This was part of a post by SimonTemplar a few pages ago. The subject of that particular post is not important now, but this particular section did remind me that I HAVEN’T added an update about my trading exploits recently. And I’ve been meaning to do it. So since I have some time to myself tonight, I thought I would update now.

I have no doubt already that this will turn into a long post, so if you do intend to read it all, it might be wise to go make the cup of coffee now.

Anyway, let’s get to it. First of all I would like to say that I already know some of the information in this post will make the more experienced guys cringe, possibly even close their eyes and shake their heads a little, and if I say that I don’t care, it’s not because I don’t value their opinions, which I do, but it’s because I have to travel MY forex journey, no-one else can do that for me, or you for that matter.

So first up is my account balance. Currently back down to $103. That is from a low of $43, back up to a high of $151 and back down to around the $133 level for a while. And that also includes the gain of + 64 pips ( $6.40 ) made today at lunchtime. So what went wrong? Well, funnily enough, I don’t think anything HAS went wrong, and I’ll tell you why.

Again, just before I start to dig the hole, if anything I write here starts to sound like an excuse, I assure you it’s not. I don’t believe in them. These are just MY thoughts and this is just the way I do things.

Over the course of this thread, I have had a changing opinion of Demo accounts. First I didn’t like them, stating that I didn’t think they taught a beginner anything regarding psychology of trading. Then I liked them, trying out trades I wasn’t brave enough to take on a live account. And now I don’t like them again, mainly due to the realization that if you don’t like a trade enough to take it in a live account, maybe that’s all the information about that trade that you really need.

Just as you hear time and time again that you need to find a trading method that suits you individually, I have ALWAYS had a quite unique learning method, even as a child. I was never a person who could study. I’ve said before I find it difficult to learn from reading, and that is true. For me, I’ve always had to fall on my arse, because that’s how I learn. Has this made life a little more bumpy than it could have been? Sure, I have no doubt about that. But in my opinion, I was lucky enough to have realised that at quite a young age.

So, was been down 90 pips in a demo account, on a trade that I took because I was trying to work out how to effectively use moving averages, with NO REAL cost to me at stake, teaching ME anything personally? No, it wasn’t. Because being down $900 in a demo account doesn’t come close psychologically to being down $1 in a live account.

So why tell you all of that? Well it’s because that is where I test new indicators now, in my live account !! ( think I just heard a few of the experienced guys groan a bit there. ) Has this caused the drop in my balance. Maybe a little, but not the main reason.

So that’s how I learn, it is what it is and I am who I am. Almost 45 now guys, I don’t think I’m going to grow out of that method now. I’m just a charge in, think about the consequences later kind of person. So what, apart from my rather suicidal learning technique, have been the challenges I’ve faced as a newbie?

One of them is the times I get to trade. Having a “real” job (LOL ! Sorry traders ! ) I only get to trade, more or less, in the last couple of hours of New York, and then I sit up to about 1 am trying to find a trade. This trying to “find” a trade invariably leads to trying to FORCE a trade. ie find one that isn’t really a trade, just a gamble. And a gamble is more or less just a coin toss. 50/50 chance of being right/wrong. Instead of waiting for higher probability trades, we just roll the dice. So has this been the major reason for my loss? Again, maybe a little, but NOT the main reason.

Funnily enough, ICT mentioned in his Aspiring Trader thread about the correlation of Strong Dollar = Weak Risk Currencies ( and Weak Dollar = Strong Risk Currencies ). And on the days where I have been fortunate enough to be off work and able to spend time in front of the TV with Bloomberg showing the news, and being able to track the direction of the Dow and S&P, these have been the times I’ve gained back some of what I’ve lost. So I guess you could say that having real time access to real time news, AS YOU ARE TRADING, is a key component to trading success.

Then for a while I was on a good winning streak, I started to win more and more and my account literally shot up from around $109 ish to $150. Then I had a big loss, which admittedly took a lot of the wind out of my sails and for the next two or three trades I slumped emotionally into the “I don’t care anymore” way of thinking and made a couple of really wreckless ones. So has the greed caused the drop? Well? Any guesses? Nope, that’s not been the main culprit either !

In fact, when I think about it, I really can’t put my loss down to most of the usual suspects. It’s not been greed, it’s not been impatience, over-confidence or lack of research, as the MAIN reason my account is down. So what IS the main reason?

Well in my opinion it’s pride. Or, put another way, my total and utter inability to accept a loss. It’s a constant struggle with me. Some time ago I made a trade in which I moved my stop loss to keep me in a trade. This turned out to be the subject of a good couple of pages on this thread. And I still do it, or things similar.

Last night I placed a trade and gave myself a error margin of 20 pips, ( without checking the exact numbers and off the top of my head, I think I placed my stop at 1-3760 on a short from 1-3740 on EU ) But I had to go to bed. Price had bobbed around 1-3740 for ages and hadn’t done anything for a while, but rather than just leave it at those levels, at which I would have only lost $2 on my trade, I moved my stop to 1-3820, “Just to be sure my trade stayed alive while I was sleeping”. And guess what happened ??? Price moved up through 1-3820 while I was in bed and I ended up losing $8. That’s 4 TIMES WHAT I SHOULD HAVE LOST !!!

So that’s the struggle I’m having with trading. Now I’ve come across some knowledgeable people on this thread( you all know who you are without going through the names ) who have been good enough to offer advice. And that is appreciated and I hope you all know that. But, even though I’ve said what I’ve just said, and you and I know that these things are wrong, they are part of MY journey, they are MY trading demons. You’ve had yours before me and had to deal with them. And I’m sure any newbies reading this are having the similar, if not the same, struggles.

But I’d just like to reassure newbies that this IS the norm. I have no doubt all traders go through the same things, ask the same questions, have the same doubts. But that’s NOT what newbies come here to hear. Newbies are in search of the answer, the secret, the well over used term “the holy grail”

Well you won’t find it on this thread, sorry. But what I WILL tell you is what I am working on just now.

First thing is Price Action. Nikitafx has a good thread called Pure Price Action For Dummies. Newbies could do worse than head over there and have a read. I find sometimes I look at price action and the candles may be telling me one thing, but the preceding trend was opposite, and I struggle to trust what the patterns are telling me. Having the faith in what I’m seeing and thinking is hard sometimes.

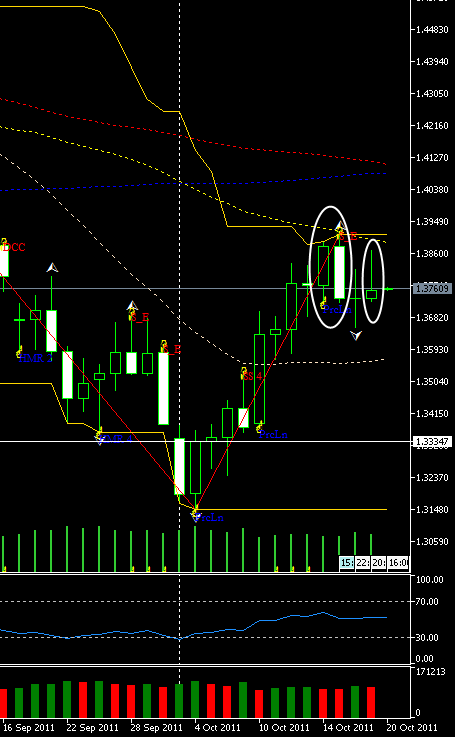

As for what I’m using besides price action on my charts, I keep a 4h chart with ONLY the last 4 weeks highs and lows, + this current week’s high and low on it, constantly as a reference. But I also at the moment run 1w, 1D, 4H, 1H, 15m, 5m and 1m charts that look like this :

I hope you can see that. Just in case you can’t, it’s a Daily chart that has Donchian Channels, Fractals and Alligator on it. I may also run a 100 EMA from time to time. Now here’s a funny thing to admit. Donchian Channels are a thing that was only mentioned recently to me on this thread and I don’t know fully how they are used. I only have a very basic working knowledge of them, I’m currently trying to research more about them and how to best effectively use them, but at a glance they give me a quick idea of support and resistance levels.

Fractals also give me a quick idea of S&P levels and again I’m currently trying to read up on them but in reality know LESS about them than I know about Donchian Channels.

Alligator, read about them a little, I know they are supposed to be used in conjunction with fractals, but I DON’T know as of yet the exact interaction between the two. Again, reading about them currently.

Strange thing about telling you all of these things I have on my chart which I have very little knowledge of, is that I get a strange sense of comfort from them. At a glance, combining them with what the candles are telling me, I’m starting to get a feel for direction. A SMALL sense of feeling of direction admittedly, but I’m trying to read and I’m trying to learn. And I just like them, that’s all !!

So anyway, all that said, what are the positives to be taken from my trading so far.

First thing, and most important thing in my opinion is that I am, or should I say my account is, still alive. Still here, still using my first live account, still going.

Next positive is I’m starting to recognise my weaknesses. Very important that, just as important as knowing your strengths.

Again I’m trying to work on them. Leave pride at the door as much as humanly possible.

Next thing is more of a personal matter in a way. As we all know, mainly from doing this very thing, the world economy is not in the best shape. And my current industry, like a helluva lot of other industries, is finding it tough just now. And for the first time, I find myself, at 45, without a back-up plan. No “plan-B” as it were. And initially I thought, if I could learn this FX thing, it may end up being the primary source of income, as it’s just as much possible to make money in FX when things are bad as it is when things are good.

But the problem is, that even now, I don’t think I’ve been treating the protection of my account balance seriously enough. It’s been a game in a way, maybe because the balance is so small, who knows. But whatever the reason, I’ve not been taking it seriously enough. And it is only in the last day or two, and I know that may seem strange, but only in the last day or two I’ve started to think, “Hold on a minute, I need to do better at this. This HAS to be treated the same way I treat my taxi business otherwise I’m just pissing about in the bedroom upstairs at night when I’d be better off spending time with kids watching cartoons. If you decide to do it, and therefore decide to spend less time interacting with the family, at least have the decency to treat it seriously”

I know that may sound a bit melo-dramatic, but it’s true never the less. It won’t ever work if you treat it like a game.

So that’s more or less my update ramble directed at the newbies. I’ve told you what I’m worth, literally I think, and what I’m currently using and working on.

Future reading plans are on Elliot waves. Not entirely sure how much I would use Elliot waves on a full time basis, but I think it would be useful to at least have a grounding on the subject.

Anyway, I think that’s about it. As I’ve said before these thoughts and rambles may not make sense to a lot of people, but they’re part of my thought process and it was always the intention of this thread to share that, as SimonTemplar put it, “Warts and all…”

HoG

PS. I am NOT advocating the “charge in, ask questions later” learning technique to any other person, take it from me, it’s a rough road, it just happens to be the way I do things apparently !!:20: