Bond auctions could trump data next week: The Week Ahead

In what seems like a while, the US economic calendar is relatively quiet with no top tier events. But US bond auctions should be on trader’s radars as they provide a look at how strong demand is (or not) for the ultimate US safe-haven asset. And if demand is low, it could send yields higher and shake a few equity bulls out of the tree and generally weigh on risk sentiment. We also have the RBA minutes and a potentially ‘live’ speech for the governor to keep tabs on.

The week that was:

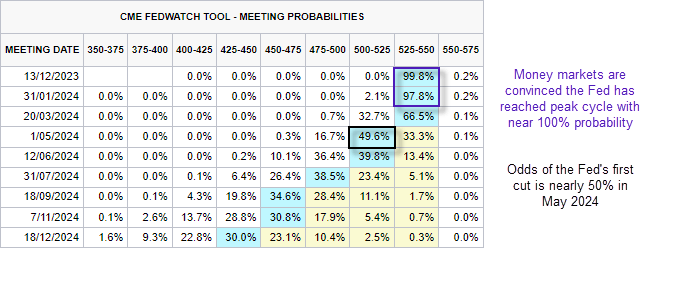

- US inflation data was broadly lower than expected which reaffirmed expectations that the Fed had reached their peak rate, and brought forward hopes of a cut

- The US dollar index suffered its worst day of the year following the CPI report, and US bond yields were sharply to bolster bets that yields may have indeed peaked for the cycle

- Producer prices also softened and US jobless claims rose to a 2-year high to add to the bets that the Fed are done with hiking

- Wall Street rejoiced and pushed US indices to fresh cycle highs, seeing the Nasdaq 100 within a cast whisker of its July high, the Dow a 3-month high and the S&P 500 a 2-month high

- The headline UK inflation rate slowed to a 2-year low, bolstering bets that the BOE will be the first central banks to cut rates

- Australia’s wage price index rose at its fastest pace on record at 1.3% but, as it came in as expected and was driven by temporary factors, AUD/USD began retracing from its highs

- Japan’s GDP contracted in Q3 and corporate goods prices deflated for a second month

- China’s retail sales and industrial production figures beat expectations, which was a welcomed sign after better-than-expected GDP in Q3

- Yet continued weakness in the property market prompted a fresh round of stimulus form Beijing, who will inject ¥1 trillion yuan into the sector

- A Reuters report claimed that the BOJ could be “priming markets for an end to negative interest rates”, which could be as early as Q1 2024

- Weak data from the US and China fanned concerns for oil demand, sending crude oil to a fresh 4-month low and towards our lower $70 target

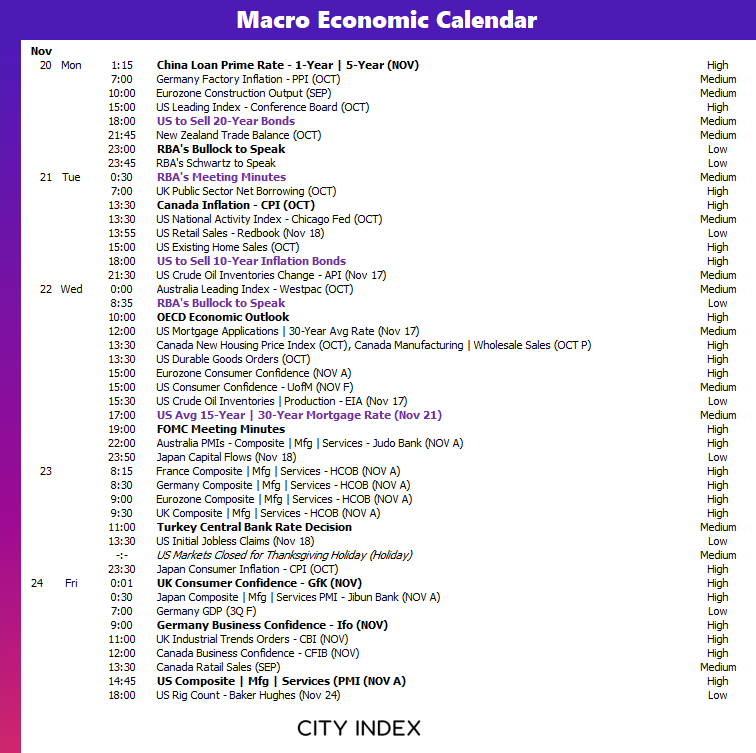

The week ahead (calendar):

This content will only appear on City Index websites!

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

- US Thanksgiving

- US bond auctions

- FOMC minutes

- RBA minutes

- China’s loan prime rate

- OECD economic outlook

US Thanksgiving

Whilst Thanksgiving is not a trading theme upon itself, it means that US markets will be closed on Thursday 23rd November. It’s also likely that US markets will be quiet on Friday as traders indulge in a four-day weekend. It also means that traders will be squaring up their books int to Wednesday.

However, I have noticed a tendency for US markets to rise heading into Thanksgiving, which make US indices markets to watch between Monday and Wednesday next week.

Trader’s watchlist: S&P 500, Nasdaq 100, Dow

US bond auctions

Demand for US treasuries has gone from bad to worse this year, with investors demand higher yields for the supposed safe-havens due to the massive budget deficit of the US government. And that means bond auctions have continued to gain interest from traders as it provides a direct view of where the demand is (or isn’t) across the yield curve. If we see demand for bonds continues to dwindle, it signals that yields could go higher still. And that could take the wind out of the sales for US equity markets and provide another round of risk-off in general.

Or, as my colleague Scutty said so succinctly on Twitter/X…

Trader’s watchlist: Gold, S&P 500, Nasdaq 100, Dow, VIX, AUD/JPY, USD/JPY

FOMC minutes

Whilst we cannot ignore the FOMC minutes, current market pricing has since killed off any hopes of another hike and we’re once again seeing headlines of the famous Fed ‘pivot’ once more. Softer CPI and PPI alongside jobless claims at a 2-year high has now removed concerns of another hike, which were fuelled by Powell’s recently hawkish comments. Still, the minutes may shed some light on any divisions among the rank and how ‘some members’ may vote next. But if US data continues to soften, it will likely overshadow what the minutes reveal or what hawkish push-back Fed members now make publicly.

RBA minutes, governor bullock speech

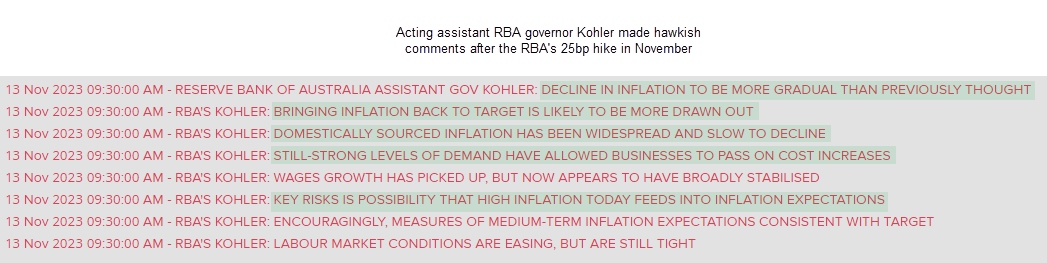

When the RBA held their cash rate steady in September alongside a familiar statement, it was assumed the cash rate would remain at 4.1%. Yet this view changed when the minutes were released and deemed as more hawkish, before an uncomfortably strong CPI report all but confirmed the RBA’s incoming 25bp hike to 4.35% in November.

Yet once again, markets deemed the minutes as dovish. Given the RBA’s acting chief economist, Marion Kohler, has warned that inflation could take longer to return to their target, will be find the RBA’s minutes are once again deemed more hawkish than the statement implied? Possibly, so it is certainly something to be on guard for on Tuesday.

Take note that governor Bullock speaks ahead of the minutes on Tuesday, but as it is a panel discussion so unlikely to cover monetary policy comments.

However, Bullock also speaks at the Australian Business Economists dinner on Wednesday 22nd November, and this has the potential for her to sway market opinion following the minutes the day prior.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

China’s 1 and 5-year loan prime rated (LPRs)

Data from China was mixed this week. Whilst retail sales and industrial production provided better-than-expected numbers which will help towards Q4 GDP, the property sector remains a drag on the economy which prompted Beijing to pledge ¥1 trillion for the property sector. It may be possible that the PBOC keep their loan prime rates unchanged, given GDP was better than expected in Q3. But if they are to be lowered again, taken alongside the investment coming, it may help provide further support if not a rally for China’s equity markets.

above expectations this week, and the ¥1 trillion pledge by Beijing to support the property sector took the edge off of the weak investment data seen in the data. This helped Chinese equities markets lead the way higher on Wednesday, as they were also bolstered by soft US inflation data and relief that further Fed hikes may be over.

Trader’s watchlist: USD/CNH, USD/JPY, S&P 500, Nasdaq 100, Dow Jones, VIX, AUD/JPY

– Written by Matt Simpson

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.