Hi all

I am back…from poker…I started FX about 1year ago hoping to rid myself from poker. But once a pokerplayer always a pokerplayer or something like that…so I slipped back to the darkside. But now with my 3rd kid born and work pressure going tons upwards and well me aging. I cannot function after playing poker all night and then off to work and after work spend time with fam. run errands and then when everyone goes to sleep i go to play poker…nononono am done (I hope). So I went back to the FX business. I also witdrew all my pokermoney and used them as downpayment to our new car we had to get due to one more childrens chari on the backseat.

So am now back. And most importantly I used more than 2 weeks on studying backtesting new strategies studying more. Watching videos reading blogs etc. Logged into my old FX account and saw the damage I did to it as a newb to FX playing with too much leverage on unconfirmed sinals and so on. I have tons and tons to study more. One big leak I immediately recognize is that I am totally terrible at estimating the exits and I have lost profits either exiting oo early or too late. But If theres someone willing to share what would be the best way to determine those. Resistnace supportlines? Fibonacci (srsly i have no clue about fibonacci  ) something else. I am going to explain the strategy Ilike to use the most atm. so it could be easier to explain???

) something else. I am going to explain the strategy Ilike to use the most atm. so it could be easier to explain???

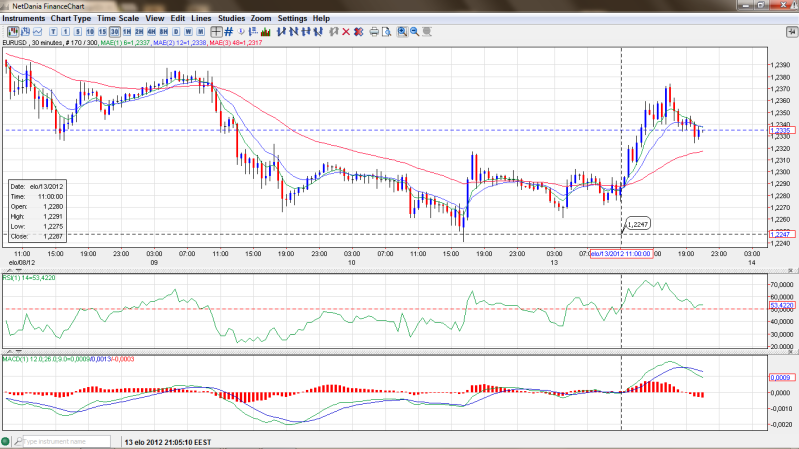

I use this kinda thing. First off I scan through daily charts thru my portfolion on FreeStockCharts.com - Web’s Best Streaming Realtime Stock Charts - Free (I use this as I do some binary option trading on stock too) This in order to look thru which pairs are trending which way etc who looks strong and who look weak. So I am at my office and set alarms on the pairs I shoose to go with. Usually just scalping kinda thing or few longer positions if something is looking good on 30min 1h charts.But mainly intraday stuff. Signals I use are MACD line crossing confirmed by RSI movement and EMA crossing MA. When all these lineup its tradingtime.

Example from Netdania I sometimes use at work too (luckily I have 2 monitor setup onmy office so i can have FX on one monitor and work on another  ) Also the facebookbroker offers charts wit ok tools for my tactics but eat tons of cpu and dont keep the studies while going thru pairs so have to open multible windows cluttering the comp even more…thus feestockcharts or netdania.

) Also the facebookbroker offers charts wit ok tools for my tactics but eat tons of cpu and dont keep the studies while going thru pairs so have to open multible windows cluttering the comp even more…thus feestockcharts or netdania.

I am also with the “most hated” broker…the one who many newbs me included get in with…and yes I am looking to move away but I am looking to

1.win back my newb losses (yes I have a nano account 156usd initial start only 9usd short from this)

2.atleast double my initial deposit probably triple

Then leave some money for the social “playstation”“facebook” broker and have “gurus” make me money.

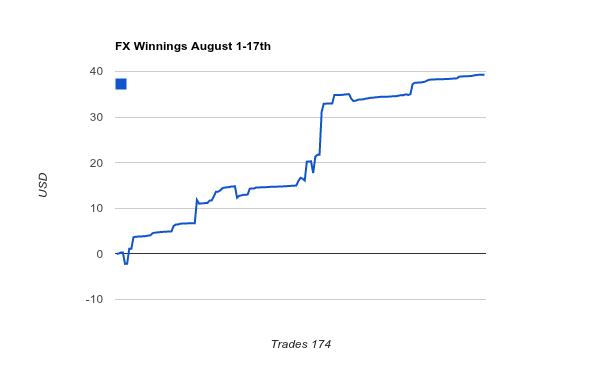

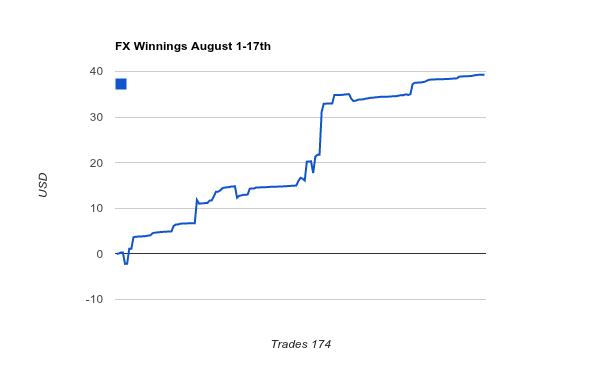

Well I hope to continue with as good success as I have had since I got back on august 1. Just focusing on my tactics. Looking to profit ateast 1% aday. I saw some reg here talk about 5% a day buti am happy for atleast profit daily even for one pip gunning for 1%. ocv sometimes loosing but for the first half of august been ob fire with 0 negative days.

Heres the chart for 1st-17th august. (including social trades) mytrades +30usd copytrades rest

wish me luck!

followup weekly from nowon.

hoping help for exits

recommendations for low spread broker with skrills as depo option mt4 and webtrader ability.

Chher and great weekend! (also have free weekends as no fx no weeknds compared to poker)

All the Best. Wish to hear some positive results.

Hi welcome back. Its interesting i was writing in a thread earlier in the week of another poker player coming across to trading. I used to play a lot as well before trading!

First thing i would say is i would concentrate on the higher time frames so h1 upwards. The reason being it sounds like you have a busy life and you can make just as much money trading a couple of hours a day than you can watching charts all day. The thread i always reccomend readin is called ‘forex price action’. I personaly dont use indicators apart from fib lines and 200sma.

As far as exits go previous swing high/lows or support/resistence are always best for exits. Most important thing is your stop loss though. Make sure this is the first thing you calculate when looking at a trade and then make sure your risk/reward ratio is ok. Its like in poker your not going to chase a flush draw if the pot odds are not adding up (ignoring implied odds obviously!).

So check out that thread amd see if tradong higher time frames works out. I am sure you will enjoy the freedom it gives you.

Thanks!

Well atn i feel am doing something right as i have almost filled the hole i spewwed as a newb overtrading compensating looking to win back losses with higher leverage and all the newb mistakes. Put almist 30% gain in 2 weeks and yes as you can see had losses too so am not on a massive heater but rather looking more patiently waiting on my signals to happend before invest. Seems to be profitable way so far. If i can keep it up i can up the ante on my trade investmens soon. Though i thinks i’ll do it only when i have atleast doubled my acco. Also emotianally fx on a nano account is nothing compared to poker so no scared money on such small investments. Now over the weekend trying to find something good about how to look for exits etc. What kinda systems you guys use when your main trading is intraday/scalping. How about on longerones? Just tren patterns support resistance etc?

Also started watching a lot of business related programs and channels to learn more. Some analyst in bloomberg’s lunchmoney suggested eur will be 1.16 at the end of september, what do you guys think. My twitter and fb are also following tons of business related things. So like said in op am taking a lot more srsbz approach to fx now as no poker for me and in the longrun am hoping to be trading on a lvl where i can withdrawl some monthly cash to compensate the money not coming in from poker.

Also why trade on nano account. Because i believe that learning from cheesburger investments and moving up the ladder to having some serious money on the table is the only way to go. One needs patience and determination to do it and as far as i know patience is a BIG virtue in fx trading. Also i like the fact that there is really no mathematical variance downswings if you keep it simple and follow chosen strategy. Ofc losses occur but they are easier to control than in poker. I made my pokercareer starting with 0 moving to midstakes games and thats what i am looking to do in fx though in the longrun i want to reach robusto levels.

What do you guys consider different levels in fx?

Bankroll

$100-500 nano stakes

$500-1k micro

1k-2k small

2k-5k low

5k-25k medium

25k-200k high

200k-1mil+ nosebleeds?

Or something else.

Also plz help me on my quest on finding a new broker as am lookinf to move on in few months or so.

Reqirements.

As low spreads as possible atleast om majors. Currently 3pip on majors and 7+ on minors and goods

supports mt4-5 and has webtrader ability so i can trade at work too as i cannot download mt4 to work computer.

Now its time for kids bday party and in the evening tons more studying the pipsolgy and videos

Cheers.

hi james!

Thanks for your input. Have to look that thread up! Also thanks for your poker allegation still have brain setup for those. Though with lately lots os HU games i love implied odds as they create monsters. But yea fx is so much better with a lot less stress time investment and especially free weekends. But yea with entering a trade on strong signals feels like 3bet jamming your 80% hand postflop with an option to buy out on smaller losses if getting sucked out on river. But still i think its almost impossible to have downswings in fx that last a month or two just because theres a lot more possibilities to predict the outcome than with your holecards on preflop. I believe with sttict strategy follow up your strategy you can have constant steady grow without having to worry about moving down levels due massive swings. And also when going to higher level the opposition is the exact same its not like when you move from $10 trades to $20 trades or compare $100 trades to $1k trades that the markets are any tougher  risk is the same in % if you keep with good money management so tilting isn’t an issue really. Obv it sucks to close a loosing trade but just looking back where your anakysis went wrong its rather easy to avoid next time…but yea lets see how this goes. I am very motivated now and want to make this a srsbz sideincome in the future.

risk is the same in % if you keep with good money management so tilting isn’t an issue really. Obv it sucks to close a loosing trade but just looking back where your anakysis went wrong its rather easy to avoid next time…but yea lets see how this goes. I am very motivated now and want to make this a srsbz sideincome in the future.

Am gonna keep “blogging” on this thread as long as i belong to newbie island. Maybe will start a serious blog later but untill then i just want as much feedback as possible good constructive whatever. Make a note am not making this thread one of those looking to go “pro” (unless obv i someday make it to comfortable enough levels). But thats far in the future if ever.

And obv s stated before. Recommendations on brokers is something i want to get here too.

Am also looking to post trades gone bad questions later. I wanna hear expert analysis what i did wrong etc. No need to post profit trades as this is not a bragging thread either. So yea off I go again. And lurking here all weekend studying and discussing etc.

Good to be back! And happy to see am not trolled for my past  and it seems not many trolls in here anyways. Atleast not on newbieisland.

and it seems not many trolls in here anyways. Atleast not on newbieisland.

) something else. I am going to explain the strategy Ilike to use the most atm. so it could be easier to explain???

) something else. I am going to explain the strategy Ilike to use the most atm. so it could be easier to explain??? ) Also the facebookbroker offers charts wit ok tools for my tactics but eat tons of cpu and dont keep the studies while going thru pairs so have to open multible windows cluttering the comp even more…thus feestockcharts or netdania.

) Also the facebookbroker offers charts wit ok tools for my tactics but eat tons of cpu and dont keep the studies while going thru pairs so have to open multible windows cluttering the comp even more…thus feestockcharts or netdania.

risk is the same in % if you keep with good money management so tilting isn’t an issue really. Obv it sucks to close a loosing trade but just looking back where your anakysis went wrong its rather easy to avoid next time…but yea lets see how this goes. I am very motivated now and want to make this a srsbz sideincome in the future.

risk is the same in % if you keep with good money management so tilting isn’t an issue really. Obv it sucks to close a loosing trade but just looking back where your anakysis went wrong its rather easy to avoid next time…but yea lets see how this goes. I am very motivated now and want to make this a srsbz sideincome in the future.