USD/CAD is poised for breakout with the weekly opening-range taking shape just below multi-month trend resistance. Battlelines drawn on the short-term technical charts.

By :Michael Boutros, Sr. Technical Strategist

Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD rally extends nearly 1.3% off monthly low- recovery testing February downtrend

- USD/CAD weekly opening-range break to offer guidance – U.S PPI, retail sales on tap

- Resistance 1.3729/50 (key), 1.3795/98, 1.3881/99 - Support 1.3670, 1.3571/90 (key), 1.3504/23

The U.S. Dollar is attempting to mark a third consecutive daily advance against the Canadian Dollar with the USD/CAD recovery now threatening the yearly downtrend. The weekly opening-range is set just below resistance and the breakout may offer further guidance in the days ahead. Battle lines drawn on the USD/CAD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.

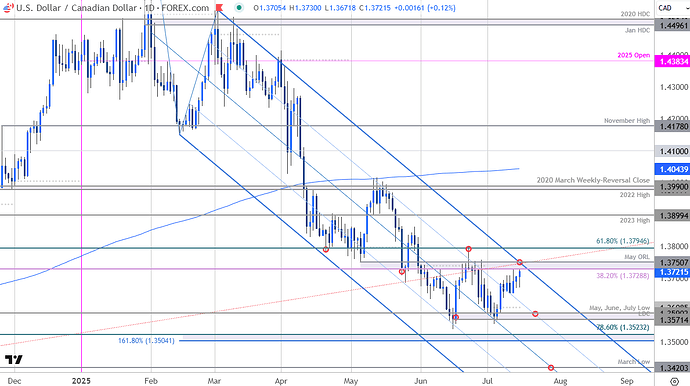

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In my last Canadian Dollar Short-term Outlook, we noted that USD/CAD had set the, “monthly opening-range just above support at the 2025 close low- looking for a reaction off this mark. From at trading standpoint, rallies would need to be limited to 1.3729 IF price is heading lower on this stretch with a close below 1.3571 needed to fuel the next leg lower in USD/CAD.” Price rallied nearly 1.3% off the monthly low with the advance now testing resistance at 1.3729/50- a region defined by the 38.2% retracement of the 2021 rally and the May opening-range lows. Note that pitchfork resistance converges on this threshold over the next few days and further highlights the technical significance of this key zone- looking for a reaction off this mark this week.

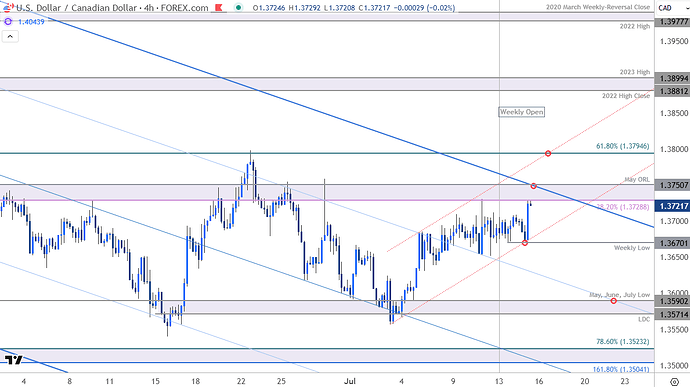

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD trading within the confines of an embedded channel extending off the monthly low with the weekly opening range taking shape just below confluent resistance at 1.3729/50. Ultimately, a breach / close above the June high / 61.8% retracement of the December 2023 advance at 1.3795/98 is needed to suggest a more significant low was registered last month / a larger trend reversal is underway. Subsequent resistance seen at the 2022 high close / 2023 high at 1.3881/99 and the 2022 high / 2020 March weekly-reversal close at 1.3977/90- both levels of interest for possible topside exhaustion / price inflection IF reached.

Initial support rests with the weekly range lows at 1.3670- a break / close below the monthly channel would threaten resumption of the broader downtrend. Subsequent support objectives unchanged at the yearly low-day close (LDC) / May, June, July lows at 1.3571/90 and the Fibonacci confluence at 1.3504/23.

Click the website link below to read our Guide to central banks and interest rates in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-central-banks-outlook/

Bottom line: The USD/CAD is testing confluent resistance at the February downtrend with the weekly opening-range set just below- look for the breakout in the days ahead. From a trading standpoint, losses would need to be limited to the weekly lows IF price is heading for a breakout on this stretch with a close above 1.3795 ultimately needed to put the bulls in control.

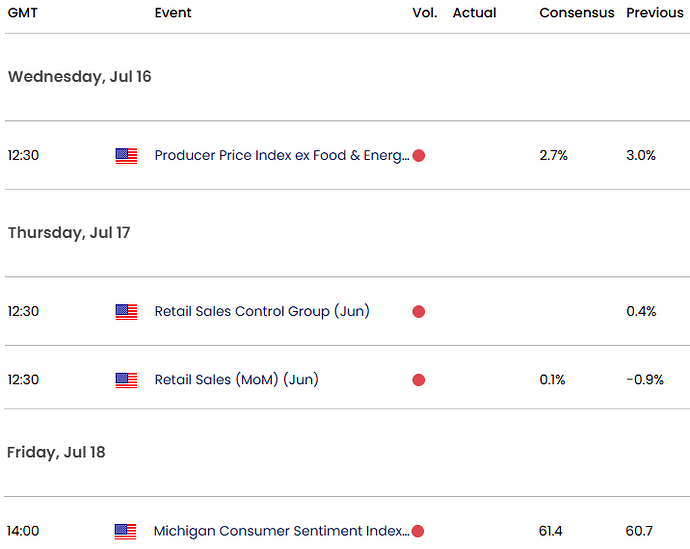

Keep in mind we get the release of U.S. produce prices tomorrow with June retail sales on tap Thursday. Stay nimble into the releases and watch the weekly close for guidance. Review my latest Canadian Dollar Weekly Forecast for a closer look at the longer-term USD/CAD technical trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

-

US Dollar Short-term Outlook: USD Bulls Eye Breakout at Resistance

-

British Pound Short-term Outlook: GBP/USD Falters at Resistance

-

Euro Short-term Outlook: EUR/USD Rejected at Trend Resistance

-

Australian Dollar Short-term Outlook: AUD/USD Struggles at Resistance

-

Swiss Franc Short-term Outlook: USD/CHF Bulls Fight to Reclaim 0.8000

-

Gold Short-term Outlook: XAU/USD Pressures Key Support Level

Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.