Cant beat abit of nostalgia😀

This might be a copypasta of an old post tbh. I vaguely recall reading an older post saying the same thing about outdated content and Robopip’s system. But I can’t recall mention of that website mentioned.

Personally I hope this guy’s not trolling & genuinely responds with substantiated claims. Nothing wrong with a healthy debate.

The post what removed

well said

Helloooo.  You have very bold claims here and it’s like you’re so sure. Hahaha. What makes you say these things?

You have very bold claims here and it’s like you’re so sure. Hahaha. What makes you say these things?  As someone who started this whole forex trading journey in BP, I’m not really impressed with the post.

As someone who started this whole forex trading journey in BP, I’m not really impressed with the post.  I guess I’m not profitable enough to solely rely on my forex trading yet, but it doesn’t mean I don’t get small wins every now and then.

I guess I’m not profitable enough to solely rely on my forex trading yet, but it doesn’t mean I don’t get small wins every now and then.  I’ve always wanted to do it on the side and I’m happy where I am now. I even got introduced to crypto here. Tbh, I’ve tried participating in other forums just to expand my social circles. But I keep going back here because the people are much nicer and more patient since they understand that majority of the new members here are really new to forex and just want to learn.

I’ve always wanted to do it on the side and I’m happy where I am now. I even got introduced to crypto here. Tbh, I’ve tried participating in other forums just to expand my social circles. But I keep going back here because the people are much nicer and more patient since they understand that majority of the new members here are really new to forex and just want to learn.

For what it’s worth, the only trading education I’ve done is babypips maybe 4 years ago and I’ve been profitable over that time. Not hugely, but I’m up almost 100% of my investment to the point that I’ve withdrawn that and trading only with profits now.

Considering that you only have one post and used it to downplay this site while suggesting another, paid site that traders should use instead makes you seem like a scammer. Just saying. How can you be so sure that this site hasn’t produced profitable traders if you literally just joined? I’d think it would talk a while to come to that conclusion.

You see this is the problem, people get offended when you question their beliefs. Trading forums are like a religion, people throwing in a bunch of nonsense and getting offended when you question their beliefs.

Its like when you say to someone that believes in god that you don’t, and they make the stupid face like you must be retarded and ask why?

And they have never seen god, they don’t know anyone that has seen him, they haven’t heard of anybody that has seen him, they don’t have any proof that he exists.

But then they almost request you to give some proof that he doesn’t exist, like they are expecting you to go and look everywhere around the world and come back and say, i looked everywhere, couldn’t find him, he doesn’t exist.

Give some names, say this guy here has proved he is able to do it, that guy in that thread has proved he can do it, give something, don’t treat people has if they stupid or crazy when you don’t have anything to prove them wrong.

Bold claims? What makes him say those things?

Well maybe he has a brain and actually uses it, he looked for it, couldn’t find it, other’s also couldn’t find it, you couldn’t help him find it. Everybody acting like he is stupid but no one couldn’t help him find one trader here that has made it.

Let people question things, encourage them to do it, that is how you become a trader, get the bs out of the way and focus on your mission. If not they will continue here years later still dumb and clueless

This is a strawman response. If you have 10,000 traders going through an educational program and the rate of success is 0%, the problem is the program. Not the traders.

What debunked research? If you can put up citations for those research papers/articles it would be a better argument. Various TA books, including this beginner’s book written by a CMT echo the course content on BP.

Books do not mean anything if they were written by people who know nothing about statistics and dread the idea of empirical research. Here (adamhgrimes . com/fibonacci-thinking-deeper/) are some statistics on the topic. Also, it isn’t my job to disprove a claim. If you want to make a claim about something, it is your duty to prove it with data. Fibonacci ratios have never been proven to work.

Believe your research is flawed or incomplete given that this is the curriculum taken on by institutional traders.

The CMT is literally a joke in finance. Try applying to a hedge fund saying you have the CMT and you’ll be shown the door.

You’re also promoting a website whose goals are solely meant for catering to a paid membership service. Yes, there is a free option, which mentions common new trader behavior traits and anecdotes for sign ups. This in turn, is used as a funnel to transition to the paid services.

I have no affiliation with that website. I said their course is equally as free as Babypips and this is not a misrepresentation. The paid stuff is not for further education: it’s for signals and communities. I don’t use the service so I won’t comment on it, but the education on trading is 100% free.

The objective of the site you mention is completely different from Babypis, which is an open forum to discuss trading ideas. No strings attached.

False. Babypips positions itself as an avenue towards learning how to trade. It gets recommended to newcomers all the time. And all the time, they come here and remain stuck in a cycle of unprofitability because the site is uncapable of teaching.

If you don’t agree with what I recommend for new traders, you could always post your own recommendations for new traders.

I just did in this thread.

how can you take serious your post when you make such a bizzare comment ,with nothing substantial to back your argument

I have been a lurker for two years, just now creating an account. I have never seen a SINGLE trader here who has been consistently profitable for more than one year. I have followed the series of blog articles by the authors on the website, and they are literally unprofitable.

They just give you the tools. It’s up to you how you use it. All babypips does is explain how to trade. It’s not a signal service.

If the tools don’t work and somebody hurts themselves using them under your guidance, it is your fault.

HAsn’y even been back to see if anyone answered - Ergo - It’s just a B>S> post to advertise some random website !

I was busy.

Personally I hope this guy’s not trolling & genuinely responds with substantiated claims. Nothing wrong with a healthy debate.

Not a troll.

For what it’s worth, the only trading education I’ve done is babypips maybe 4 years ago and I’ve been profitable over that time. Not hugely, but I’m up almost 100% of my investment to the point that I’ve withdrawn that and trading only with profits now.

If you are not willing to show a track record, there is no discussion to be had.

How can you be so sure that this site hasn’t produced profitable traders if you literally just joined? I’d think it would talk a while to come to that conclusion.

I have been lurking for a few years.

You, very clearly haven’t read any credible technical books. Either that or you don’t know what statistics are. Because if you did you’d have heard of books like this:

Very poor resource. No statistical data available on sample size, methodology, depth and breadth of instruments or time frames used. He hasn’t demonstrated any clear knowledge of statistics in the cited article.

Plus, why is Adam Grimes better and more knowledgeable than the likes of John Murphy, Julie Dahlquicst, James Kirkpatrick III, Thomas Bulkowski or J Welles Wilder Jr?

Here’s the founder of Fairfield capital, Katie Stockton, using Fib bars. Guess you’re going to say she’s a hack too. Video time-stamped at the mention of the indicators used for her analysis. Edit: I missed the fact that she also uses MAs, mentioned about a minute later.

When you make a claim on debunked research it is your job to put up those claims. Whatever your argument is there is a significant enough number of people who rely on Fibonacci ratios to make it significant enough to warrant a mention. Doesn’t matter if you believe whether golden ratios and the like actually work.

You missed the point of the CMT mention. The course content of babypips mirrors the foundation of knowledge that any trader, irrespective of instrument must have in his arsenal. Doesn’t matter if you build never use them as tools or if you don’t believe them. Atleast you have a knowledge of the most widely used tools out there and how they are supposed to work.

What organization will hire you based solely on a CMT? Obviously you’ll need more than that. Tell you what though, I’d rather hire someone who has a CMT than someone who’s citing marketlifetrading and an Adam Grimes blog as credible sources of information and knowledge.

This reminds me of a thread I came across of a troll who claimed to be a fountain of knowledge after having lurked the forums for an extend period of time. He kept asking obvious questions about trader profitability and was banned on multiple forums. This is his thread on BP

If you truly lurked the forums like you claimed to have. You’d have found the journals and threads for the profitable traders who were in the forums.

Here’s a freebie for you from one of a pro traders from back in the day (coincidentally also applying Fibs in some of her analysis) on BP.

So far you’ve provided nothing of substance to prove your arguments. Hope you’re able to reply to this with something more substantial

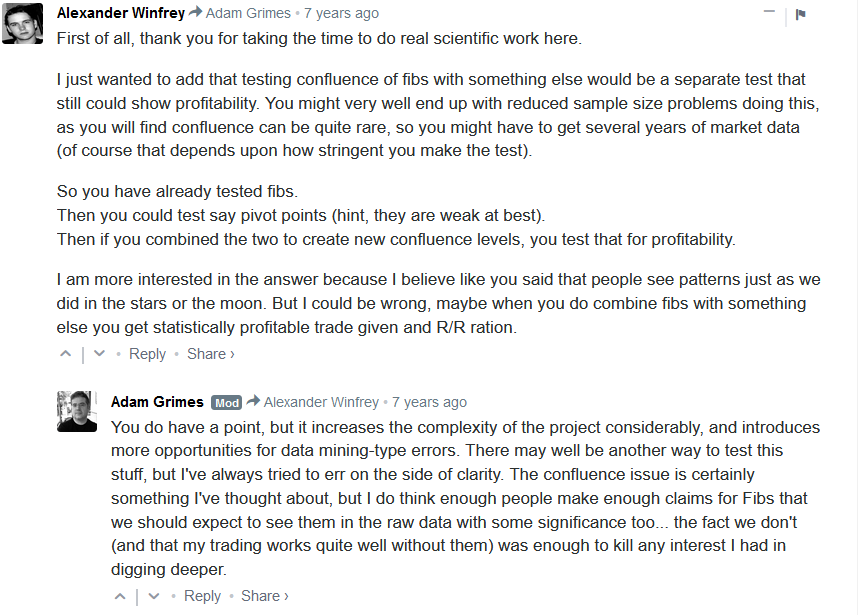

I take back what I said about Adam Grimes not employing a statistical approach to this testing. He has demonstrated it in another thread that I will read on the downtime. Source:

Maybe he wanted to know who was all the successful traders on here , so if he could read all their posts

@Ematharon if you think babypips is so bad, make your own site, your own course, and post a link for us.

I’d be happy to take a look!

Well here’s your chance to do something constructive.

Post up corrections in training materials where you see errors, post up strategies that work where you see flawed systems, post up the important market principles that should be followed so that developing traders can complete their own systems, post up the positive resources you have found that might help other people, post up your own conclusions on trialling and testing various TA features or indicators.

With your own experience, you could actually contribute something positive and helpful to new traders.

@Ematharon: Why didn’t you disclose Adam Grimes as the trader behind the marketlife website? Are the only sources of information from this one author? You do realise that he used Fibs standalone right? Not as a confluence?

Your source of information so far is one individual only and that’s scary. You embody the same cult like mentality that you are rallying against. If Adam Grimes says TA books preach nonsense you also, by default, agree with his conclusion. Not because you read any of those books but because you’ve bought into someone else’s arguments without doing your own diligence.

I personally don’t use Fibs. But if someone in my family wanted to learn how to trade asked for my advice I’d tell him/her to learn about it. Knowing that a modern day traders use it make it significant enough to study it. This is the same reason that harmonic patterns and Gann lines aren’t covered in the more modern TA books (and in the BP course) in greater detail.

You haven’t lurked the forums, as you’ve claimed to have. That’s because there’s a lot of quantifiable tests and strategies shared by good traders you haven’t found.

I don’t get it. Why are you here? Are you trying to save us from BP? If this place is the dumps, why have you been lurking for years?

Maybe you don’t know how to use Search??

I just checked out that course you mentioned. It’s from 2017. The first video lesson literally says this was created 5 years ago. So now you’re back to 2012. What were you saying about outdated content being worthless?

There are several paid options, not at all involving signals. I don’t think you know your product. Worst shill ever.

I’d noted some observations from the data posted by Mark Grimes in his blog. I wanted to wait for a reply from the OP to post it. Since it doesn’t seem imminent I thought I’d just get it out of the way now. All screenshots below sourced from his blog post and study related to Fib ratios, which I believe is the debunked research the OP was referring to.

If the purpose of the study was to determine whether a significant number of retracements conform to Fibonacci ratios, then there’s an arguable case. Whether that disqualifies Fib ratios from being used as an indicator is another case entirely. Reasons as follows:

Histogram for all instruments

The above histogram is a bimodal distribution of data after filtering out all 100% retracements. The logic for the omission, with a diagram, are explained very clearly in the blog. I plotted the red line at 50% and guesstimated a minimum 67% of all frequency distributions (frequency x intervals) at > 50%. If I had the numbers to crunch I’m sure this could easily be in the 75% range.

For most Fib proponents that alone justifies the significance of a 50% retracement atleast. As someone using Fibs I don’t really care if the price retraces exactly 70% or 80%. If it’s close enough to a significant Fib level then that justifies using it as a buy stop for the retracement, in the case of an uptrending market environment.

Histogram by instruments

Red lines and remarks are mine. Although the author clearly mentions it doesn’t look good for Fib ratios if you look closely enough at the peaks for the histogram for FX you’ll see they appear to be pretty close to significant Fib areas. Without a grid and more x-axis labels it’s hard to determine with certainty though.

Data table

When you look at the data table it could be argued that Forex, as an instrument is statistically insignificant, (1% of data samples) in this study given.

Where the FX data sample reveals though is significant the median has skewed right compared to Equities and futures (2-4%). The likeliest reason for this skew is the fact that the minimum retracement value is at 16%, as opposed to the 1.2% & 4.9% for equities and futures. Is the data populated by a lot of noise?

The author did a good job to acertain an upper limit to retracements, but he hasn’t established a lower limit. Is a 1.2% retracement even counted as one? This is a significant argument because that affects how you analyze at least 94% of the data (the sample size for equities).

Another possible hole in the data

Although there’s no explicit mention of what parameter is used I’m strongly guessing that the author used the close price. Here’s the problem if that’s the case:

Most recently USDJPY chart if you want to check. For anyone using Fibonacci ratios, this is a valid retracement because the candle high came within ~3 pips of the 50% retracement. If this price movement was calculated on closing price the data would record it as a 25% retracement instead.

Not insinuating that the author hasn’t accounted for it, but he hasn’t made it clear that .

Takeaways

I’m really impressed by Mark Grimes analysis of the data. He’s made a very clear effort to be transparent and has issued an open challenge to prove him wrong. Very manly.

I’m nowhere near an expert at trading and statistics as Mark is (heck I haven’t even gone to college). But I raise a number of valid questions that poke a few obvious holes in the way the data was analyzed. I think if Mark approached it from the eyes or mindset of a practitioner the gaps in the analysis would’ve obvious to someone of his intellect.

IMO, the data and findings are inconclusive at best and don’t that Fibs are irrelevant tools. The approach to the study wasn’t to find whether the Fib is a reliable tool, which is what should concerns anyone practicing it. But that not all retracements happen at Golden ratios.

Helloooo.  I’m not one to argue, but I just feel like questioning is completely different from disregarding. I was not impressed simply because the original post made it seem like it was a fact. To be honest, I’m not really sure about the comparison with religion.

I’m not one to argue, but I just feel like questioning is completely different from disregarding. I was not impressed simply because the original post made it seem like it was a fact. To be honest, I’m not really sure about the comparison with religion.

This doesn’t really answer the question since I was seriously asking where he was coming from.  I wanted to know where he was coming from so i could make sense of his position. I’m not saying he’s wrong for feeling that way. I’m saying I want to understand why he feels that way.

I wanted to know where he was coming from so i could make sense of his position. I’m not saying he’s wrong for feeling that way. I’m saying I want to understand why he feels that way.

I’ve had different opinions with people on this forum before, and even other forums and pages. But I feel like, you can educate people, you can question things, you can argue about different opinions without calling other people names and saying mean and irrelevant things.

To add to Ria_Rose’s reply the OP wouldn’t have faced the kind of backlash he did if he’d put his arguments with properly researched & cited references.

- What were the badly written technical books he was referring to?

- Where was the mention of the debunked Fib analysis in the OP?

- Where is the mention of the debunked analysis of MA?

- How can he not know the obvious course content for any aspiring trading professional if he’s claiming BP online content was misguided?

Also the following claims are dubious at best:

- Source of online learning material from one online site with paid service content

- Source of cited Fib study from author of same site.

- Claim of being a BP lurker for years yet finding no evidence of profitable traders. I’ve been really serious on this site for less than a year and found a lot of evidence without having to look that hard. Then again, I looked with the intention of searching for good analysis and strategy. Not skimmed the surface of the popular daily threads that pop on the right side pane, which is the only possible explanation if his claim is true.

Actually even that benefit of doubt is hard to give because Alg’s Price action thread is really popular the past few months. If that’s not the blog of a profitable and very open minded trader I don’t know what is.

Is… this a post to advertise “marketlifetrading”

This service is free of charge and yes some concepts may be presented in a simpler fashion but how are you supposed to present it to new traders ?

It has to be easier to digest otherwise they’ll be overwhelmed