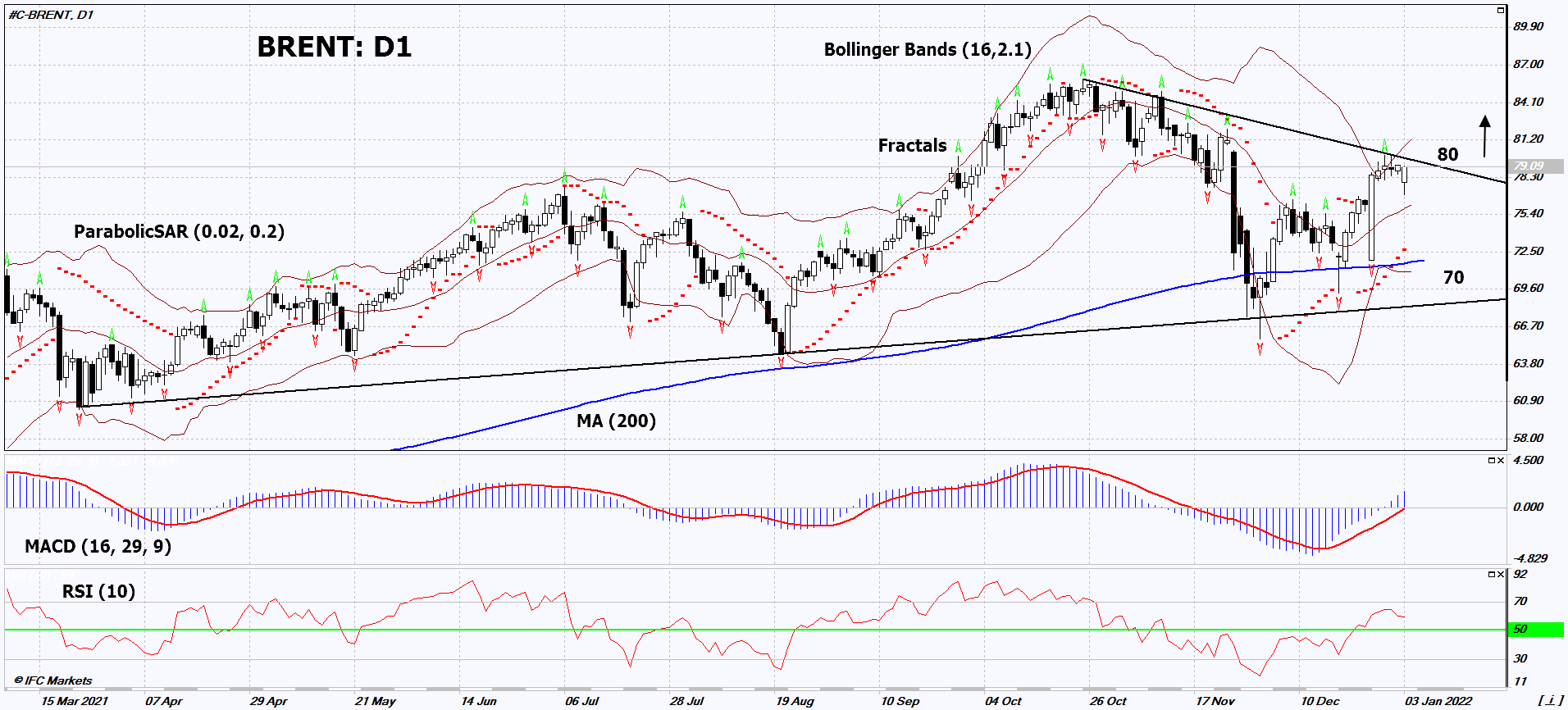

Brent Crude Technical Analysis Summary

Buy Stop:Above 80

Stop Loss:Below 70

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

Brent Crude Chart Analysis

Brent Crude Technical Analysis

On the daily timeframe, BRENT: D1 approached the downtrend resistance line. It must be broken upward before opening a buy position. A number of technical analysis indicators have formed signals for further growth. We do not exclude a bullish movement if BRENT rises above the last upper fractal: 80. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the last lower fractal, the 200-day MA and the lower Bollinger line: 70. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (70) without activating the order (80), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Commodities - Brent Crude

OPEC + is expected to continue to adhere to its long-term plan to increase production quotas. Will the BRENT quotes continue to rise?

It should be emphasized that OPEC + only sets quotas for oil production for the participating countries. The real increase in production depends on their production capabilities. The International Energy Agency (IEA) estimates that in November the backlog from the plan was 650 thousand barrels per day (bpd). Recall that OPEC + has declared an increase in oil production, monthly by 400 thousand bpd, since August 2021. The cartel is going to reach the dock level by September 2022. The next OPEC + meeting will take place on Tuesday, January 4, 2022. A typical increase in oil production is expected by the usual 400 thousand barrels per day (bd). It is unlikely that the cartel will demand from its members to eliminate the backlog of real production from quotas. Since the OPEC + Joint Technical Committee believes that the world market will have a surplus of oil in the amount of 1.4 million bpd. An additional positive for oil quotes was the announcement of the Libyan National Oil Corp on the reduction of oil production in Libya by 200 thousand bpd to an annual minimum of 700 thousand bpd due to the accident on the oil pipeline. In addition, Argus reported that demand for motor fuel in India in December 2021 almost reached the pre-pandemic level of December 2019.