Dollar Gains Pressure on Euro, Metals, and Pound (09.26.2025)

Markets moved cautiously on Friday as the dollar strengthened on the back of robust U.S. data

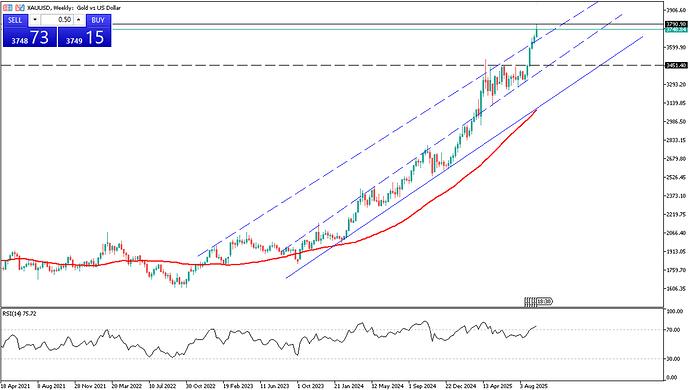

Stronger U.S. Data Weighs on Gold Prices

Gold prices retreated to around $3,725 on Friday as stronger U.S. economic data boosted the dollar and tempered expectations for a Fed rate cut ahead of next week’s key inflation report. Weekly jobless claims declined, while Q2 GDP was revised higher, reflecting robust consumer spending and business investment. Following these developments, the probability of a Fed rate cut in October eased from 90% to 85%.

From a technical perspective, holding above $3,750 keeps the outlook constructive. Resistance is seen at $3,790 (all-time high), followed by $3,810 and $3,850. On the downside, the $3,720–$3,725 zone serves as the first support area.

| R1: 3790 | S1: 3720 |

|---|---|

| R2: 3810 | S2: 3600 |

| R3: 3850 | S3: 3550 |

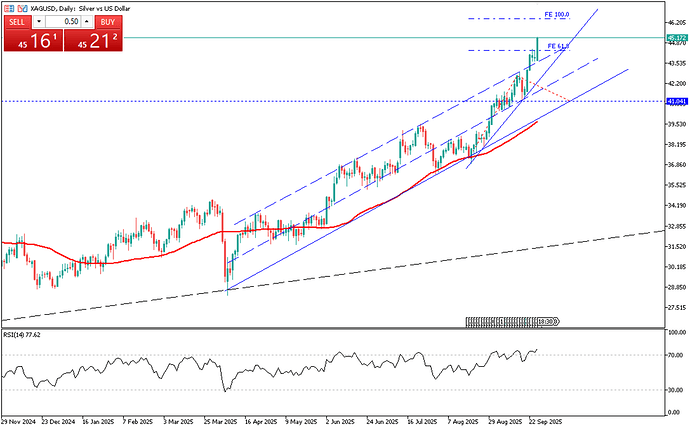

Silver Pulls Back From 14-Year Highs

Silver continues to trade around $45 per ounce after slightly pulling back from its 14-year high on Friday. The main reasons are the strengthening of the dollar following strong U.S. economic data and reduced expectations for deeper interest rate cuts by the Federal Reserve. Data released on Thursday showed weekly jobless claims falling to 218,000, indicating a resilient labor market. In addition, Q2 GDP growth was revised up to 3.8% annualized, marking nearly the fastest growth rate in the past two years. While markets still expect a quarter-point Fed cut in October, the total interest rate cut expectation for the rest of the year has decreased from 43 basis points to 39 basis points.

From a technical perspective, if silver holds above $45.25, it could target $46.05, with a further potential upside towards $48. On the downside, the main support level to watch is $43.65.

| R1: 44.05 | S1: 43.65 |

|---|---|

| R2: 48.00 | S2: 42.50 |

| R3: 50.00 | S3: 40.00 |

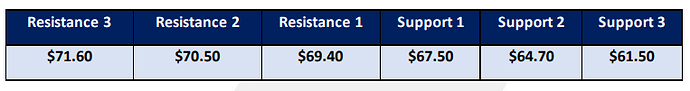

Brent Crude Oil

Brent crude oil is nearing USD 70, supported by renewed pressure from President Trump on buyers of Russian energy, including Turkey and Hungary. His remarks offset the impact of OPEC+ production increases and the restart of northern Iraqi exports after a two-year halt, as producers weigh further steps to reduce crude output.

Brent faces resistance at $69.40, with key support at $67.50.