Just lifted this from my diary as a lesson to all other newbies. Better to learn from other people’s mistakes than try to make the ALL yourself :

" Last week, rather than make my intended 50 pip profit, I ended up with just over a 200 pip loss. Balance went from $67 area to $43 area before I made a few pips back to finish the week at $44-86. So what went wrong ??

Probably a classic beginner’s mistake I would imagine, or at least, a couple of beginners mistakes.

Big news event for the Euro last week was Jean Claude Trichet’s speech on Thursday lunchtime GMT. I would imagine that the experienced trader would wait for the speech to end, gauge the reaction and trade accordingly. But oh no, that would be far too simple for a beginner like me. I need to get involved BEFORE the speech.

And to be fair, it almost worked, had I not decided to get too fancy and just left things alone, I would have been fine. Let me explain.

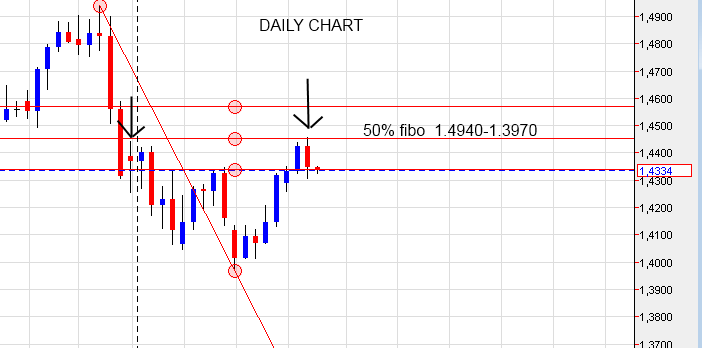

On the evening of Wednesday 8th of june, (the night before the speech ), I decided to SELL the EUR/USD at 1-4590 ish. I put my stop at 1-4655 but put no TP as I thought that in the event of things going my way I would just let it ride.

Up until an hour before the speech, that trade was losing roughly 30 pips, trading around the 1-4620 area, however I was still in a positive mood about the whole thing as I thought the debt crisis Europe finds itself dealing with right now would not allow the price of the Euro to go a helluva lot higher. So, as I said, up until an hour before the speech, I was doing fine.

But that is when inexperience raised it’s ugly head and I began to second guess myself. I decided that I would get a bit fancy and catch any jump in price right at the start. So this is what I did.

For some bizarre reason I decided to lower my stop on my first trade to 1-4650. Then I placed a BUY order at 1-4650, so that I could catch the price as it shot up through the roof. Yes, those of you who know what happened must be shaking your heads right now. For those of you who don’t, here’s what happened.

As the price bobbed along during the speech at around 1-4620, Mr Trichet used his ‘Strong Vigilance’ phrase which has become ECB code for, “Listen gang, us guys here at the ECB are going to raise interest rates next month.” And with this, the EUR/USD price spiked in less than a heartbeat to 1-4651.

This cancelled my first SELL trade, locking in a 60 pip loss, and at the same time opened my BUY trade at 1-4650.

Incidentally, where was I while this account busting action was taking place? Was I sat in front of the PC watching every move? Was I glued to the TV listening to every syllabel coming out of Mr Trichet’s mouth?

Eh…No! I was in the garden spraying weedkiller on the back pathway. ( That was probably the biggest mistake now that I see it wrote in black and white !! )

It was then that Mr Trichet decided to change the tone of the outlook and just as quickly as the price spiked, it then promptly fell off a cliff and by the time I caught it, I had made a further 156 pip loss.

So at $44-86 I’m definitely on life support. It’ll take a monster effort to ressurect this account but hey, what else ya gonna do ??"

Hope this helps other beginner’s out there.

HoG

Sure, we can and what even more, I think that we have to feel and know our feelings and emotions. If you know yourself and your emotions, feeling, how they affect you, then you become stronger as you can prdict in what situations it could affect your mind and decisions. When emotions affect on our mind, then we should wait for losses. It’s just impossible to analyse market and it’s movement in this case.

Sure, we can and what even more, I think that we have to feel and know our feelings and emotions. If you know yourself and your emotions, feeling, how they affect you, then you become stronger as you can prdict in what situations it could affect your mind and decisions. When emotions affect on our mind, then we should wait for losses. It’s just impossible to analyse market and it’s movement in this case.