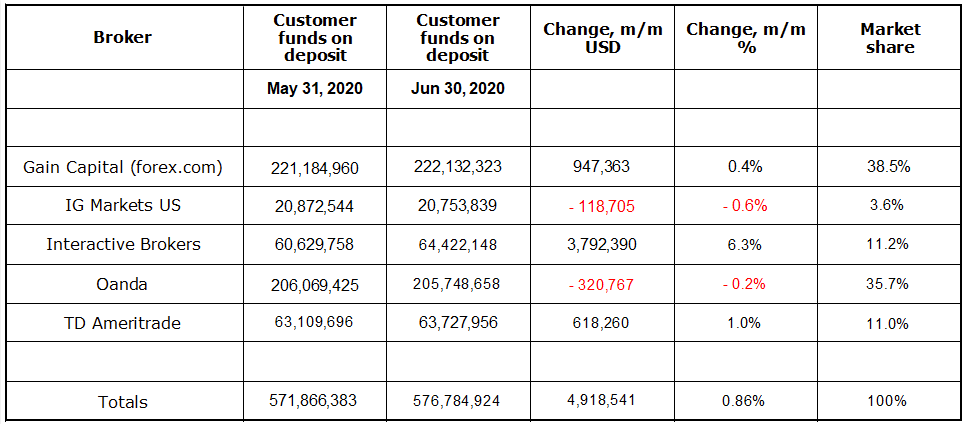

We continue to track the five CFTC-registered forex brokers on the basis of customer funds on deposit, and market share. The data comes from the CFTC’s monthly reports titled Selected FCM Financial Data, published early in the first half of each month, reporting the financial positions of commodities brokers and forex brokers as of approximately 40 days previous. The latest report, released in early August, lists data as of June 30, 2020.

For multi-asset brokers, such as Interactive Brokers, our summary here considers only forex market metrics.

Customer funds on deposit

In the month of June, Interactive Brokers added almost $3.8 million in customer funds on deposit — four (or more) times the gains made by any of the other U.S. brokers. For IB, this translates to an increase in customer funds of 6.3% for the month of June, closely approximating the $3.8 million (6.7%) gains made in the previous month.

That was the only notable change, among the five U.S. brokers, during June.

Two brokers, IG and Oanda, posted small percentage losses in customer funds held, while Gain and TD Ameritrade posted small increases…

Market shares

Market shares changed only slightly during the month of June.

Gain Capital (forex .com) and Oanda continue to run almost neck-and-neck in the top tier, with 38.5% and 35.7% market shares, respectively.

Interactive Brokers and TD Ameritrade, with nearly equal market shares of 11.2% and 11.0%, respectively, continue to occupy the second tier, far behind the leaders.

Newcomer IG Markets US held steady in June at 3.6% market share, despite posting a small percentage loss (-0.6%) in customer funds for the month.

Overall, total customer forex accounts on deposit at the five registered brokers increased by nearly $5 million in June, an increase of slightly less than 0.9% for the month.

Here are the June metrics in table format

And here is a link to the CFTC report Selected FCM Financial Data as of June 30, 2020