In this technical blog, we are going to take a look at the past performance of 1 hour Elliott Wave Charts of BABA, which we presented to members at elliottwave-forecast.com. In which, the rally from October 2019 lows, showed the higher highs in an impulse sequence favored more strength to take place. Also, the right side tag pointed higher & favored more strength against $197.14 low seen on 12/10/2019. Therefore, we advised our members to buy the dips in BABA in 3, 7 or 11 swings at the blue box areas. We will explain the structure & forecast below:

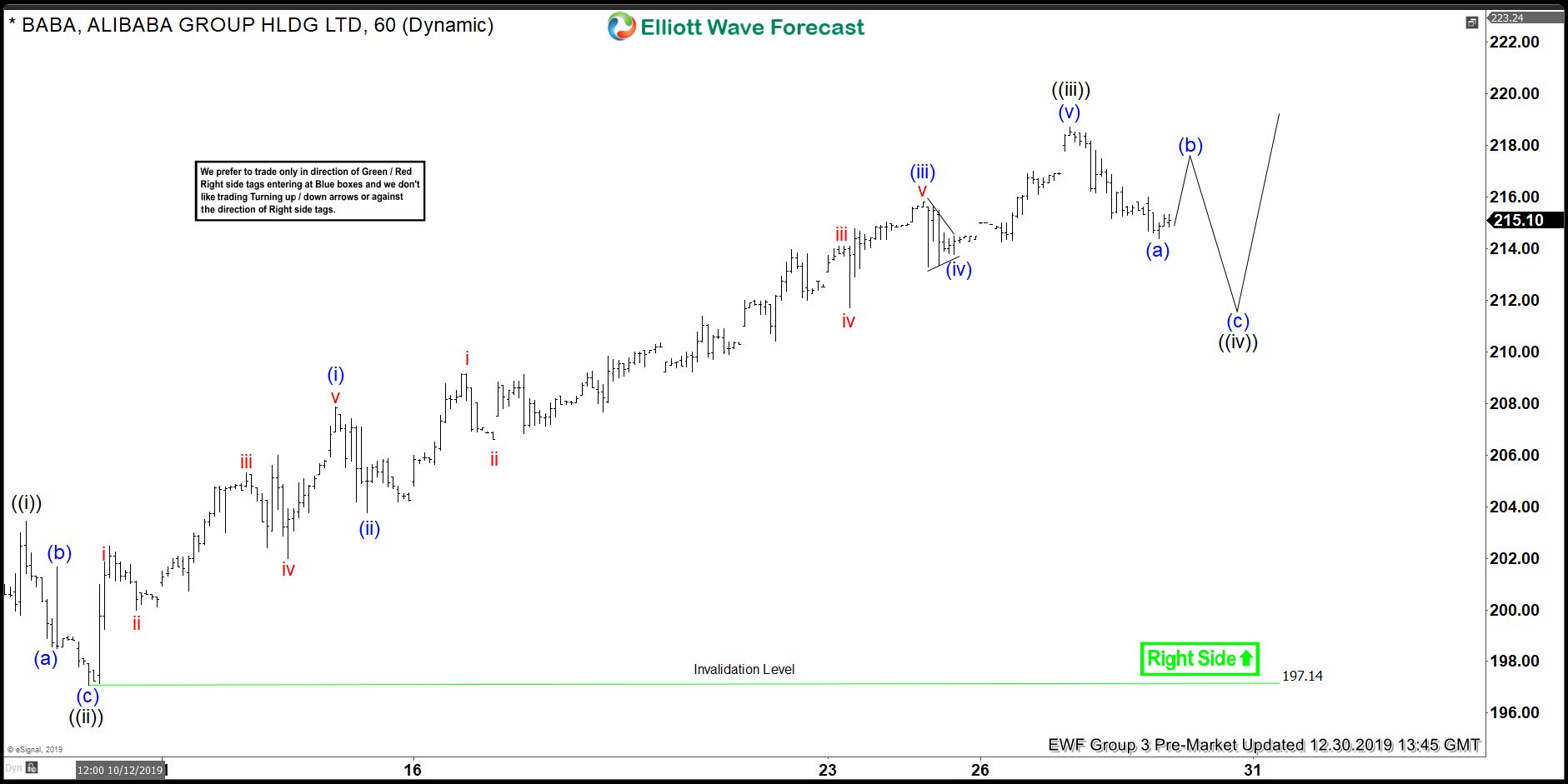

BABA 1 Hour Elliott Wave Chart

BABA 1 Hour Elliott Wave Chart from 12/30/2019 Pre-Market update in which the stock is showing an impulse rally taking place where wave ((i)) ended at $203.43 high. Wave ((ii)) ended at $197.14 low, wave ((iii)) ended at $218.70 high and wave ((iv)) pullback is taking place. It’s important to note that in an impulse structure wave ((i)), ((iii)) & ((v)) always shows the sub-division of lesser degree 5 wave structure. While wave ((ii)) & ((iv)) can be any corrective sequence i.e such as zigzag, double three etc.

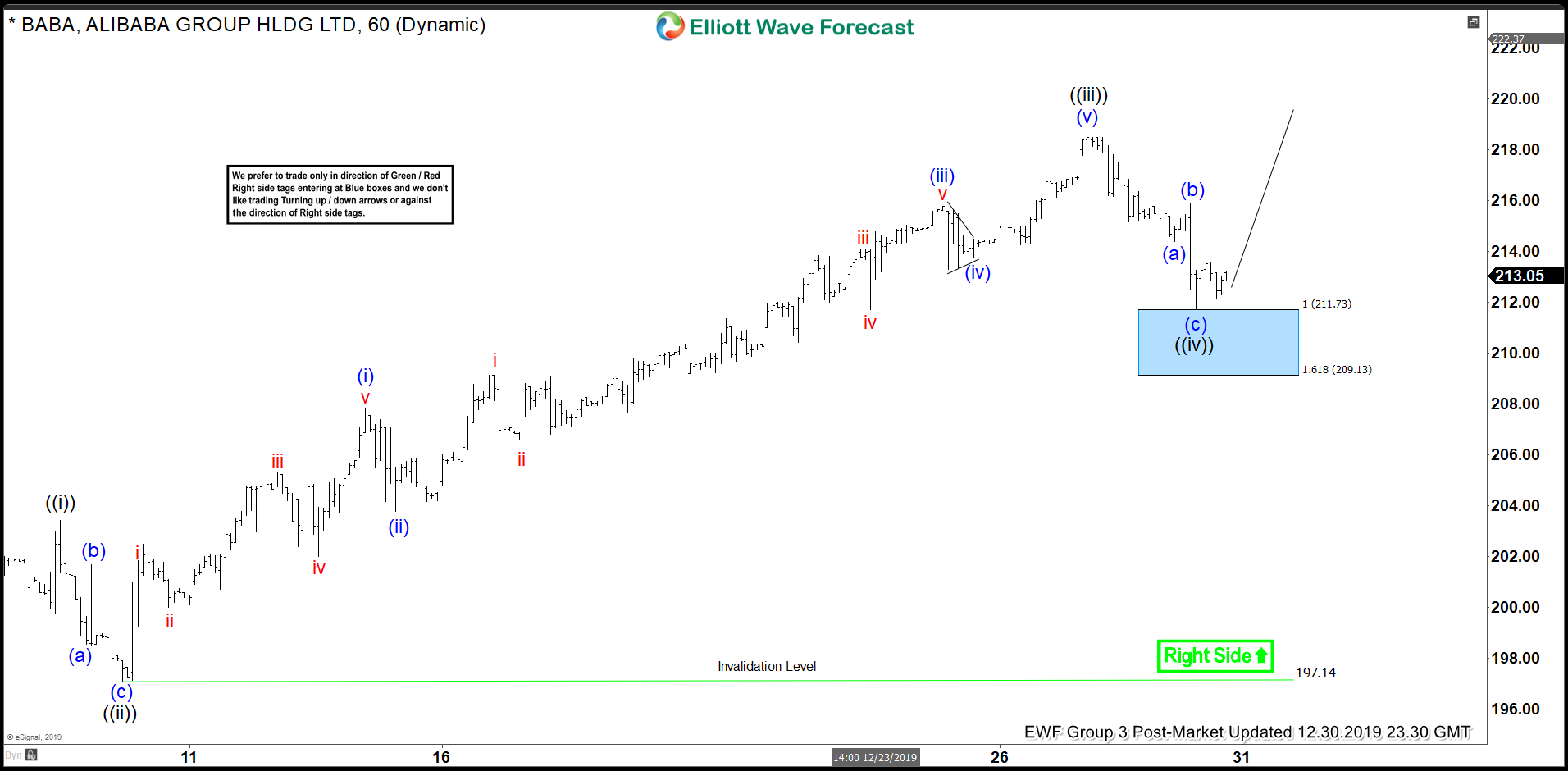

$BABA 1 Hour Elliott Wave Chart

BABA 1 Hour Elliott Wave Chart from 12/30/2019 update, in which the pullback from the peak unfolded as zigzag structure. And managed to reach the blue box our entry area at $211.73-$209.13 100%-161.8% Fibonacci extension area of lesser degree wave (a)-(b). Thus provided buying opportunity to the members into the direction of the green right side tag.

BABA 1 Hour Elliott Wave Chart

Here’s 1 hour Elliott Wave Chart of BABA from 1/03/2020, in which the stock is showing reaction higher taking place from the blue box area. Allowed members to create a risk-free position shortly after taking the longs.