@1odi Thank you mate for replying. I had people helping me, don’t deny this, but rarely encountered someone like you.

To describe my setup: -none.

I never trade against the trend, this is the first time. I expected a deeper correction on D1.

This dude came with the idea:

I noticed he was right about a lot of longterm moves:

- he predicted the AUDUSD crash (breaking through W trendline), and also the the start of a new W uptrend, which turned out as a trap.

- also the rise on USDCAD (I was with the downtrend but eventually noticed how powerful the corrections are on longterm trends)

- he forceasted OIL downfalls

- he said to stay away from NZDUSD & USDCHF, and this pairs, espescially the formed are really f.up.

- pointed the EURJPY, CADJPY and USDJPY massive downfalls

- the GBP pairs are ranging but he expects downard moves

etc.

- basically he took all the pairs right

Since the week already started falling, and my bullish candle confirmation occurred, I said to give it a shot, so I bought.

He said a next downmove may occurr, but since it fell already I assumed that’s it.

After the correction and the next downward move, I assumed this is the potential downmove he mentioned.

And since another bullish signal on H4 occurred (confirmed by RSI & Stochastic Oscillator) I bought again.

Now, I don’t really care about his correct predictions since I real live traded on one, and wrong.

What to say, trading is really… abject. The callousness of all this currency pairs (and stocks, bonds, ETFs, etc.), is beyond impossible. Coldhearted, take you money with no mercy. Soulless. Conscienceless. No wonder why people lose. They all have such pervert and parasitic moves, a lot of tentacles…

The regular people are just victims. Stand no chance. Not to mention about the ones that really knows nothing about trading, or people with low levels of education in general. Even the ones that took the time to study lose a lot.

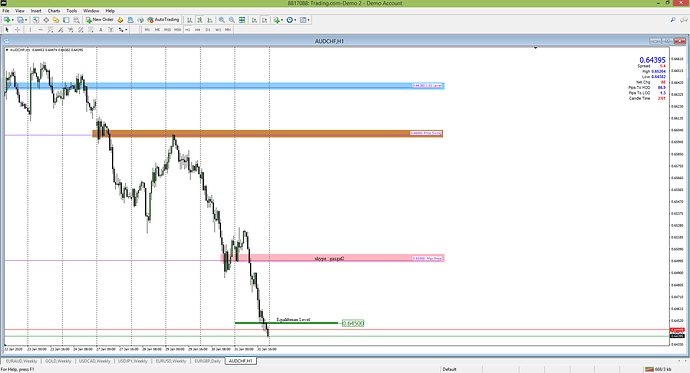

If you search on YouTube (AUDCHF) you will find people who got wiped out on that pair this week. Unexpected downmoves. Now, I’m trapped in this and although I should have a plan I don’t know what to do.

Thank you for your replies. I know sounds weird, but I guess I never met people like you in real life, let alone online environment…

I don’t know how this will turn out. I hope it will be good. But to be fair, most likely the worst scenario will happen on Monday or next week almost 100%. It always ends like this, for almost anyone. We’ll see…

Wish you the best.

Edit: and to be fair (to split in this edit all my toxicity, frustrations and heavy thoughts about this domain), this dropped that hard only because people bought. This markets does not look descentralised. Looks definetly rigged.

Forex/ all financial markets doesn’t seems real to me. They are 100% controlled by banks. They do what these banks wants.

These banks do whatever they want with them. You have nothing to chase. Markets cannot be predicted simply because they are under the control of banks just like in communism.

And they use this to take your money with every single chance. That’s how it looks to me, hope I’m wrong. But it doesn’t really matter now.