There’s a couple of posts I want to do tonight so I’ll get cracked on. Here’s a question for all newbies reading this thread. Have you ever “discovered” a new song that you just love, and for the next couple of weeks you just play it constantly, over and over, you play it?

I have. A few months ago I found - She Talks To Angels by the Black Crowes. Played it religiously for days on end, over and over.

Well, personally, I think beginning to trade FX is very much like that same, almost hypnotic song. You discover it, you love and you want to play it every day, as often as possible. So you look at the 4 hour charts, then the 1 Hour charts. Because that is what the experienced guys tell you to do. They don’t trade from the smaller time frames.

But the problem with those long time frame charts is that they don’t give you many trading signals. What good are they? We’re here to trade for God’s sake !! So what gives you the most signals ? The 1 Min chart. Signals every couple of seconds. That’s the boy for us !!

Fast forward a couple of months. Do you still play that song everyday? Or do you even turn it off when it DOES come on now? What about your FX ? Do you still have that account ? And if you do, is your balance depleted some what ? And are you just plain tired of losing trades ?

Well, that’s the way I feel right now. But let me tell you why I believe that’s a good thing. I AM tired of losing trades. So much so, that in the last couple of weeks, I’ve even told my wife I’m going to quit doing this all together. That it’s probably not something I’m going to be very good at anyway by the looks of things. But it was only this morning that I realised, I’m not tired of it, I’m learning. I’ll tell you why.

In a post this morning before I went to school with the kids, I wrote that I was tempted to go long, maybe target around 1-3950 I think it was. But I didn’t take the trade. And the reason I didn’t take it was that I just wasn’t convinced by it. Not 100%, so I left it. Because I didn’t want the depression that goes along with ANOTHER losing trade. Here’s what happened.

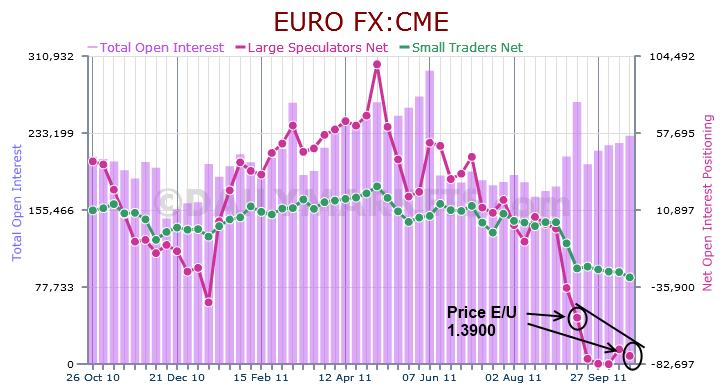

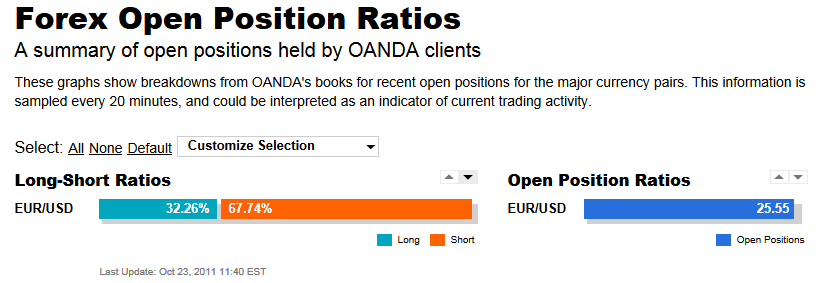

This is an image of the 1 min chart that I was looking to take a trade from this morning. Now personally speaking, looking at this chart, I think it would be reasonable, GOING BY THIS CHART, to enter at 1-3898, put a Stop under the low of 1-3888, and put your target at 1-3938, the reason for that is that it was a previous high which isn’t visible on this image.

As I said, going purely by this chart, I think that would be a reasonable BUY. Risking 10 pips to make a possible 40, and in all fairness, if price CAN break up through that little resistance level, then I think that trade stands a reasonable chance. And as I write this, some 13 hours later, price is up around 1-3924, and did reach as high as 1-3957 today. But let me ask you this, where is the MAJOR flaw in this trade ?? Any guesses ?

I’ll tell you, - IT’S THE 1 MINUTE CHART we’re looking at !!

Here’s the 1 Hour and 4 Hour charts which correspond to the same time this morning, with the same levels marked on them. Now you tell me, looking at THESE candles, would you STILL take that same long trade ?

1 Hour :

4 Hour

So what are we thinking ?

The 1 Hour surely is telling us to SELL no? And although the 4 Hour image is obviously taken AFTER the last candle has closed, even if we ignore it, and purely use the second last candle, it still ISN’T telling us to BUY is it ? So what DID happen in the time after the minute chart snapshot? Well here is another 1 min chart:

So as we see NOW, 24 minutes after the trade would have been opened, we’d have been stopped out for a 10 pip loss. Now 10 pips may not be the biggest financial catastrophe to ever hit you, but when you are a beginner, as I still am, and you’re on a bit of a losing streak, IT’S ANOTHER PSYCHOLOGICAL LOSS. It feeds that feeling of loss. Then it feeds desperation, which will lead to more trades made in haste which will lead to more losses. ( See where that ones going ? )

So, because I feel that I am slowly “graduating” away from the small time frames, and I didn’t take a trade that I was less than convinced about, which I definitely would have done even up until very recently, I’m taking today’s non-involvement as a victory. Like the song we found at the start, I’m tired now of losers, I’ve had enough of them. I’d honestly rather just give up as continue to lose, get a little back, then continue to lose again.

The novelty of trading has worn off, and I maintain this is a good thing. You may also have to go through this journey for yourself, in fact you definitely will because no-one can go through it for you. But when the thrill of hitting buttons wears off, hopefully we’ll have grown mentally in our FX trading. I’m not saying you’ll never have a loser again, because we all will, but just hopefully we’ll make better decisions in future.

Having said all of that, do you remember the song I spoke of at the start? ( Black Crowes - She Talks To Angels ) well I still play that everyday. It’s just the best song ever. The accoustic version is best, so here it is for your amusement. I hope I don’t break any site rules by posting this.

She Talks To Angels {Acoustic} - The Black Crowes - YouTube

Although, the studio version is pretty damn good too gang,

The Black Crowes - She Talks To Angels - YouTube

Remember to crank that volume up !!