AUD/USD steadies before CPI as RBA patience limits downside; AUD/NZD rally slows near highs, with traders watching support levels for dip-buying.

By : Matt Simpson, Market Analyst

The Australian dollar is back in focus as AUD/USD traders await key CPI data and AUD/NZD consolidates after the RBNZ’s dovish cut. With the RBA preferring to act on quarterly inflation reports, and the US dollar caught between Fed politics and weak yields, the stage is set for volatile Aussie price action. Meanwhile, AUD/NZD momentum has paused near historical highs, with traders weighing whether bulls can extend the rally.

View related analysis:

- GBP/USD, EUR/GBP: COT Data Appears Favourable to British Pound Bulls

- USD/JPY Outlook: US Dollar and Japanese Yen Brace for PCE Inflation

- US Dollar, Japanese Yen and VIX Futures: Weekly COT Positioning Insight

- Australian Dollar Outlook: Dip Buyers to Circle The Aussie

AUD/USD and AUD/NZD Price Action Levels

US Dollar Reacts to Fed Governance Tensions

Fed Governor Cook is preparing to sue President Trump for attempting to fire her, a move that could thwart his efforts to replace sitting Federal Reserve members with Republican doves. This marks a pivotal moment, as it may set a precedent for future attempts to remove board members for political gain.

The US dollar tracked Treasury yields lower during quiet Asian trade on Tuesday following initial reports that Trump had sent a dismissal letter to Cook. Still, downside was limited given the potential significance of these developments. Meanwhile, Wall Street indices, ever the optimists, closed higher regardless.

AUD/USD Traders Focus on CPI after RBA’s Latest Cut

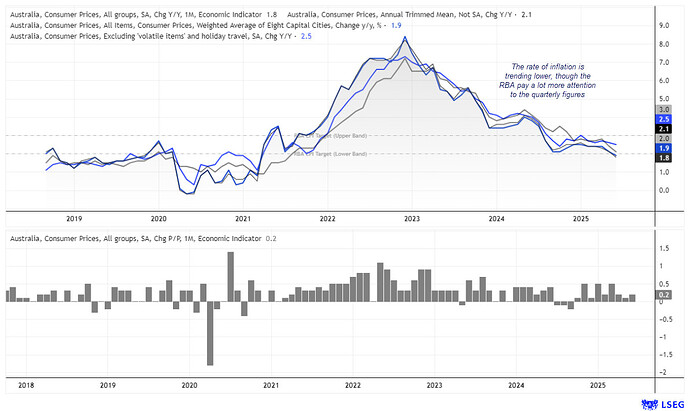

Australia’s monthly inflation figures will be closely watched by AUD/USD traders today at 11:30 AEST. Trimmed mean and weighted mean CPI eased to 2.5% and 1.9% y/y respectively in last month’s report and could soften further today. However, given that the Reserve Bank of Australia (RBA) chose to wait for the more robust quarterly release before delivering a cut it could have made in July, a materially weaker CPI print would be required to spur bets of a September move.

That may limit the immediate market impact of today’s inflation data unless we see a sharp downside surprise. While the RBA has pencilled in one more cut for the year, policymakers appear in no rush to act. With employment conditions still firm, my bias remains for AUD/USD bulls to seek dips, assuming continued US dollar weakness in the coming weeks.

Chart prepared by Matt Simpson – Data source: Australian Bureau of Statistics (ABS), London Stock Exchange Group (LSEG).

AUD/USD Technical Analysis: Australian Dollar vs US Dollar

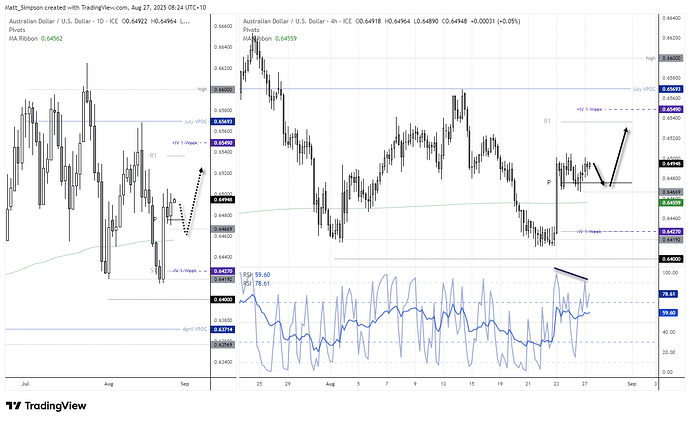

The Australian dollar gained just 0.2% against the US dollar on Monday, a modest move considering Trump’s latest attack on the Federal Reserve. Even so, Friday’s strong bullish range expansion candle suggests sentiment remains tilted in favour of AUD/USD bulls, with dips potentially offering improved reward-to-risk opportunities.

Key support levels to watch include the weekly pivot point at 0.6475 and the 200-day EMA at 0.6456 — areas that bulls may look to defend, while bears could target on lower timeframes.

Chart analysis by Matt Simpson - data source: TradingView AUD/USD

AUD/NZD Technical Analysis: Australian Dollar vs New Zealand Dollar

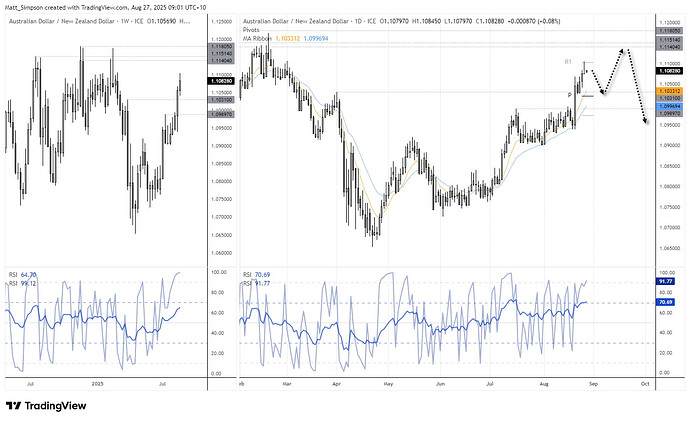

The Australian dollar has enjoyed and undeniably strong rally against the New Zealand dollar with the RBNZ being the outright winner of the dovish central bank competition. While bullish momentum on the AUD/NZD weekly chart is showing signs of slowing, its weekly RSI (14) is not yet overbought and is confirming the rally. So perhaps AUD/NZD will make its way closer to the historical highs around 1.1140 – 1.1180.

However, the daily RSI (14) and RSI (2) have reached overbought levels, and a bearish pinbar formed on Tuesday to show a hesitancy to break above 1.11 for now. Should mean reversion kick in, bulls could seek evidence of support around the 1.1032 high / 10-day EMA, or 1.10 handle near the 1.996 high and 20-day EMA.

Chart analysis by Matt Simpson - data source: TradingView AUD/NZD

Key Economic Events for Traders (AEST / GMT+10)

11:00 AUD MI Leading Index (Jul) (AUD/USD, AUD/JPY, ASX 200)

11:30 AUD Construction Work Done (Q2), Weighted Mean CPI (Jul) (AUD/USD, AUD/JPY, ASX 200)

11:30 CNY Industrial Profit YTD (Jul) (USD/CNY, AUD/CNY, CN50)

18:00 CHF ZEW Expectations (Aug) (USD/CHF, EUR/CHF, CHF/JPY)

20:00 GBP CBI Distributive Trades Survey (Aug) (GBP/USD, EUR/GBP, GBP/JPY)

21:00 USD MBA 30-Year Mortgage Rate, MBA Mortgage Applications, MBA Purchase Index, Mortgage Market Index, Mortgage Refinance Index (S&P 500, Nasdaq 100, USD/JPY)

22:30 CAD Wholesale Sales (Jul) (USD/CAD, EUR/CAD, CAD/JPY)

00:30 USD Crude Oil Inventories, EIA Refinery Crude Runs, Crude Oil Imports, Cushing Crude Oil Inventories, Distillate Fuel Production, EIA Weekly Distillates Stocks, Gasoline Production, Heating Oil Stockpiles, EIA Weekly Refinery Utilization Rates, Gasoline Inventories (WTI Crude, Brent Crude, USD/JPY)

01:45 USD FOMC Member Barkin Speaks (S&P 500, Nasdaq 100, USD/JPY)

03:00 USD 5-Year Note Auction (S&P 500, Nasdaq 100, USD/JPY)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter u/cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.