Chewy.com is an e-commerce company that specializes in pet food. Along with many other stocks, prices started a new cycle higher in March 2020. Chewy is now correcting that cycle and currently going fairly deep, and threatening to make new all time lows. Lets take a look at the company profile and see what they do:

“Chewy, Inc. is an American online retailer of pet food and other pet-related products based in Dania Beach, Florida. In 2017, Chewy was acquired by PetSmart for $3.35 billion, which was the largest ever acquisition of an e-commerce business at the time. The company completed its initial public offering in 2019, raising $1 billion.

Following the acquisition, Cohen remained CEO and operated the business largely as an independent unit of PetSmart. Between 2017 and 2018, Chewy’s sales increased from $2.1 billion to $3.5 billion, with 66% of sales coming from customers signed up for automatic recurring shipments. In 2018, Chewy created Chewy Pharmacy, an online pharmacy providing pet-targeted prescription medications. Orders placed through the business are completed in coordination with a team of in-house veterinarians.”

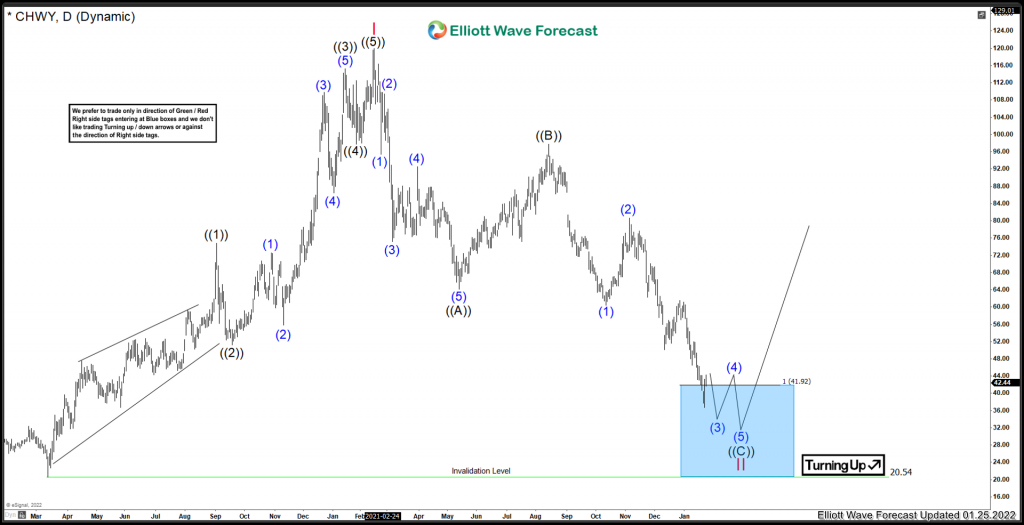

Lets take a look at the view from January 2022.

Elliottwave view January 2022:

At the time, I was still looking for more swings lower to complete the correction. However, prices are at the blue box where a bounce can take place. This is the area where we do not like to sell anymore. Lets take a look at the updated view from May 2022.

Elliottwave View May 2022:

This stock made new all time highs in February 2021. After that peak, a deep correction has taken place. From the all time low @ 20.54, the stock has rallied in 5 waves and peaked in February of 2021. Medium term term view from Feb 2021 peak set @ 120.00 . The pullback since the peak over a year ago, has been a fairly clean pullback. There is a clear 5 waves down into ((A)), bounce in ((B)). As a result, the stock is declining in the final leg before a larger bounce may take place. Currently, the momentum is suggesting that blue (3) and (4) are set and as long as the 20,54 low remains intact, this instrument can still be correcting that 20.54 low.

It should be noted that there is a blue box that is present, from the 41.92 to invalidation level at 20.54. The blue boxes are areas where algos and buyers typically enter for a bounce. Prices are very close do invalidtion the bullish thesis. For now, we like to wait for some other sectors and indices like $SPY, $XLK, $XLY to reach some equal leg before buying some of these names. It can be choppy sideways to lower in the near term.