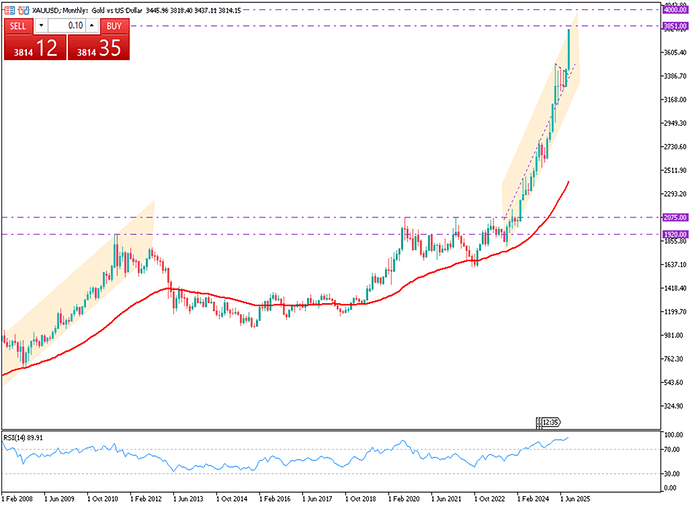

Gold Breaks $3,800 on Fed Cut Bets

Gold surged past $3,800 in Asian trading Monday, hitting a record high as in-line U.S. inflation data boosted expectations of further Fed rate cuts. Lower yields and persistent geopolitical tensions continue to fuel safe-haven demand. Traders now await remarks from Fed officials, with any hawkish signals likely to lift the dollar and weigh on gold.

From a technical perspective, support is around 3782 and resistance is at 3850.

| R1: 3850 | S1: 3782 |

|---|---|

| R2: 3910 | S2: 3760 |

| R3: 4000 | S3: 3700 |

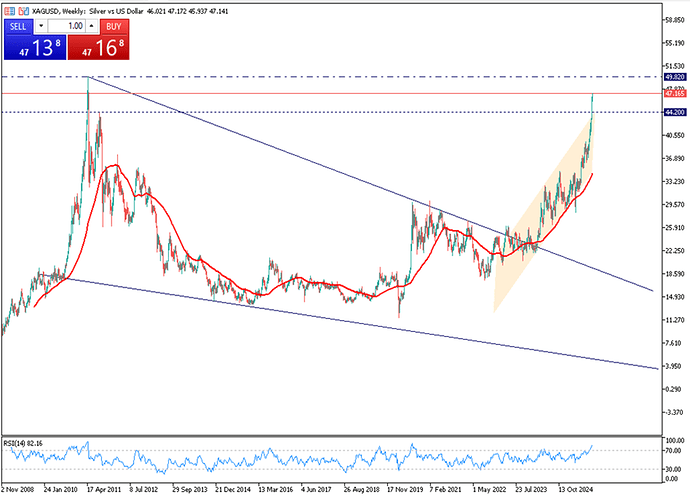

XAG/USD Hits 14-Year High on Fed Cut Bets

Silver (XAG/USD) surged to a 14-year high of $47.10 in Asian trade Monday, supported by expectations of more Fed rate cuts. US August PCE inflation matched forecasts at 2.7%, with core at 2.9%. CME FedWatch shows an 89% chance of an October cut and 66% for December. Lower rates support the appeal of non-yielding assets, lifting silver alongside broader precious metals demand.

From a technical perspective, the resistance is seen at 48.00, while the support is at 45.95.

| R1: 48.00 | S1: 45.95 |

|---|---|

| R2: 49.00 | S2: 45.20 |

| R3: 50.00 | S3: 44.50 |

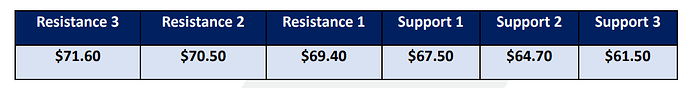

Brent Crude Oil

Brent crude fell below $70 per barrel after Iraq’s Kurdistan region resumed exports following a 2.5-year halt, adding supply to an already surplus market. Under a deal between Baghdad, the Kurdish Regional Government, and international firms, 180,000–190,000 bpd will initially flow to Turkey’s Ceyhan port, with volumes expected to reach 230,000 bpd. The move, pushed by US pressure, coincides with OPEC+ plans to stimulate output, with another hike of at least 137,000 bpd likely this week. Last week, Brent gained over 5%, its biggest rise since June, as Ukrainian attacks disrupted Russian fuel exports.

Brent faces resistance at $69.40, with key support at $67.50.