Hello, i am new to forex trading. i have read about the best & worst time to trade in the school of pipsology. both parts indicate Major news event. what does this mean?

IMO best time for entry during fundamental events - after 5-10 min of their release, when you can make a clear picture of whats going on.

It’s all depends of your trading strategy. Some traders are trading the releasing of the events, in the other hand some traders will wait stabilisation than trade.

The worst time for trading is when we can not control our emotion because we will lose our money, our strategy, rule, plan will not undergo well. That’s is why, when we can not control our emotion, we should not trade.

8-16 GMT is best. Everything else is the worst…besides maybe Asia open for about 2 hrs.

It depends on the trader’s personality. Some thrive on trading news events while others prefer trading intraday trends. In the end though, most traders just trade whenever they’re awake in their part of the world and learn to structure their trading strategies around their local trading hours.

As others have already said, there are many different styles of trading. Some will perform well at times when others struggle.

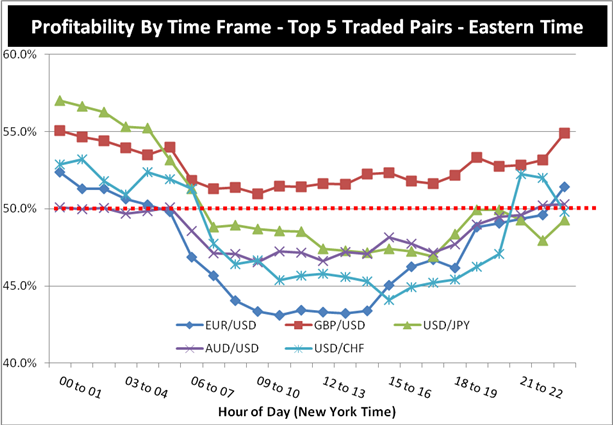

However, if you want overall view ignoring the particular strategies used, the table below is from a series of studies on trader profitability conducted by DailyFX. They analyzed over 12 million real trades conducted by FXCM clients, and found that trader profits and losses could vary significantly by time of day.

That data showed that most traders are what are called “Range Traders”, and their successes and failures very much depend on market conditions. In fact, this trading style means that many of them have trouble being successful in forex because they are trading during the wrong time of day.

Most forex traders are more successful during the late US, Asian or early European trading sessions – essentially 2 PM to 6 AM Eastern Time (New York), which is 7 PM to 11 AM UK time.

This chart again. The market often moves very little off hours. For many open trades it will take an active time a day to have the stop loss hit. I wouldn’t read much more into it. More price movement means more stops getting hit.

Off hours is a time when more winning positions get closed more because they have the luxury of closing when they want, rather than a forced stop out. I just think this is misleading. It’s basically saying that your best chance to make money is on u/j, g/u at Asia open and worst chance is e/u, u/chf during main hours. I don’t think that the majority of successful traders are doing that so something doesn’t add up. Maybe I’m missing something but thats what I get from it.

It’s similar to the “take small profits” stats you once posted. Showing that traders that take smaller profits win more often. Again, misleading if your looking for any edge or formula using that info. Statistically you have a better probability of hitting your target the smaller it is. It doesn’t mean those small target traders are actually profitable end of the day, week, month.

Don’t mean to be on your ass Jason lol.

Hi, trading new events is not a bad idea but you need to know what you’re doing. Trading the news is called Fundamental trading, using Technical strategies to determine entry and exits - technical trading. I’m a technical trader and the best times for me so far is when London opens and when the NY session starts. Hope it helps.

The worst times according to my experience is near news time, if you are an inter day trader or scalper, then you need to keep an eye on news as a must. The best times, off course when you get a good setup from your trading system.

Hello, and welcome to the forums.

One thing that should be said, as well as what has already been written (all valuable advice), is that the worst times to trade are:

- when you are emotionally unstable, e.g. after an argument, upsetting news, or having just experienced a losing trade;

- when you are tired, due to lack of sleep, or a hard day, or if you have been ill;

- when you compete with other people for gains, and gamble your money into unplanned trades;

- when you have debts and attempt to use trading to turn your finances around quickly, with potentially worse results.

Cheers.

No problem, I enjoy a good discussion :57:

That said, the findings from the DailyFX study about taking small profits were the opposite of what you thought they were, and in fact were more in line with your own conclusion:

[B][I]“Traders are right more than 50% of the time, but lose more money on losing trades than they win on winning trades. Traders should use stops and limits to enforce a risk/reward ratio of 1:1 or higher.”[/I][/B]

source: What is the Number One Mistake Forex Traders Make?

Also, the study about the best time of day to trade was not based on when trades were closed. That means it was not impacted by traders closing profitable trades manually on their own terms as opposed to getting stopped out. Rather it looked at the gains or losses made on the open positions of traders during each of the 24 one-hour blocks during the day. Overall, the open positions of retail traders experienced the most gains during the times highlighted in graph I posted previously.

[B][I]“Our data show that over the past 10 years, many individual currency traders have been successful range trading European currency pairs during the “off hours” of 2 PM to 6 AM Eastern Time (7 PM to 11 AM UK Time). Many traders have been very unsuccessful trading these currencies during the volatile 6 AM to 2 PM time period. Asia-Pacific currencies can be difficult to range trade at any time of day, due to the fact that they tend to have less distinct periods of high and low volatility.”[/I][/B]

That’s most enlightening Jason… thank you for sharing. Is there a comparable study or at least some statistically relevant data compiled by FXCM showing the success rate of longer duration trades (regardless of strategy employed)? Say for example four days to several weeks?

Ah, it didn’t occur to me that open/close times are not part of that profitable time of day stat.

But with the R:R stats, that is what I was saying. Bigger losses, smaller targets mean more wins but not necessarily profitable in the end. If they limit their stop to less pips it is more likely to get hit and I would guess they would no longer be right more than 50%.

Found again a very helpful advises. Thank you for sharing.

H R Carter,

Not that I’m aware of, though I’m curious what such data would tell us. Remember, the DailyFX study was not based on how long trades were held open, but rather which one-hour blocks of the day proved to be most profitable for retail trades overall.

Are you looking for example to find what days of the week are most profitable for retail traders? I’ve heard different theories about this but no detailed data.

Thank you for replying Jason. No not exactly, although I’m sure the data would throw up some interesting findings… Friday, Sunday (evening) and Mondays for example. I am more interested in settling the long standing debate, ‘[B]which is statistically more profitable, trading intraday or holding positions longer[/B]’… several days to several weeks for instance. I strongly suspect the latter and imagine from what I have observed, your trading team do too.  Thanks again Jason and keep up the good work on BP.

Thanks again Jason and keep up the good work on BP.

DailyFX instructor James Stanley touched on this topic in his trading lesson last week What is the “Best” Time Frame to Trade?

[B][I]"By many accounts, trading with a shorter-term approach is quite a bit more difficult to do profitably, and it often takes traders considerably longer to develop their strategy to actually find profitability.

There are quite a few reasons for this, but the shorter the term, the less information that goes into each and every candlestick. Variability increases the shorter our outlooks get because we’re adding the limiting factor of time.

There aren’t many successful scalpers that don’t know what to do on the longer-term charts; and in many cases, day-traders are using the longer-term charts to plot their shorter-term strategies.

All new traders should begin with a long-term approach; only getting shorter-term as they see success with a longer-term strategy. This way, as the margin of error increases with shorter-term charts and more volatile information, the trader can dynamically make adjustments to risk and trade management."[/I][/B]

[QUOTE=“Jason Rogers;617162”] DailyFX instructor James Stanley touched on this topic in his trading lesson last week What is the “Best” Time Frame to Trade? “By many accounts, trading with a shorter-term approach is quite a bit more difficult to do profitably, and it often takes traders considerably longer to develop their strategy to actually find profitability. There are quite a few reasons for this, but the shorter the term, the less information that goes into each and every candlestick. Variability increases the shorter our outlooks get because we’re adding the limiting factor of time. There aren’t many successful scalpers that don’t know what to do on the longer-term charts; and in many cases, day-traders are using the longer-term charts to plot their shorter-term strategies. All new traders should begin with a long-term approach; only getting shorter-term as they see success with a longer-term strategy. This way, as the margin of error increases with shorter-term charts and more volatile information, the trader can dynamically make adjustments to risk and trade management.”[/QUOTE]

I feel that limiting a newer trader to only trading higher timeframes is actually detrimental to the learning experience.

While I do agree with the majority of what is being said here in theory, in practice though here are my thoughts…

First, what’s considered a higher timeframe? H1, H4, D1?

I’d say most would agree that H4 and D1 are considered “higher timeframe”.

A D1 chart changes once a day / H4 changes 6.

Of those 6 H4 printed candles, let’s say a trader maybe has access to charts and is in the proper mindset to trade off 3.

So, using logic, one could argue that a newer trader would most likely only need to check their charts a few times a day for a setup.

Obviously this depends on how they trade, but again, I’d argue that the majority of new traders will await a candlestick signal before deciding to take entry.

A novice trader really shouldn’t be watching more than 5 or 6 instruments. They need to be focusing on understanding how each pair trades, as we all know most move to a beat of their own drum.

Given the current diminishing volatility in the markets, how is a newer trader supposed to learn only taking a handful of trades each month?

I’ve seen it advocated on this forum in the most popular threads that there are only 3-5 setups / month worth trading.

This blows my mind for lack of better words.

How can you sharpen a trading plan and your skills, if you aren’t doing anything and sitting on your hands waiting for the market to fire off a signal?

Trading, in my opinion, is not a passive task. You must be proactive. Professionals are proactive, not reactive.

Newer traders should be learning how to employ strategies across multiple timeframes, using basic technical and fundamental analysis.

I understand that these types of strategies which account for only a handful of trades each month may be profitable, but, who is trading this way? An individual who has dedicated a ton of time and capital to establish a disciplined approach to trading.

Most novices are anxious, impatient, and unwilling to exercise proper money management. They literally force themselves into a position, while waiting for one. I’ve seen it countless times on many forums. There’s almost a debilitating impact trading only 1or 2 timeframes has on a trader’s ability to learn how the markets work.

A baseball player doesn’t have batting practice 3 times a month, in hopes of hitting only home runs when he’s up at bat. They’re in the cages 5 days a week, looking for singles and doubles to boost their batting average at game time.

The same goes for trading.

If you’re not demo testing or using testing software to forward test during down time, how is the novice learning how to proactively trade?

Is it recommended that they watch 20 currency pairs to ensure maximum efficacy in finding a signal, then working their way backward to justify opening a position?

Looking forward to responses,

Jake

True, but I don’t think your analogy supports the idea of trading more frequently. Rather, I think it suggests that regular practice is important.

Perhaps what we can learn from this is that a new trader could use a demo account to practice short term trading (which is harder) while waiting for longer term trades to pan out on a live account. Along with allowing the new trader to develop confidence in short term trading in a safe environment, this would encourage the development of another important skill: patience.

Even with all the hours a baseball player dedicates to batting practice, when it comes to the real game, he doesn’t swing at every pitch.