Global Markets Rise as Yields Drop to 4%

Global markets climbed as weak U.S. jobs data (22,000 new payrolls, unemployment at 4.3%) increased expectations for Fed rate cuts. The 10-year Treasury yield dropped to 4%, its lowest in five months, with traders pricing in at least a 25 bps cut and watching this week’s PPI and CPI.

Gold surged above $3,650 to record highs, supported by lower yields, a softer dollar, and safe-haven demand after U.S. sanction threats on Russia. Oil extended gains, with Brent above $66 and WTI near $62, after OPEC+ confirmed only a modest October output increase of 137,000 bpd.

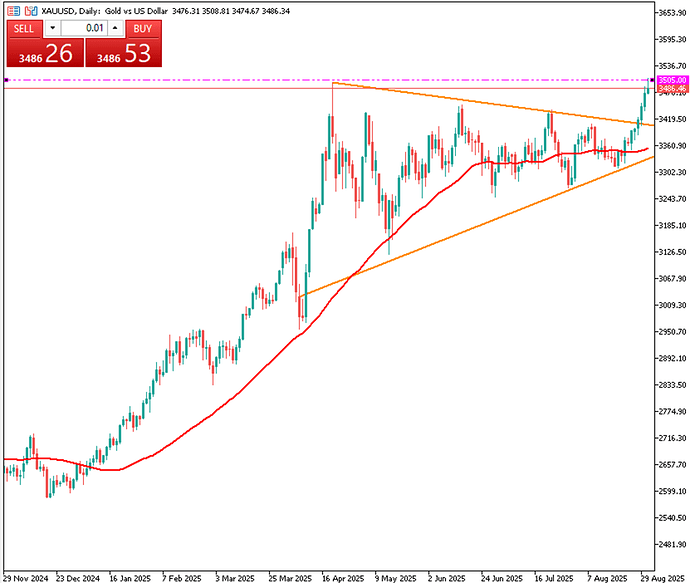

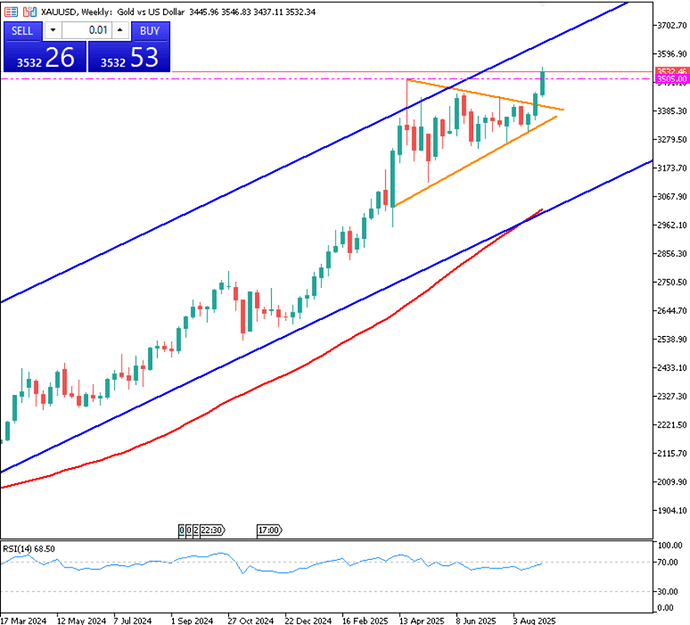

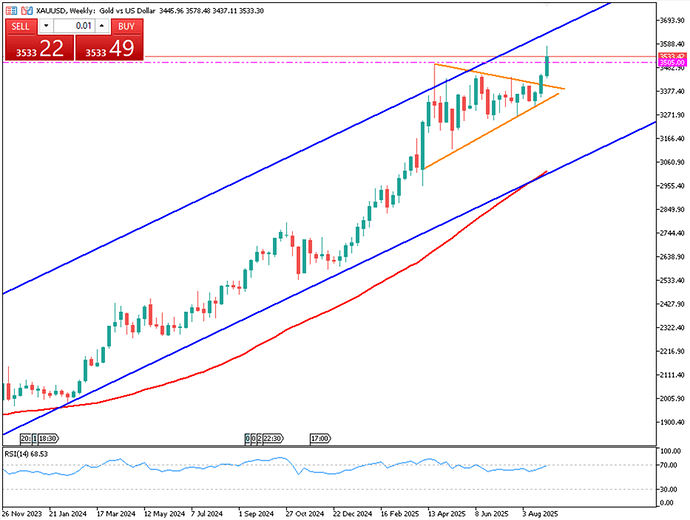

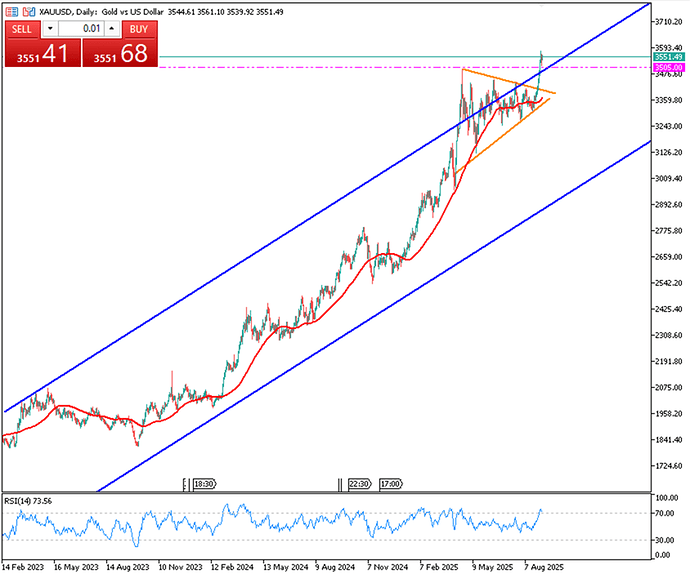

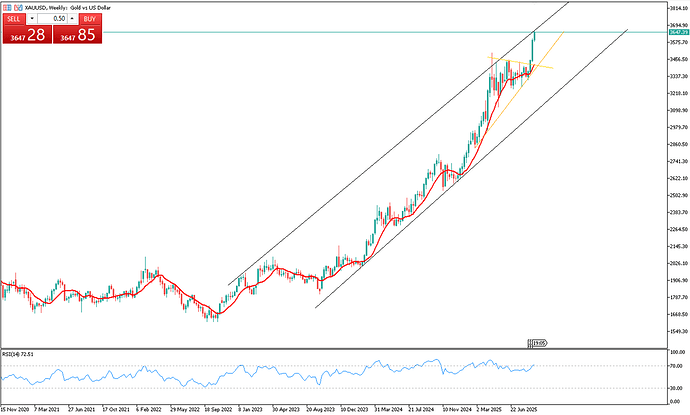

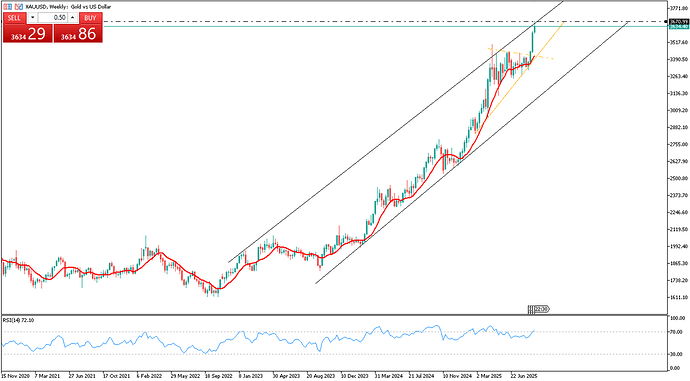

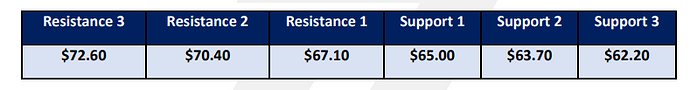

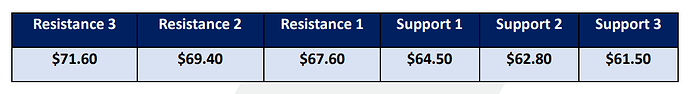

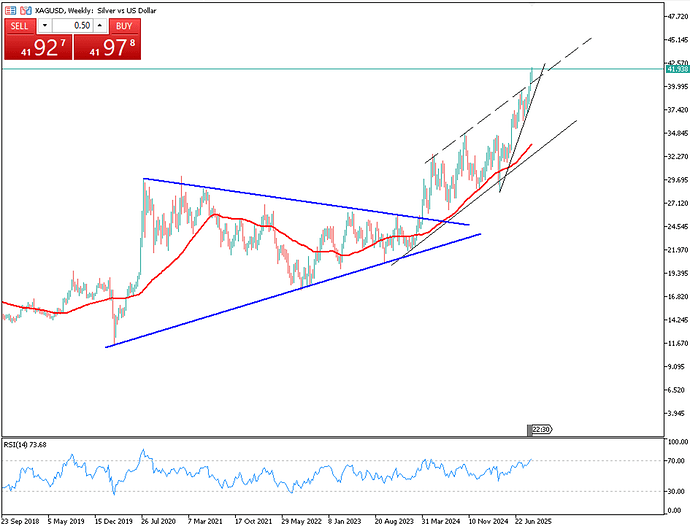

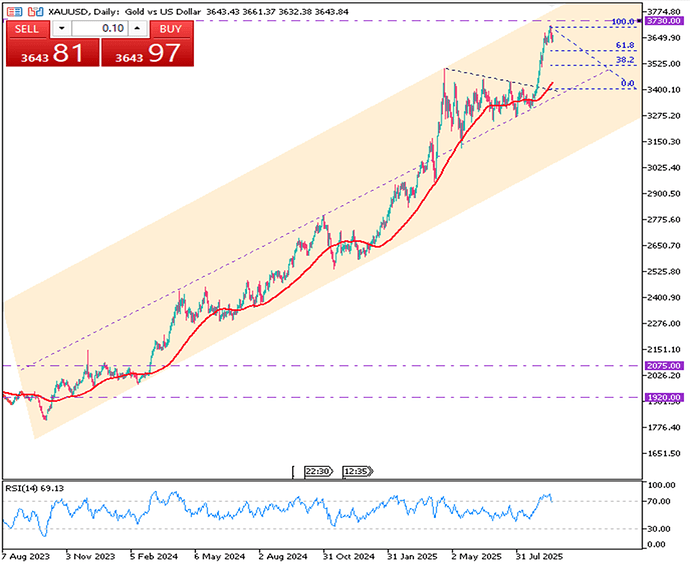

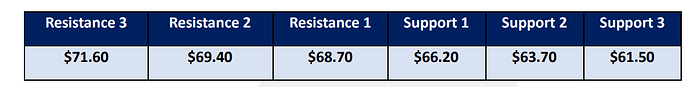

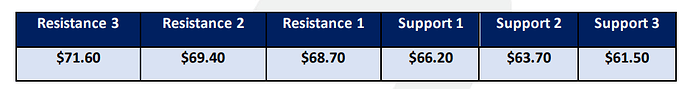

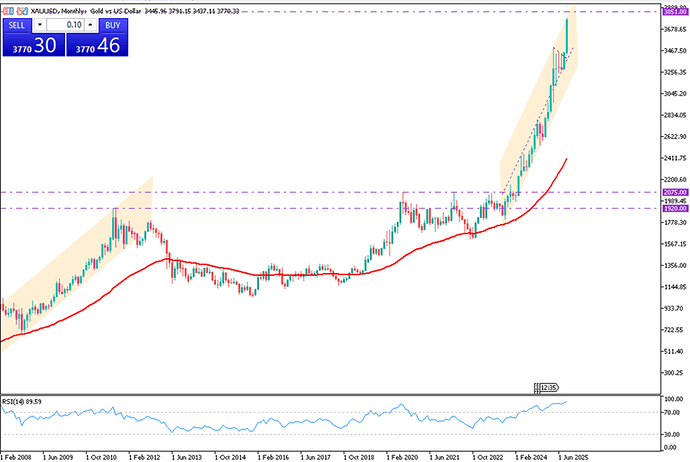

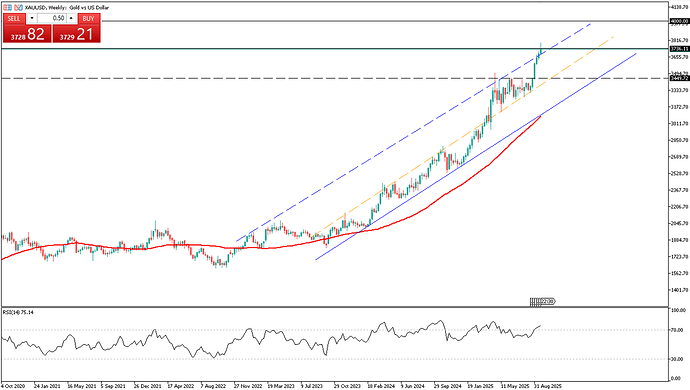

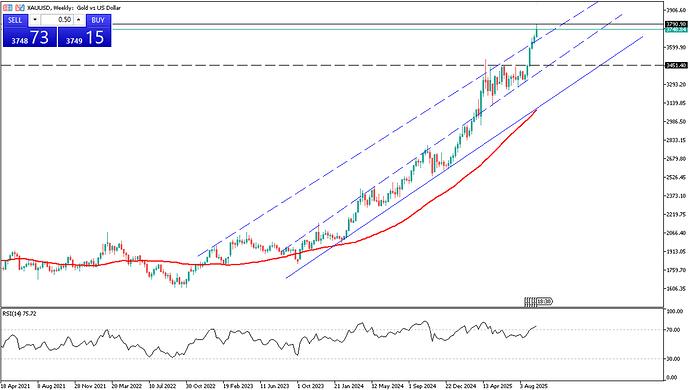

Gold Extends Record Rally Above $3,650

Gold extended its record rally for a third day, climbing above $3,650 in Tuesday’s Asian session. The surge is driven by Fed cut bets after weak U.S. jobs data, with markets pricing in up to three reductions this year. The weaker dollar, along with political instability in Japan and France, increased safe-haven demand. Momentum remains strong, though overbought conditions could cap gains ahead of U.S. inflation data (PPI Wednesday, CPI Thursday).

Gold is currently facing resistance around $3,670, with strong support near $3,625.

| R1: 3670 |

S1: 3625 |

| R2: 3700 |

S2: 3570 |

| R3: 3730 |

S3: 3500 |

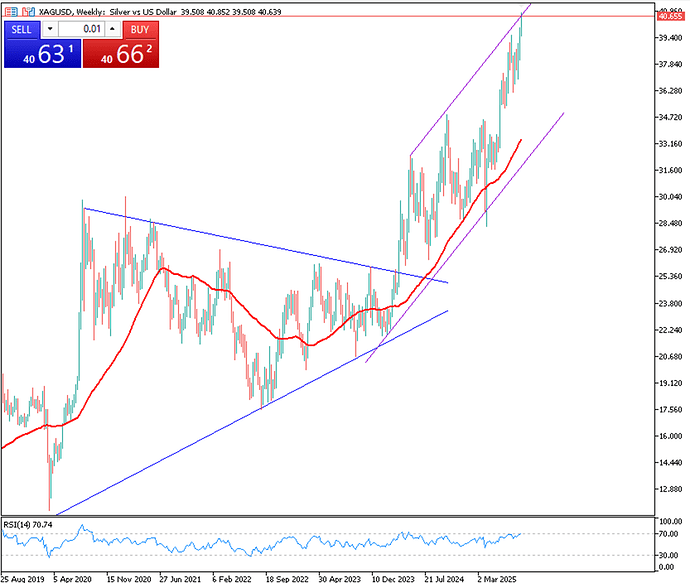

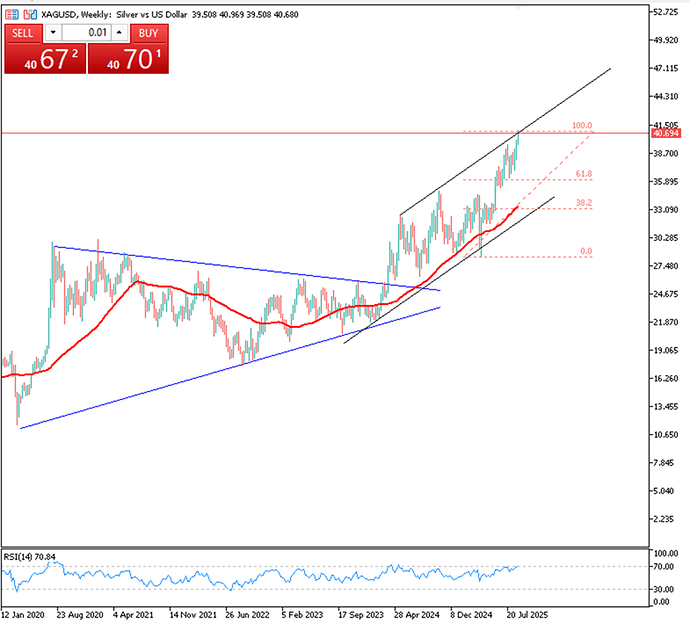

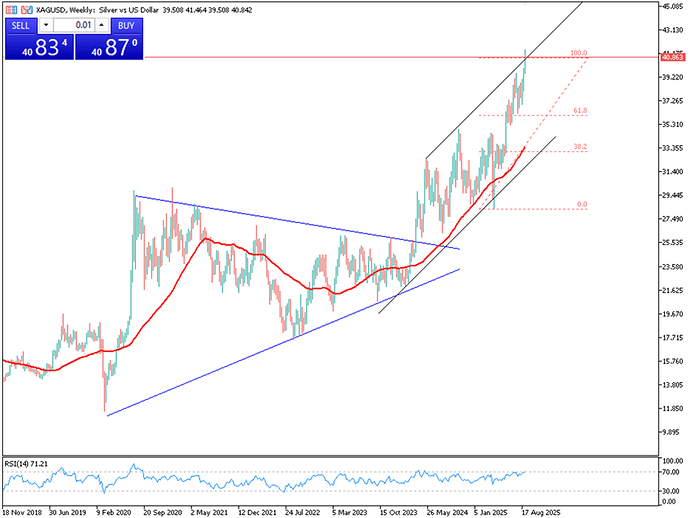

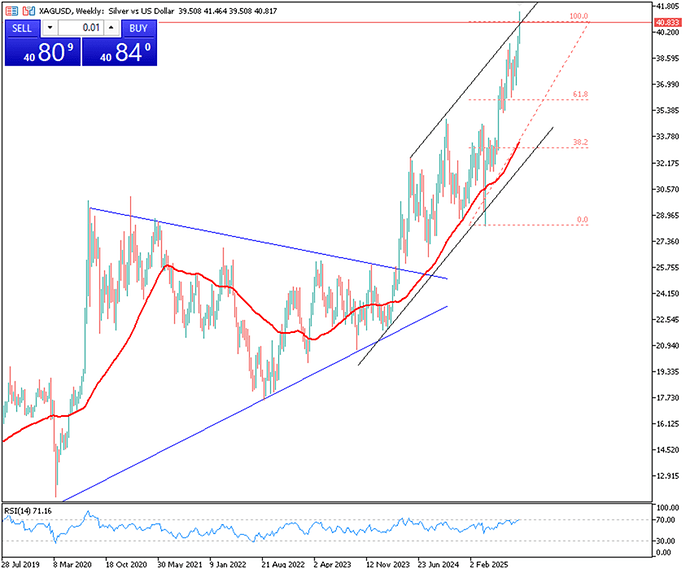

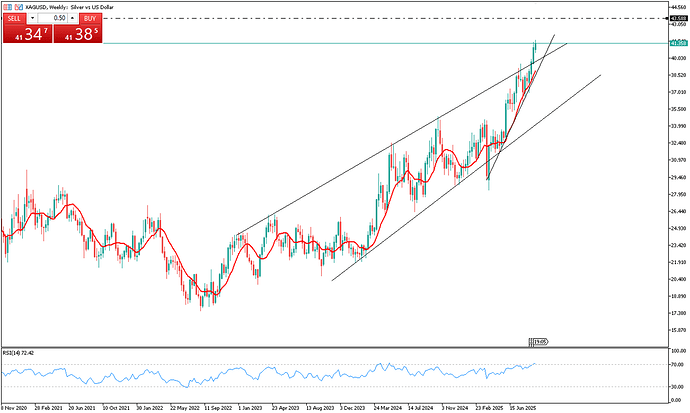

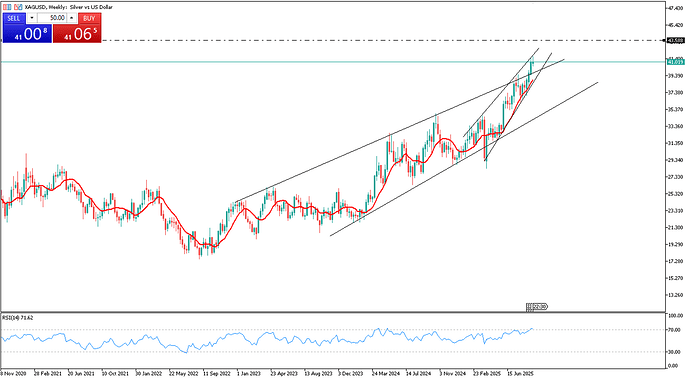

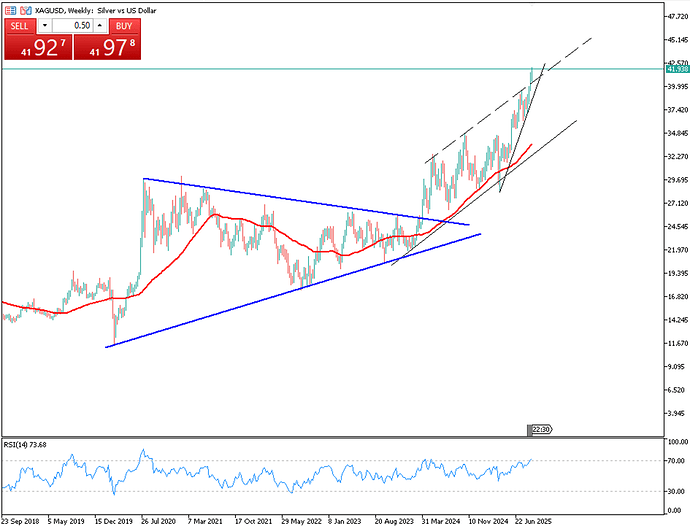

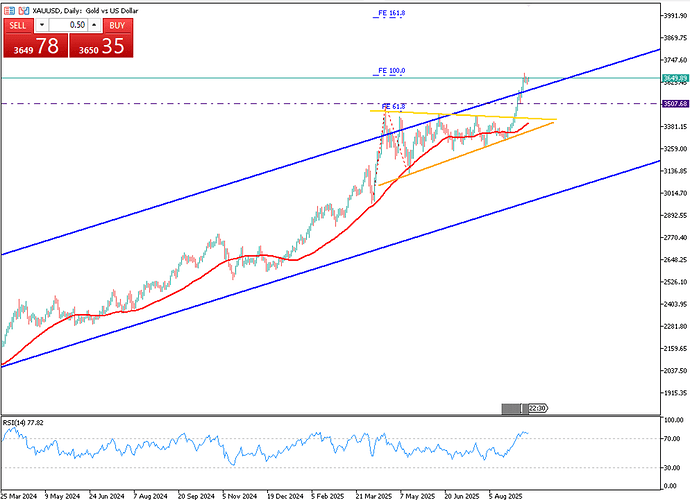

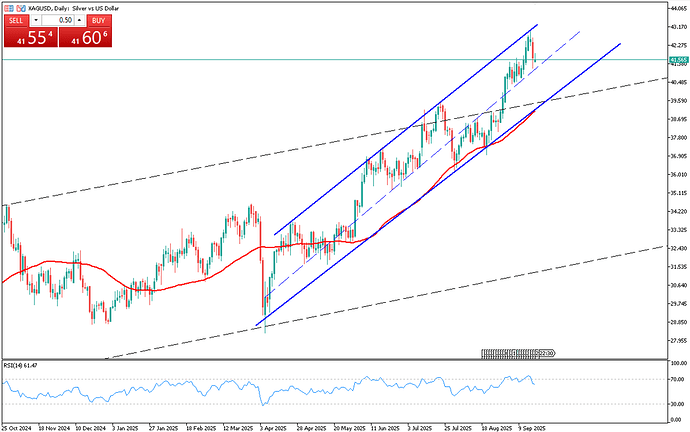

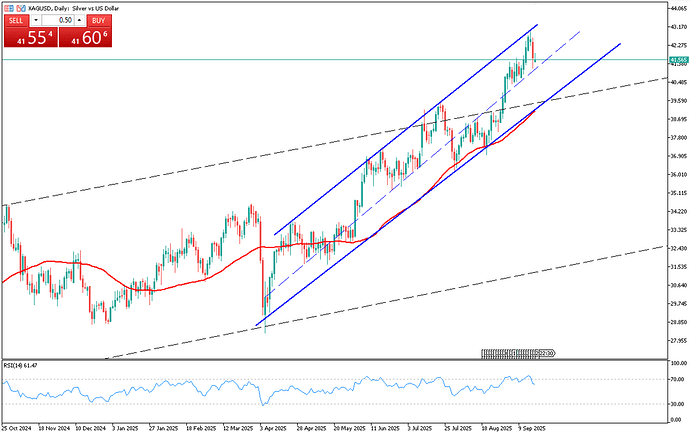

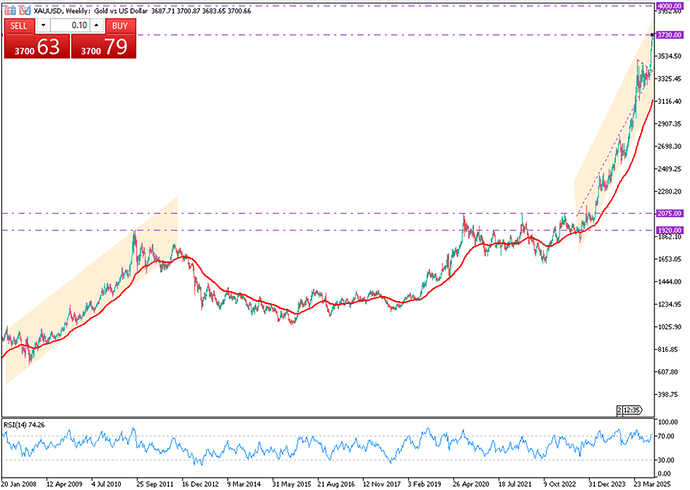

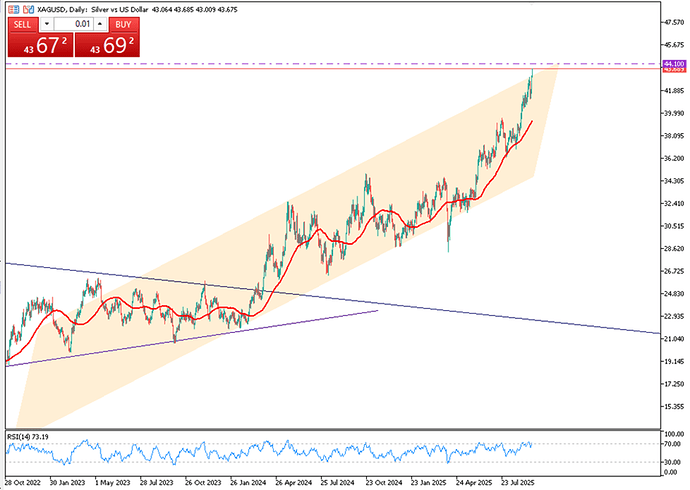

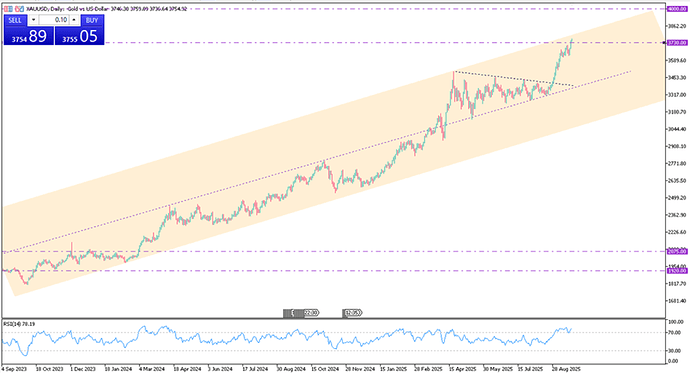

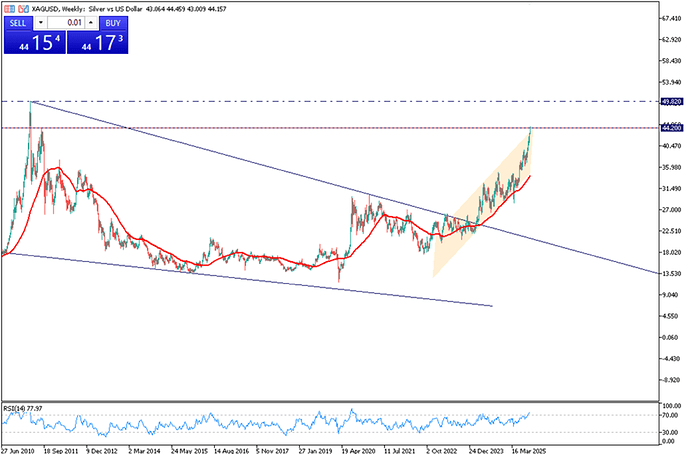

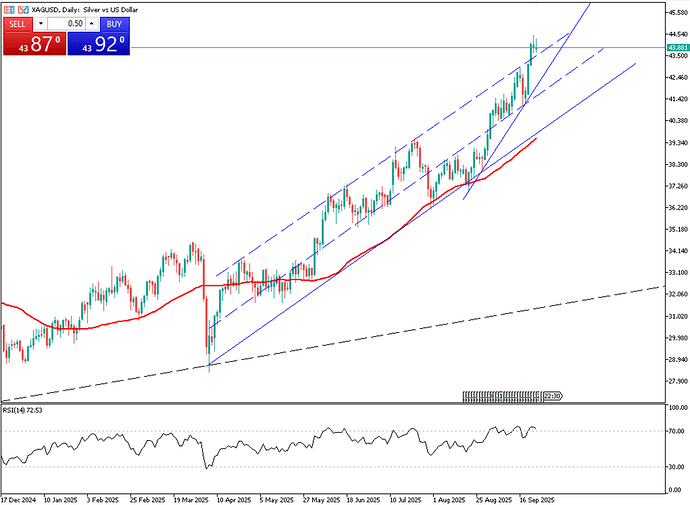

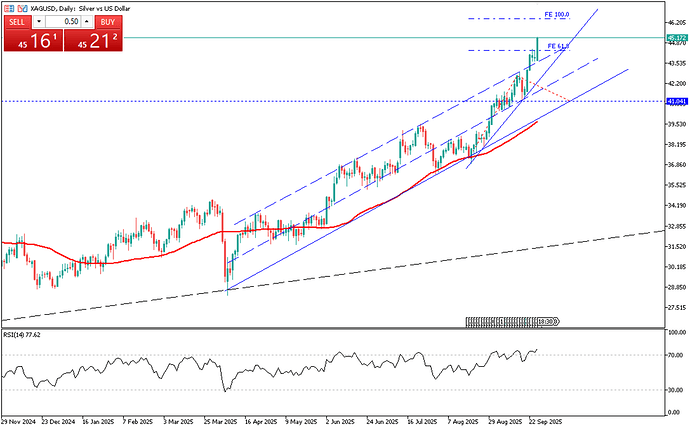

XAG/USD Extends Rally for Third Day

Silver (XAG/USD) extended gains for a third straight session, trading near $41.40 in Tuesday’s Asian hours. The rally is fueled by expectations of a jumbo Fed cut after weak labor data, with August’s NFP showing just 22K jobs versus the 75K forecast. The cooling job market strengthens the case for easing, lowering the cost of holding non-yielding assets like silver. Geopolitical tensions and trade war concerns also add safe-haven demand, with IBJA’s Haresh Acharya noting that Fed cut bets and risk aversion are driving the surge.

The first resistance at $42.00 and support at $40.40.

| R1: 42.00 |

S1: 40.40 |

| R2: 42.40 |

S2: 39.80 |

| R3: 43.40 |

S3: 38.20 |

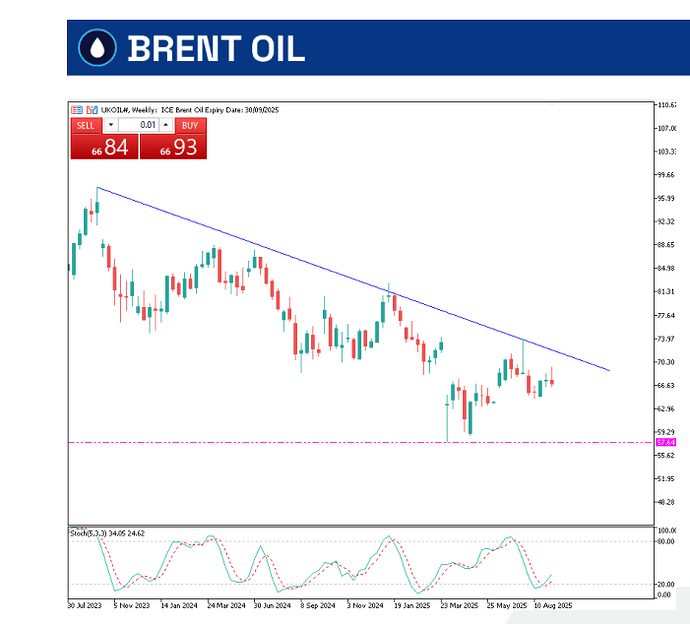

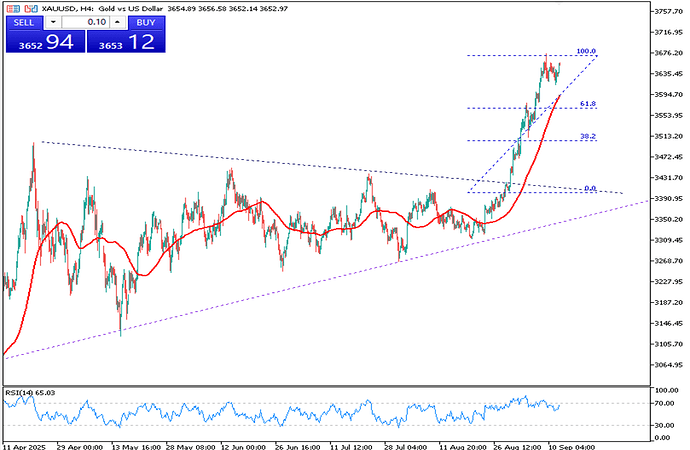

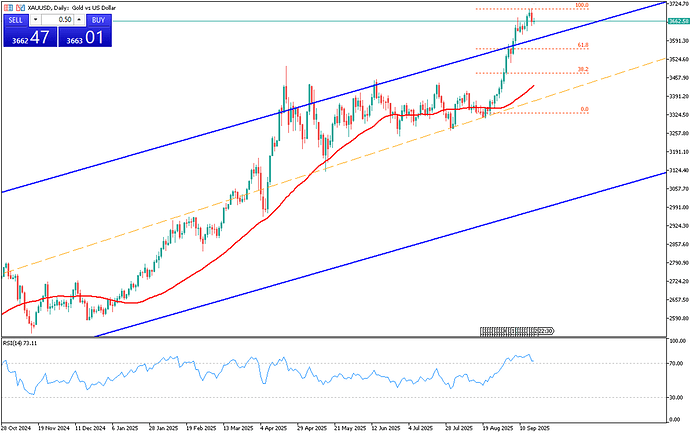

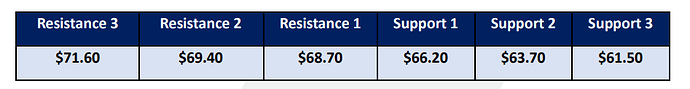

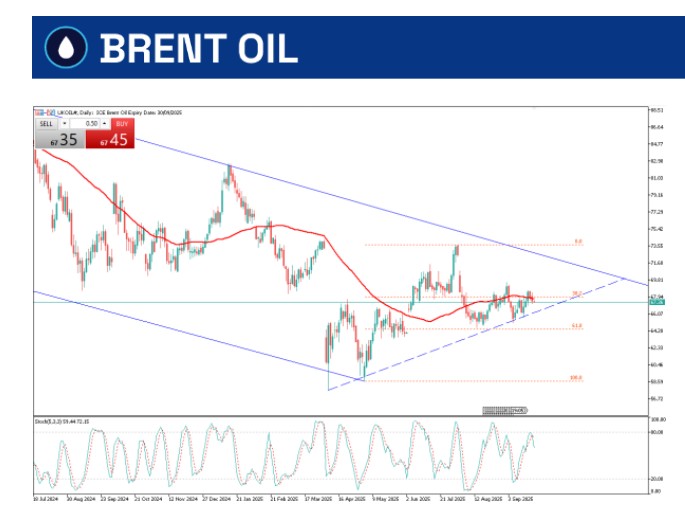

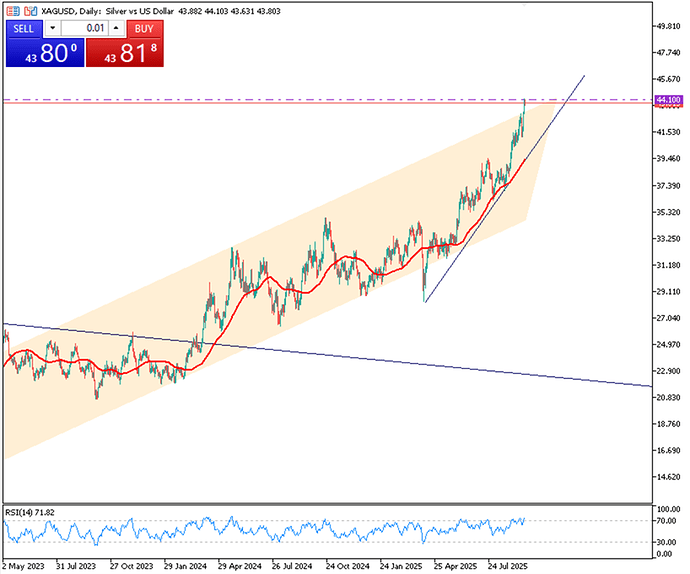

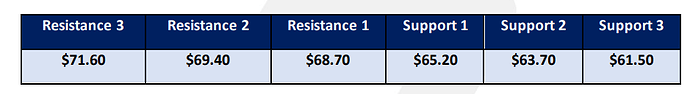

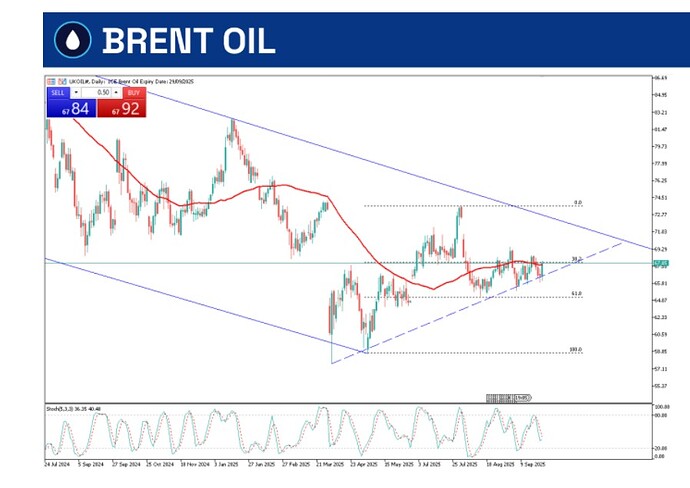

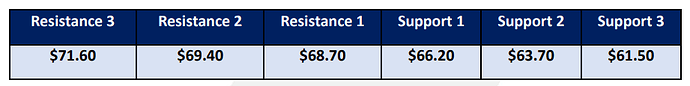

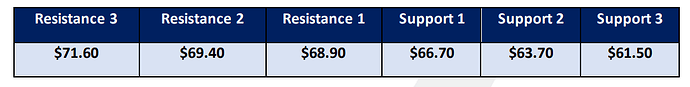

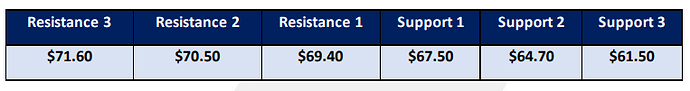

BRENT CRUDE

Brent crude futures rose above $66 per barrel on Tuesday, building on Monday’s gains, supported by OPEC+’s slow output increase and renewed concerns over potential sanctions on Russian oil. On Sunday, OPEC+ agreed to boost production by just 137,000 barrels per day starting in October, significantly less than previous monthly hikes, which ranged from 411,000 to 555,000 bpd. The modest increase reflects the group’s cautious approach amid expectations of a market surplus.

U.S. President Donald Trump signaled readiness to impose further sanctions on Russia following its most intense airstrikes on Ukraine since the war began, raising fears of global energy supply disruptions. However, gains were capped after Saudi Arabia cut prices on all crude grades for October deliveries to Asia, suggesting softer regional demand.

Brent faces resistance at $67.10, with key support at $65.00