Sterling plummeted more than 2.8% off the post-FOMC high with GBP/USD now approaching key support- PCE on tap. Battle lines drawn on the weekly technical chart.

By : Michael Boutros, Sr. Technical Strategist

British Pound Technical Forecast: GBP/USD Weekly Trade Levels

- British Pound post-Fed sell-off approaching attempting to break to fresh monthly lows

- GBP/USD key support now in view- Major U.S. inflation data on tap tomorrow, NFPs next week

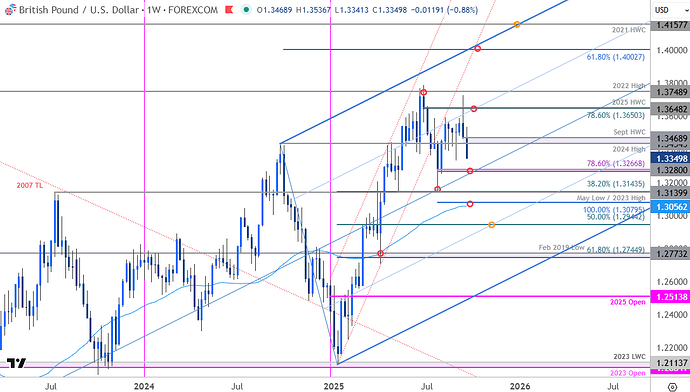

- Resistance 1.3434/69 (key), 1.3648/50, 1.3749- Support 1.3267/80 (key), 1.3140/44, 1.3056/80

Sterling is poised to mark a second consecutive-weekly decline with GBP/USD attempting to break to fresh monthly lows today. The post-Fed reversal is now approaching technical support at a multi-year slope and the battle lines drawn on the Sterling weekly technical chart heading into key inflation data tomorrow.

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In my last British Pound Weekly Forecast we noted that a rebound off slope support kept the focus on a potential breakout and that, “From a trading standpoint, losses should be limited to the median-line IF price is heading higher on this stretch with a breach / close above 1.3650 needed to fuel the next leg of the advance.” GBP/USD surged nearly 3% off the September low with the rally briefly registering an intraday high at 1.3726 on the heels of the Fed rate decision. Price failed to mark a close above resistance with an outside daily / weekly reversal off the highs now extending more than 2.8%.

Initial weekly support rests with the 78.6% retracement of the August rally / the August low-week close at 1.3267/80- note that the median-line converges on this threshold over the next few weeks and a break / close below this threshold is needed to suggest a more significant high was registered last week and that a lager trend reversal is underway. Subsequent support objectives rests with the 38.2% retracement of the yearly range / May low / 2023 high at 1.3140/44 and 1.3056/80- a region defined by the 52-week moving average and the 100% extension of the June decline. Look for a larger reaction there IF reached.

Initial weekly resistance now eyed at the 2024 high / September high-week close (HWC) at 1.3434/69. The threat remains tilted to the downside while below this threshold with key resistance steady at the 2025 HWC / 78.6% retracement of the June decline at 1.3648/50- a breach / close above this threshold would threaten resumption of the broader uptrend with subsequent resistance objectives eyed at the 2022 high at 1.3749 and the 1.40-handle.

Click the website link below to Check Out Our FREE “How to Trade GBP/USD” Guide

https://www.cityindex.com/en-uk/whitepapers/

Bottom line: The Fed reversal in GBP/USD is now approaching support at the median-line with major event risk on tap tomorrow. While the near-term risk is weighted to the downside, the decline may be vulnerable into technical support just lower. From a trading standpoint, look to reduce short-exposure heading into slope support- rallies should be limited to 1.3469 IF price is heading lower on this stretch with a close 1.3267 needed to fuel the next major leg of the decline.

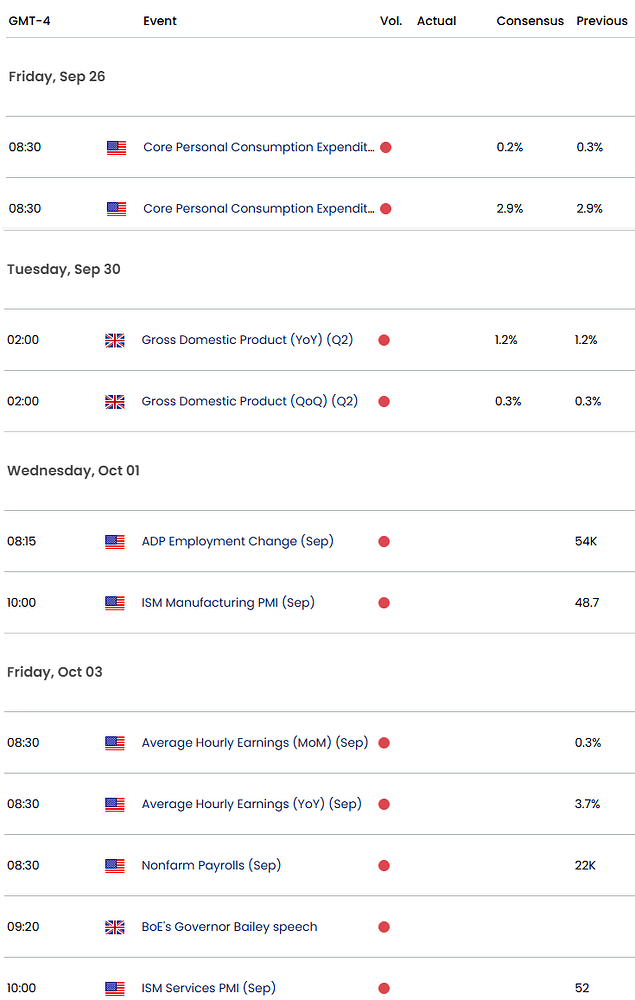

Keep in mind we get the release of Core Personal Consumption Expenditures tomorrow morning with Non-Farm Payrolls on tap next week. Stay nimble into the releases and watch the weekly closes for guidance here. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

GBP/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

— Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.