AUD/USD climbs to a fresh monthly high (0.6563) as it extends the rebound from earlier this week.

By :David Song, Strategist

Australian Dollar Outlook: AUD/USD

AUD/USD climbs to a fresh monthly high (0.6563) as it extends the rebound from earlier this week, and Australia’s Employment report may keep the exchange rate afloat as the update is anticipated to show a pickup in job growth.

Australian Dollar Forecast: AUD/USD Climbs to Fresh Monthly High

AUD/USD seems to have registered the monthly low (0.6419) on the first day of August as it continues to hold above the June low (0.6373), and the exchange rate may further retrace the decline from the July high (0.6625) even as the Reserve Bank of Australia (RBA) lowers the cash rate by 25bp in August.

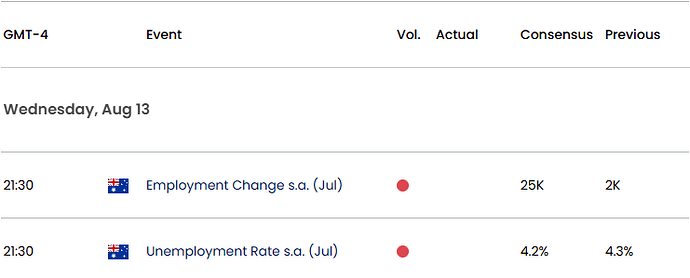

Australia Economic Calendar

Looking ahead, Australia is expected to add 25K jobs in July following the 2K expansion the month prior, and a positive development may generate a bullish reaction in the Australian Dollar as it raises the RBA’s scope to keep the cash rate on hold at its next meeting on September 30.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

However, a weaker-than-expected employment report may push Governor Michele Bullock and Co. to further unwind its restrictive policy as ‘updated staff forecasts for the August meeting suggest that underlying inflation will continue to moderate to around the midpoint of the 2–3 per cent range, with the cash rate assumed to follow a gradual easing path.’

With that said, the recent rise in AUD/USD may turn out to be temporary if it struggles to retain the advance from the weekly low (0.6482), but the exchange rate may further retrace the decline from the July high (0.6625) as it starts to establish a series of higher highs and lows.

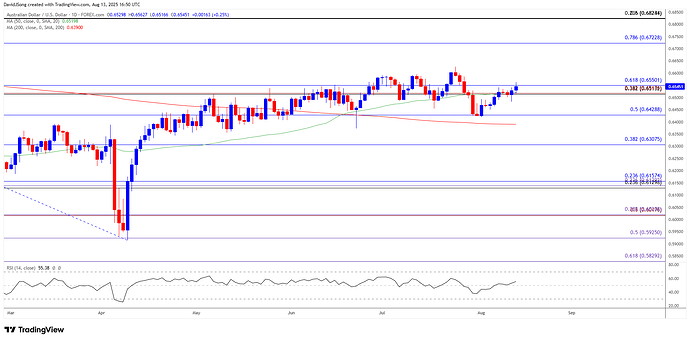

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- AUD/USD extends the rebound from earlier this week to register a fresh monthly high (0.6563), with a close above the 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement) zone bringing the July high (0.6625) on the radar.

- Next area of interest comes in around the November high (0.6688), but the rebound from the weekly low (0.6482) may unravel should AUD/USD struggle to hold/close above 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement) zone.

- A move/close below 0.6430 (50% Fibonacci retracement) may lead to a test of the June low (0.6373), with a breach of the May low (0.6357) opening up 0.6310 (38.2% Fibonacci retracement).

Additional Market Outlooks

USD/JPY Pulls Back from Fresh Weekly High as US CPI Holds Steady

Canadian Dollar Forecast: USD/CAD Bounces Back Ahead of 50 Day SMA

US Dollar Forecast: EUR/USD Climbs to Fresh Weekly High

British Pound Forecast: GBP/USD Rebound Persists Ahead of BoE

— Written by David Song, Senior Strategist

Follow on X at @DavidJSong

Click the website link below to read our Guide to central banks and interest rates in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-central-banks-outlook/

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.