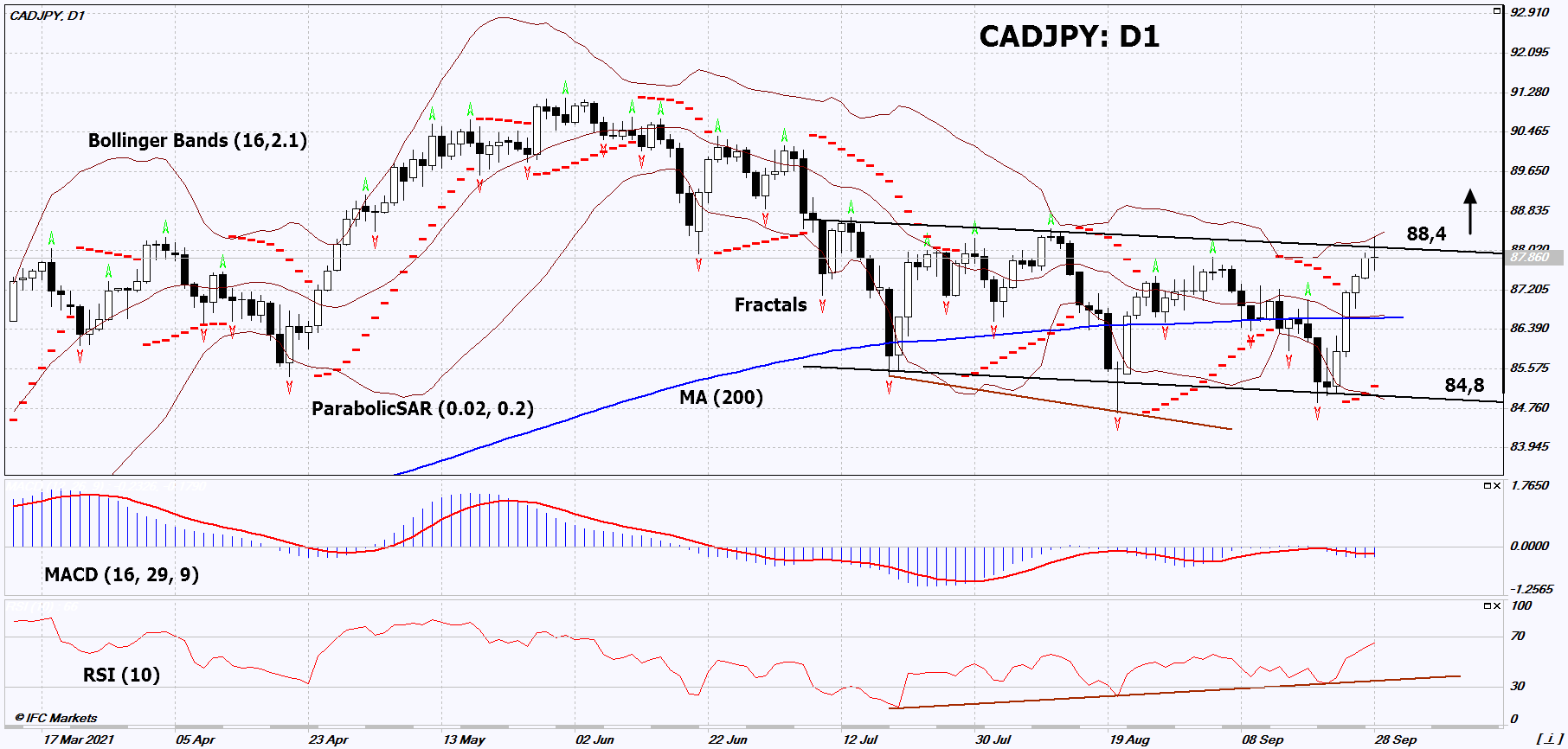

CAD/JPY Technical Analysis Summary

Buy Stop։Above 88,4

Stop Loss։Below 84,8

| Indicator | Signal |

|---|---|

| RSI | Buy |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

CAD/JPY Chart Analysis

CAD/JPY Technical Analysis

On the daily timeframe, CADJPY: D1 approached the upper border of the price channel. It must be broken upward before opening a position. Several technical analysis indicators have generated signals for further upside. We do not rule out a bullish movement if CADJPY rises above the last high and the upper Bollinger band: 88.4. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the last lower fractal and the lower Bollinger line: 84.8. After opening a pending order, move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (84.8) without activating the order (88.4), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - CAD/JPY

The Canadian dollar is strengthening amid high world oil and natural gas prices. Will the CADJPY quotes continue to rise?

The upward movement means strengthening of the Canadian dollar and weakening of the Japanese yen. Fuel products account for approximately 18% of Canadian exports. Canada’s share is about 6% in world oil production and 3% in exports. Canada occupies 5% of the world’s gas production. The growth of oil and gas quotes can have a positive impact on the Canadian economy and the exchange rate of its currency. Last week, the country released positive data on retail sales in July. On October 1, Canada will release GDP for July. This indicator may affect the dynamics of the Canadian dollar. Note that on September 30, Canada will celebrate the National Day of Truth and Reconciliation. The Japanese yen is weakening after the publication of negative inflation data for August. The consumer price index dropped 0.4%. Thus, deflation has been recorded in Japan. Investors fear that this may require additional easing of the monetary policy of the Bank of Japan (BoJ). Recall that its rate is -0.1%, and the rate of Bank of Canada (BoC) is much higher and is equal to + 0.25%. There will be a lot of important economic information in Japan this week. In particular, there will be data on retail sales, unemployment, and a speech by the head of Bank of Japan. Tankan business activity indicators will also be published.