Bank of Montreal (BMO) provides diversified financial services primarily in North America. The company’s personal banking products & services include checking & savings accounts, credit cards, mortgages, financial & investment advice services & commercial banking products & services. It is based in Montreal, Canada, comes under Financial services sector & trades as “BMO” at NYSE.

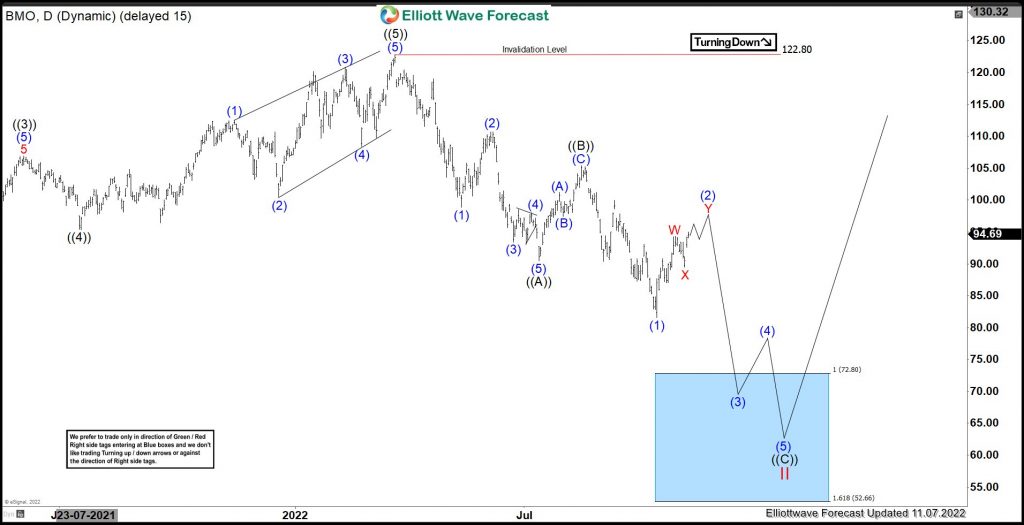

As discussed in last blog, BMO started impulse from March-2020 low & ended wave I at $122.77 high. Below there, it favors a corrective pullback in II as proposed zigzag structure.

BMO - Elliott Wave View from 8/07/2022 :

Above March-2020 low, it placed ((1)) at $55.34 high & ((2)) at $43.26 low. ((2)) was 0.618 Fibonacci retracement against ((1)). Above there, it started third wave extension & ((3)) ended at $106.88 on 6/04/2021 high. It favored ended ((4)) at $95.37 low on 7/20/2021 as shallow correction. It finally ended ((5)) as ending diagonal at $122.77 as ATH on 3/22/2022 as wave I. Below there, it correcting in II as zigzag down.

BMO - Elliott Wave Latest Weekly View :

Below wave I high, it placed ((A)) at $90.44 low & ((B)) at 105.40 high. While below there, it confirms lower low in ((C)) leg, calling for more weakness to continue. It placed (1) at $81.57 low. Above there, it expect a corrective bounce in (2), which expect to fail below ((B)) high to resume lower in (3) of ((C)) leg. ((C)) leg expect to extend towards $72.80 - $52.66 area to finish II correction. We like to buy the dips towards blue box area, when reached.

BMO - Elliott wave Latest Short term Daily view:

Source: https://elliottwave-forecast.com/stock-market/bmo-expect-correcting-lower-towards-support-zone/