Chevron Corporation (CVX) is an American multinational energy company. It is the second largest oil company in the United States and has operation in more than 180 countries. Chevron is involved in the entire spectrum of supply chain within the oil and natural gas industries from exploration, production, refining, marketing, transport, and sales. The stock shows a bullish sequence from all-time low but now is in the process of correcting cycle from March 2020 low. Below is the Elliott Wave outlook for the stock.

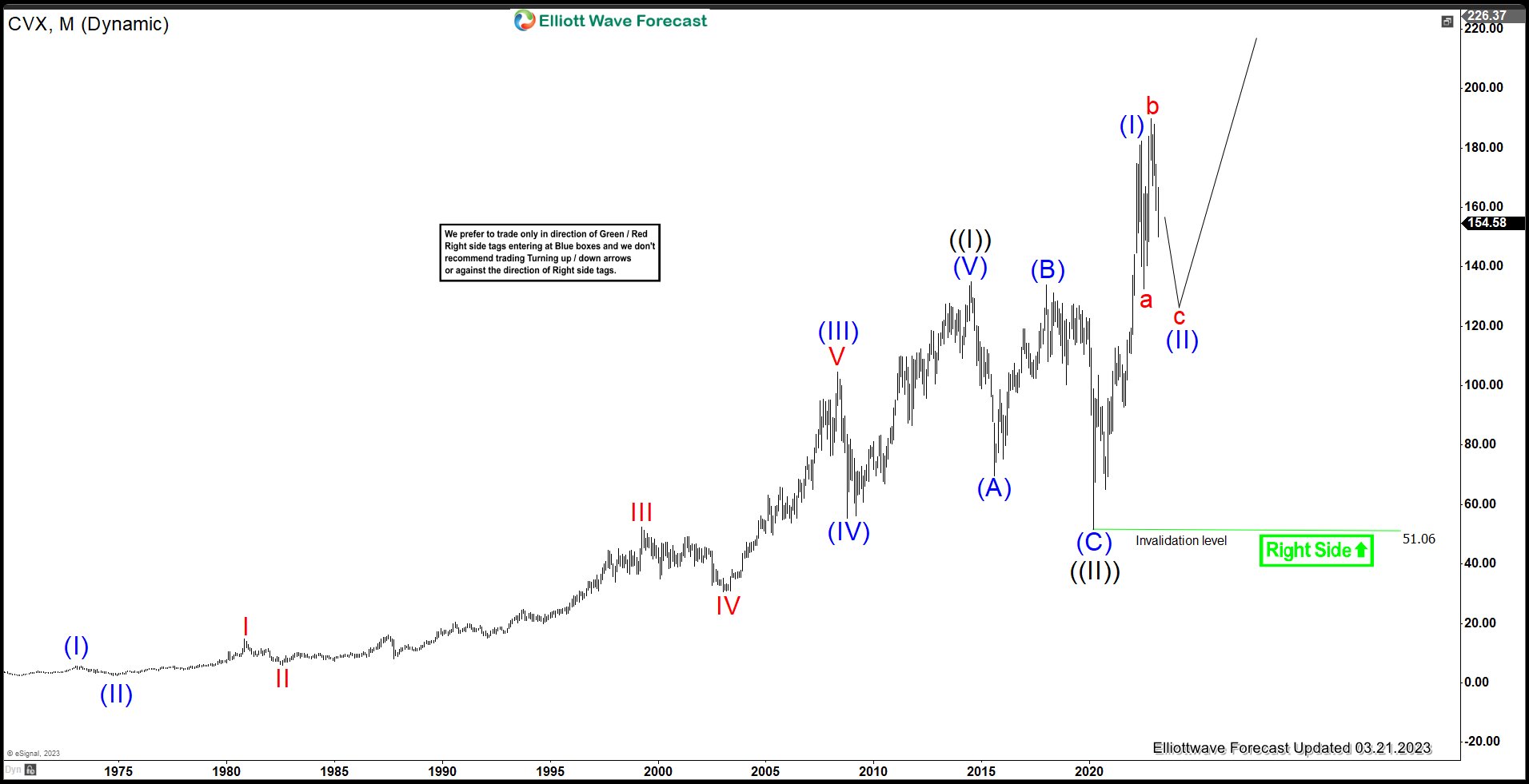

Chevron Monthly Elliott Wave Chart

Monthly Elliott Wave of Chevron (CVX) above shows the stock ended wave ((I)) at 135.1 on 7.1.2014 high. The stock then did a larger 3 swing pullback in the form of a zigzag and ended wave ((II)) at 51.06 on 3.1.2020 low. The stock has rallied higher in wave ((III)). It has broken above wave ((I)) at 135.1 confirming the next leg higher has started. Up from wave ((II)), wave (I) ended at 182.4. Pullback in wave (II) is in progress to correct cycle from 3.1.2020 low before the rally resumes. As far as pivot at 51.06 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.

Chevron Daily Elliott Wave Chart

Daily Elliott Wave chart of CVX above shows the pullback in wave (II) is in progress as an expanded Flat Elliott Wave structure. Down from wave (I), wave a ended at 132.54 and wave b rally ended at 189.68. Wave c lower is in progress as a 5 waves impulse. Potential target for wave c is 100% - 161.8% Fibonacci extension of wave a which comes at 109.1 - 139.7. This is the area to end wave c of (II) and the stock can resume higher from here.

Source: https://elliottwave-forecast.com/video-blog/chevron-cvx-expanded-flat-elliott-wave-correction/