Blackstone Inc., (BX) is an alternative asses management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt & multi-asset class strategies. The firm typically invests in early stage companies. It is based in New York, comes under Financial services sector & trades as “BX” ticker at NYSE.

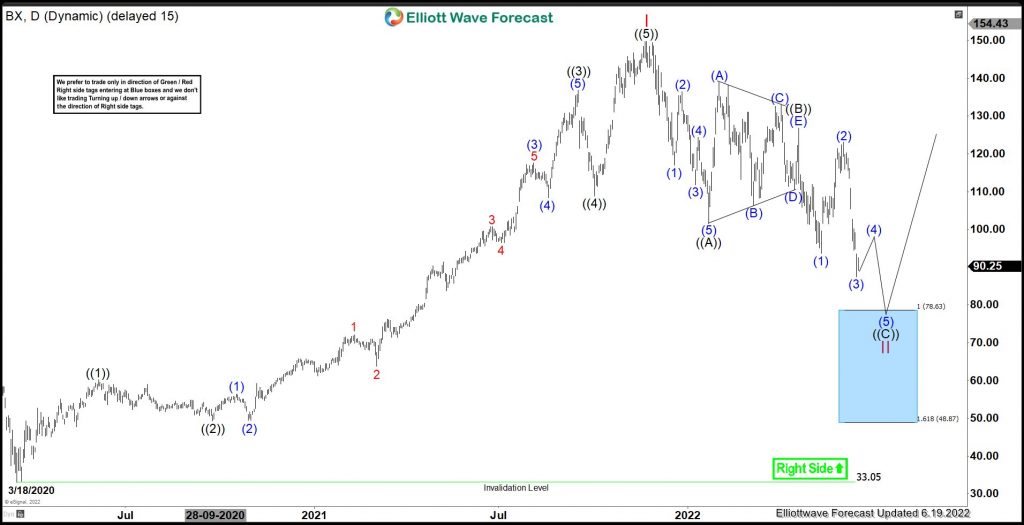

BX started impulse sequence higher from $33.00 low made on 3/18/2020 during global sell off. It made an all-time high of $149.78 on 11/19/2021 as wave I & started correcting lower against March-2020 low. It expect to trade lower towards $78.63 - $48.87 area to finish the correction before turning higher.

BX - Elliott Wave Latest Daily View :

It placed ((1)) at $60.20 high on 6/05/2020 of the impulse sequence started from 3/18/2020 low. Later it favored ended ((2)) at $49.26 low on 9/24/2020 low as 0.382 Fibonacci retracement of previous cycle. Above there, it started third wave extension of third wave extension & placed ((3)) at $136.88 high on 9/17/2021. It ended ((4)) at $108.81 on 10/04/2021 low as slightly above 0.382 retracement. Finally, it ended ((5)) at $149.78 high on 11/19/2021 as wave I. While below there, it favors correcting lower in II in zigzag correction.

Below $149.78 high, it placed ((A)) at $101.65 low and ((B)) at $126.80 high as triangle on 4/21/2022. While below there, it favors lower in ((C)) leg towards $78.63 - $48.87 area to finish II correction before upside resumes in either new sequence up or at least 3 swing reaction higher. Currently, it appears ended (3) at $87.39 low and above there it should bounce in (4) before final leg down to finish ((C)) leg. We like to buy the dips towards blue box area for upside to resume

Source: BX - Correction Expect to Continue Before Rally Resumes