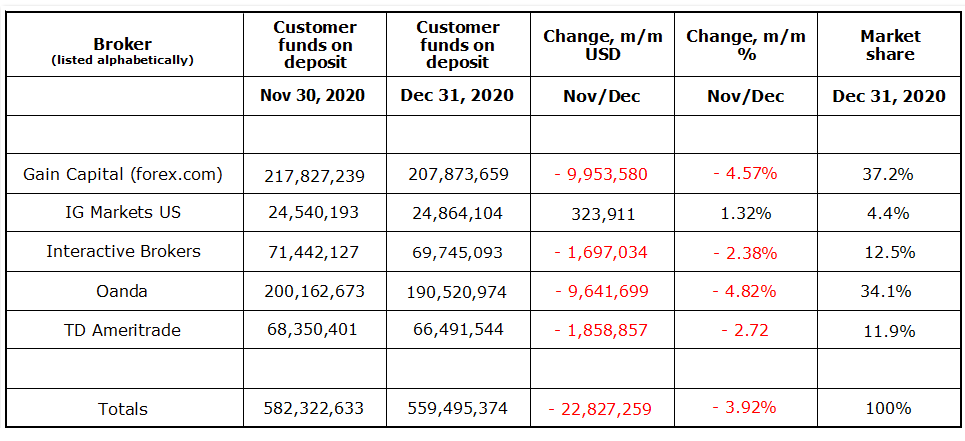

The following table shows total customer funds on deposit for each of the five CFTC-registered forex brokers in the U.S., as of December 31, 2020, together with month-over-month changes (in USD, and

in %) from the November 30 figures.

These data were taken from the CFTC’s most recent FCM Financial Data report, published earlier this month. There is a link to the entire CFTC report at the bottom of this post.

Also shown in the table below is each broker’s share of the domestic forex market, based on the customer funds each broker held as of December 31.

Customer funds held by the five U.S. forex brokers

• In the month ended December 31, four of the five U.S. forex brokers shed customer funds.

• IG Markets was the only broker to add customer funds, increasing their customer funds on deposit by nearly $324,000 (up 1.32%).

• In total, nearly $23 million of customer funds disappeared from the domestic market in the month ended December 31.

Market-shares of the U.S. brokers

• The domestic forex market continues to be a 3-tier market.

• Gain Capital and Oanda comprise the top tier, with a little over 71% of the overall market between them.

• Interactive Brokers and TD Ameritrade comprise the second tier, sharing almost 24½% of the market.

• In the bottom tier, IG Markets (the newest of the five CFTC-regulated forex brokers) continues to hold more than 4% of the overall market.

Here is a link to the CFTC’s FCM Financial Data report for December. Note that only 5 of the 65 FCM’s (Futures Commission Merchants) shown in the CFTC’s spreadsheet are forex dealers, having forex customer funds on deposit. Those forex deposits appear in the far right-hand column of the CFTC report.