In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of Boeing ticker symbol: BA. In which, the rally from 15 March 2023 low unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. We will explain the structure & forecast below:

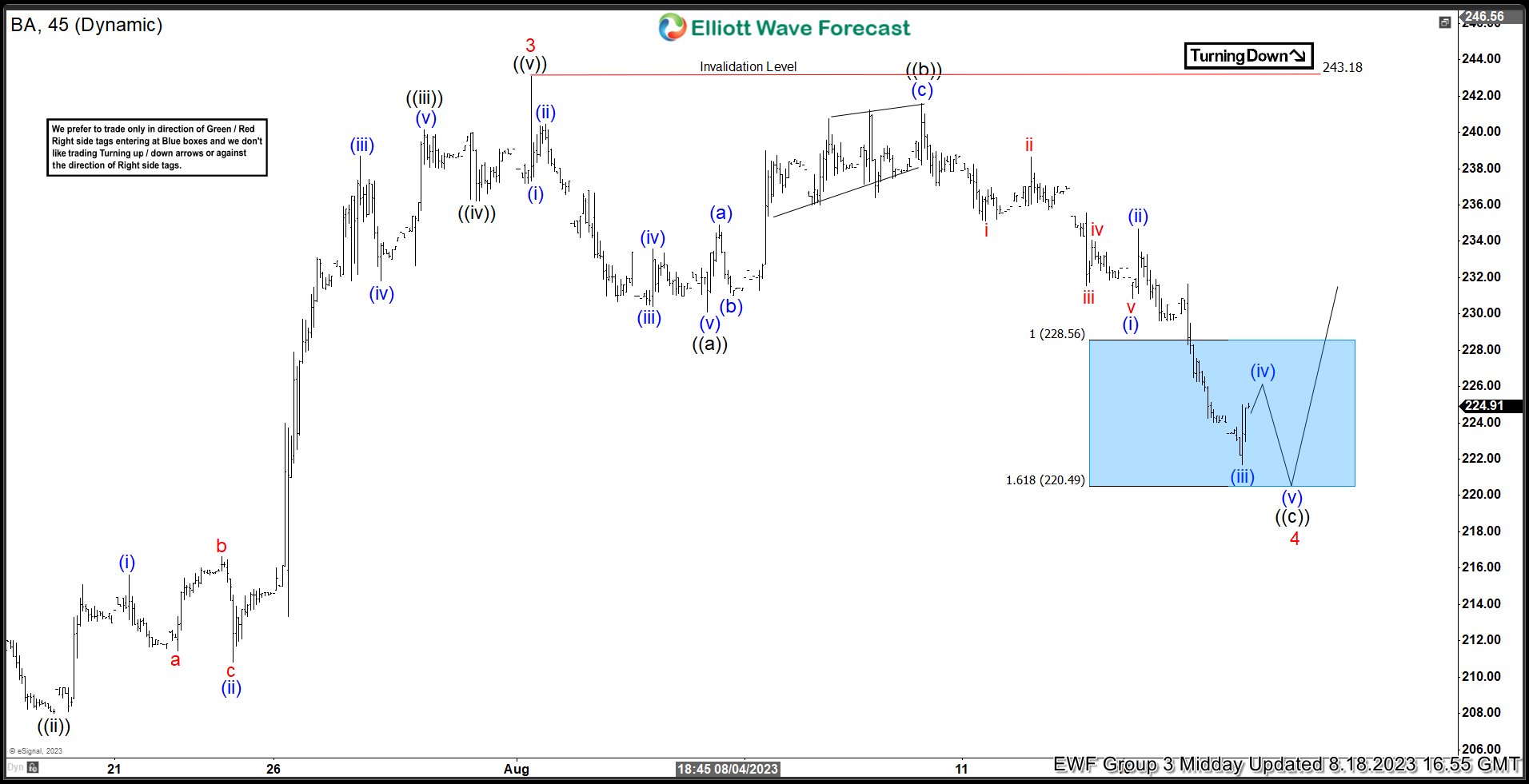

Boeing 1-Hour Elliott Wave Chart From 8.18.2023

Here’s the 1hr Elliott wave chart from the 8/18/2023 Midday update. In which, the rally from the 6/23/2023 low unfolded in an impulse sequence where wave 3 ended at $243.10 high. Down from there, the stock made a pullback in wave 4 while the internals of that pullback unfolded as Elliott wave zigzag structure where wave ((a)) ended at $230.08 low. Wave ((b)) ended at $241.58 high and wave ((c)) managed to reach the blue box area at $228.56- $220.49 area. From there, buyers were expected to appear looking for the next leg higher or should do a 3 wave bounce at least.

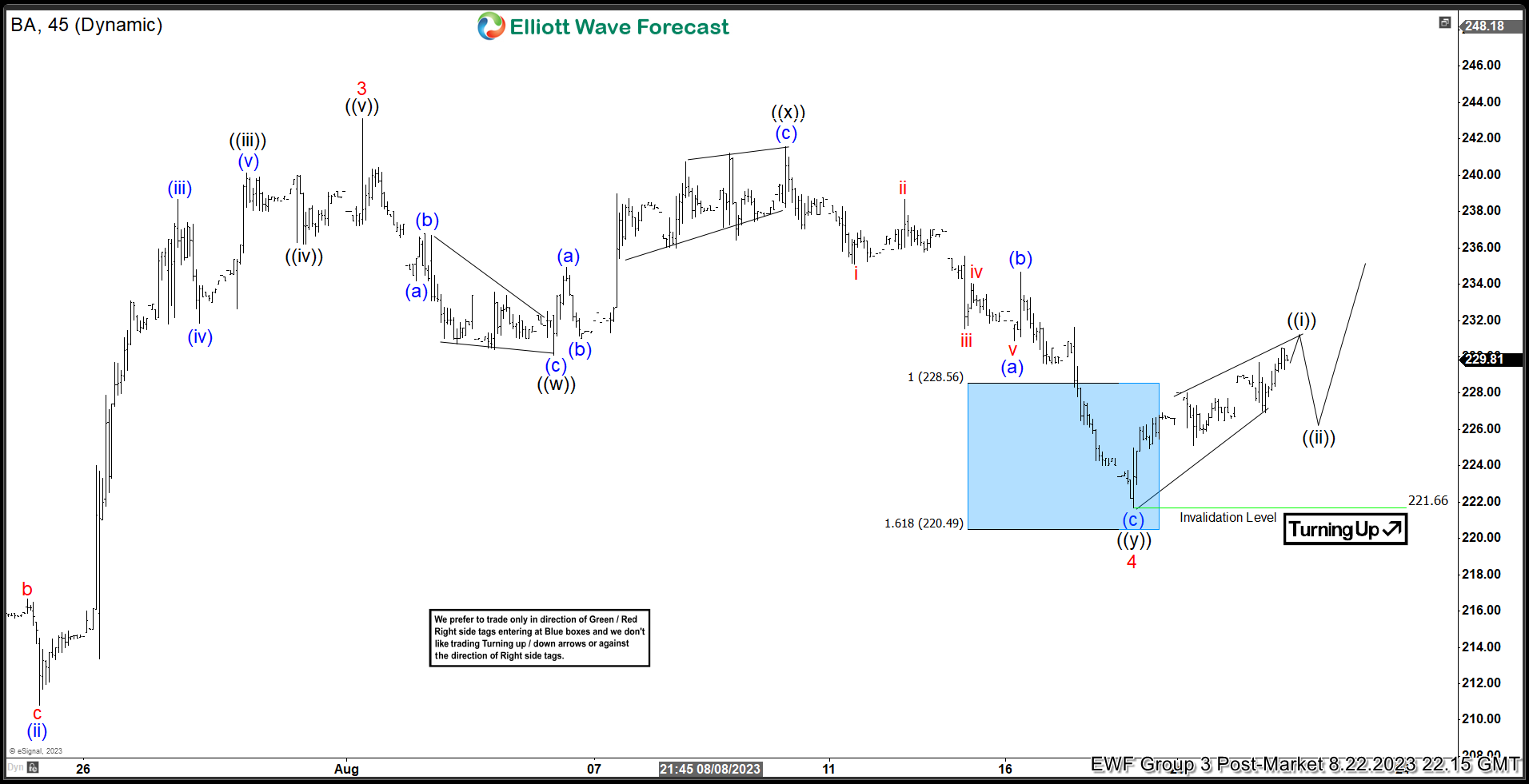

Boeing Latest 1-Hour Elliott Wave Chart From 8.23.2023

This is the latest 1hr Elliott wave Chart from the 8/23/2023 Post-Market update. In which the stock is showing a reaction higher taking place, right after ending the pullback within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. However, a break above $243.10 high is still needed to confirm the next extension higher towards $248.22- $256.40 area & avoid a double correction lower. It’s important to note that with further data, the pullback adjusted to a double three correction.