflation (quarterly trimmed mean) remains too high at 3.5%. So we may also need to see the monthly CPI drop notably in December to make a meaningful impact for rate-cut bets. And given AUD/USD has endured a multi-week selloff, I suspect bulls may have better luck capitalising on stronger-than-expected data around these levels.

Michelle Bullock is scheduled to speak at the annual CEDA conference on Thursday

Perhaps she could address the recently released inflation figures, but she has already said since the US election that it is too soon to speculate the impact Trump 2.0 may have on the Australian economy, making the topic a moot point already.

Click the website link below to get our Guide to central banks and interest rates in Q4 2024.

https://www.forex.com/en-us/market-outlooks-2024/Q4-central-banks-outlook/

The RBNZ are expected to cut their cash rate by 50bp

If the RBNZ go for the full fifty, a cash rate of 4.25% would see it beneath the RBA’s 4.35% for the first time since 2020. But with that being the consensus, eye will be on whether they have an appetite to signal further cuts. Given the uncertainty surrounding Trump’s return to the Whitehouse, I suspect they will retain a data dependence stance and not provide an overly-dovish 50bp cut.

US data makes a comeback

After a week away from the spotlight, US data has made a return to the economic calendar. Even so, none of it is really grabbing me. The FOMC minutes will warrant a look, but we know the USD is rallying as markets continue to doubt a December rate cut given strong economic data and Trump 2.0m on the horizon.

It will be interest to see if US consumer sentiment improves following the US election, but again this is not likely to be a market mover.

Note that US Thanksgiving is on Thursday, which traditionally sees the US stock market rally into the close. Perhaps the ASX can catch a tailwind. I will release analysis this week looking more closely at the stats, because form memory there are some notable patterns.

AUD/USD futures – market positioning from the COT report:

- Total open interest increased for the first week in seven to show the general derisking of AUD/USD may have come to an end

- Speculative open interest (large speculator and asset managers) also increased alongside prices last week, to suggest an important swing low may have been seen

- Large speculators remained net-long and close their most bullish level in nearly seven years

- Asset managers slightly increased net-short exposure by increasing gross-shorts, while gross longs remained flat

Click the website link below to get our exclusive Guide to AUD/USD trading in Q4 2024.

https://www.forex.com/en-us/market-outlooks-2024/Q4-aud-usd-outlook/

AUD/USD technical analysis

A bullish inside week formed on AUD/USD to help it recoup some of its post-US-election losses. Which is not bad considering that the USD index rose to a fresh 2-year high and rallied for the last three days of the week. AUD/USD met resistance around the October low as suspected, the question now is whether it can break above it. I suspect it will.

A bullish divergence formed on the weekly RSI (2) within the oversold zone and is now above 50 to show bullish momentum on that timeframe. A bullish divergence also formed on the daily RSI (14) and on the cusp of moving above 50.

Prices are already higher at this week’s open and retesting the October low. A spinning top doji formed on Thursday to suggest a swing low formed at 0.6472, which could be part of a small bullish flag from the cycle low. I suspect AUD/USD is now ready to break above the October high and head for at least 66c, with the 161.1% Fibonacci level (0.6638) and 0.6650 level also in focus for bulls.

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

https://www.forex.com/en-us/news-and-analysis/aud-usd-weekly-outlook-2024-11-25/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.