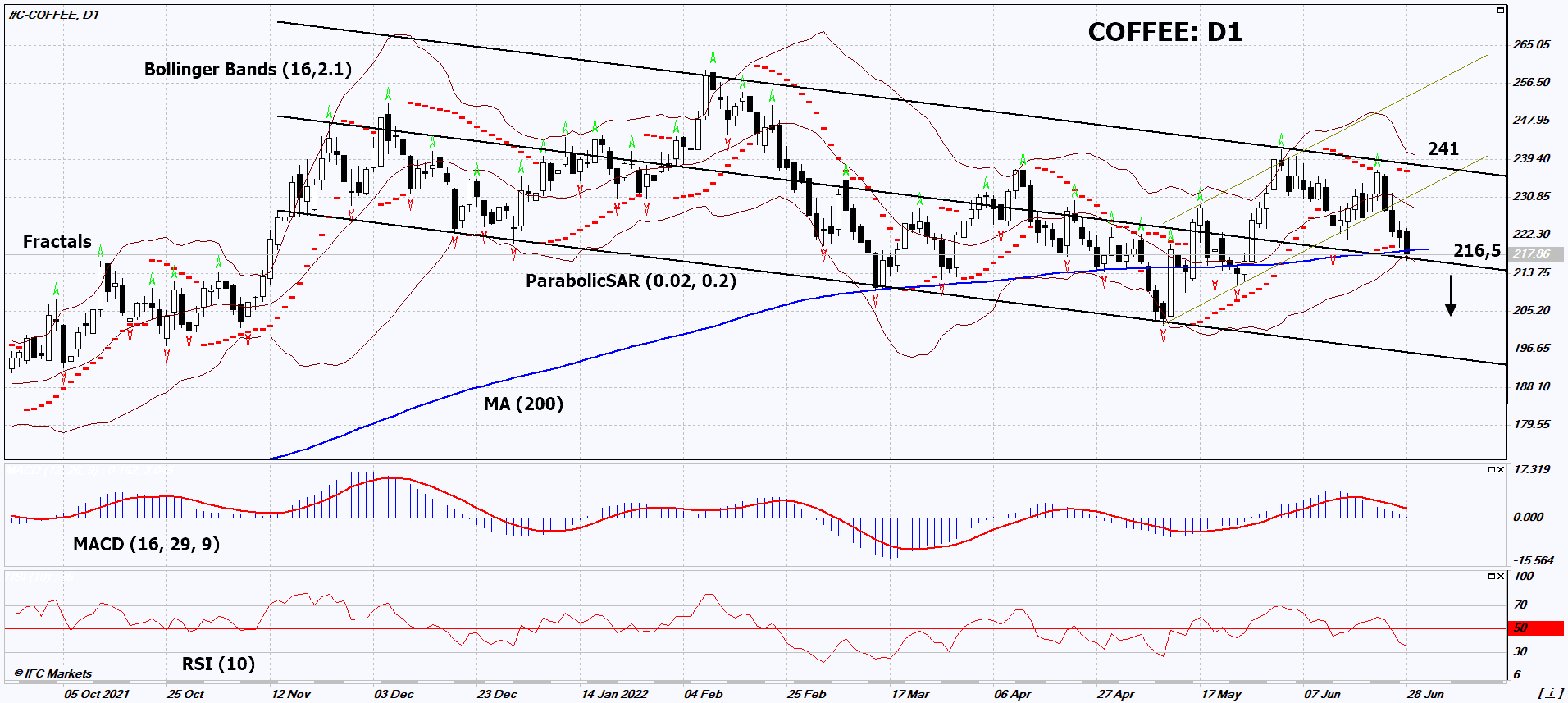

COFFEE Technical Analysis Summary

Sell Stop։ Below 216,5

Stop Loss: Above 241

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

COFFEE Chart Analysis

COFFEE Technical Analysis

On the daily timeframe, COFFEE: D1 is in a descending channel and is trying to move towards its lower border. A number of technical analysis indicators have formed downward signals. We do not rule out a bearish movement if COFFEE falls below the 200-day moving average, the latest down fractal and the lower Bollinger band: 216.5. This level can be used as an entry point. The initial risk limit is possible above the last upper fractal, the upper Bollinger band and the Parabolic signal: 241. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (241) without activating the order (216.5), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Commodities - COFFEE

The United States Department of Agriculture (USDA) is expecting an increase in world coffee production. Will the correction of COFFEE quotes continue?

According to the USDA forecast, global coffee production in the 2022/2023 crop season will increase by 4.7% y/y, or by 7.8 million bags, to 175 million. At the same time, world consumption will increase by only 1.8 million bags to 167 million. This could cause a 6.8% increase in global stocks to 34.7 million bags. It should be noted that, according to the USDA, the main increase in coffee consumption should occur in the European Union (+1 million bags) and the USA (+0.5 million bags). Accordingly, economic risks may interfere with this. An additional negative factor for arabica coffee quotes is the weakening of the Brazilian real against the US dollar. It can also be noted that according to the Green Coffee Association, green coffee stocks in the US in May increased by 3.2% y/y to 6 million bags. It should be emphasized that coffee quotes can be highly dependent on the weather in Brazil, where the harvest is currently underway. In case of drought, they are able to turn up. In the meantime, the USDA expects that the crop of arabica coffee in Brazil this season will increase by 5.1 million bags y/y and amount to 41.5 million.