Dollar Weakens on Jobs Miss and Shutdown (10.02.2025)

Gold hovered close to record highs above $3,870 as safe-haven demand persisted, and silver traded near $47.20 amid expectations of another global supply deficit.

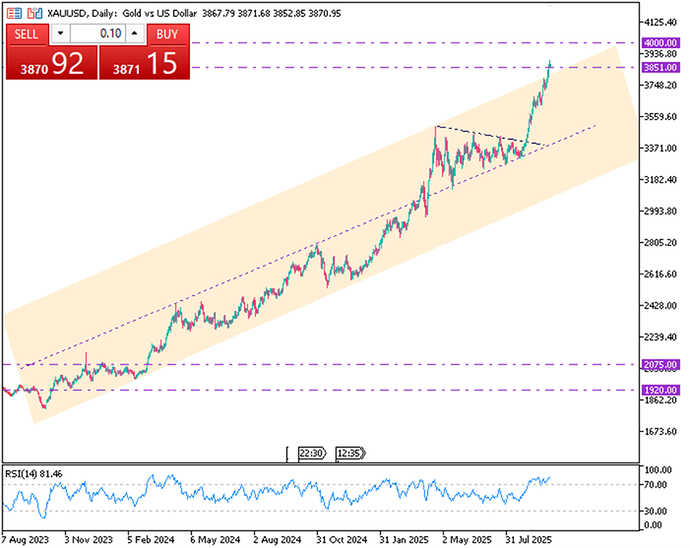

Gold Steadies Close to Record Highs

Gold held near $3,870 per ounce on Thursday, staying close to its record high as investors turned to safety and anticipated further Federal Reserve rate cuts. ADP data showed a decline in US private-sector jobs in September, marking a second consecutive drop and the steepest since March 2023, reinforcing expectations for additional easing by the Fed this year.

From a technical perspective, support is around 3792, and resistance is at 3880.

| R1: 3880 | S1: 3792 |

|---|---|

| R2: 3910 | S2: 3770 |

| R3: 4000 | S3: 3700 |

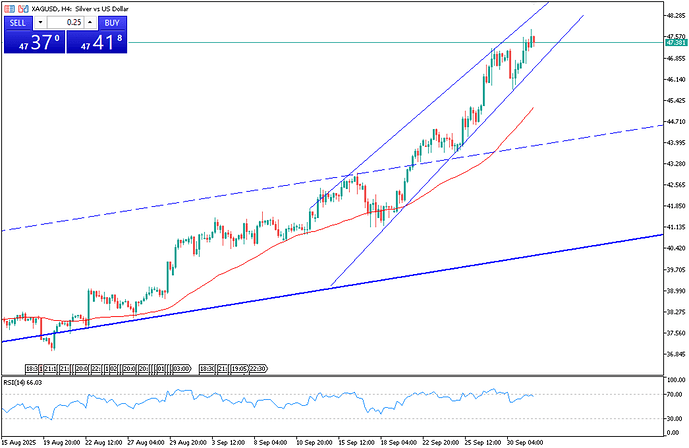

Silver Holds Near $47.20 as Supply Deficit Looms

Silver steadied near $47.20 per ounce in Thursday’s Asian session, staying close to the record high hit a day earlier after the US government shut down following the Senate’s rejection of a short-term funding bill. Supporting the bullish outlook, the Silver Institute projected a global market deficit for a fifth straight year in 2025, with expected output of 844 million ounces trailing demand by roughly 100 million ounces.

From a technical perspective, resistance is observed at 47.75, while support is located at 45.95.

| R1: 47.75 | S1: 45.95 |

|---|---|

| R2: 48.70 | S2: 45.20 |

| R3: 50.00 | S3: 44.50 |

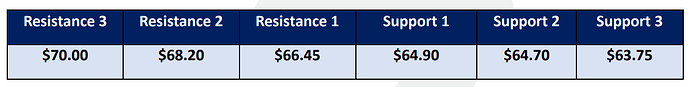

Brent Crude Oil

Brent crude futures inched up to around $65 per barrel, yet remained close to a four-month low as markets weighed potential increases in OPEC+ production. Speculation that the group could exceed planned output grew ahead of this weekend’s meeting, although OPEC+ denied such intentions.

Oversupply worries were further pushed by a 1.8 million-barrel rise in US crude stocks, higher gasoline and distillate inventories, and gasoline demand slipping to a six-month low.

Brent faces resistance at $66.45, with key support at $64.90.