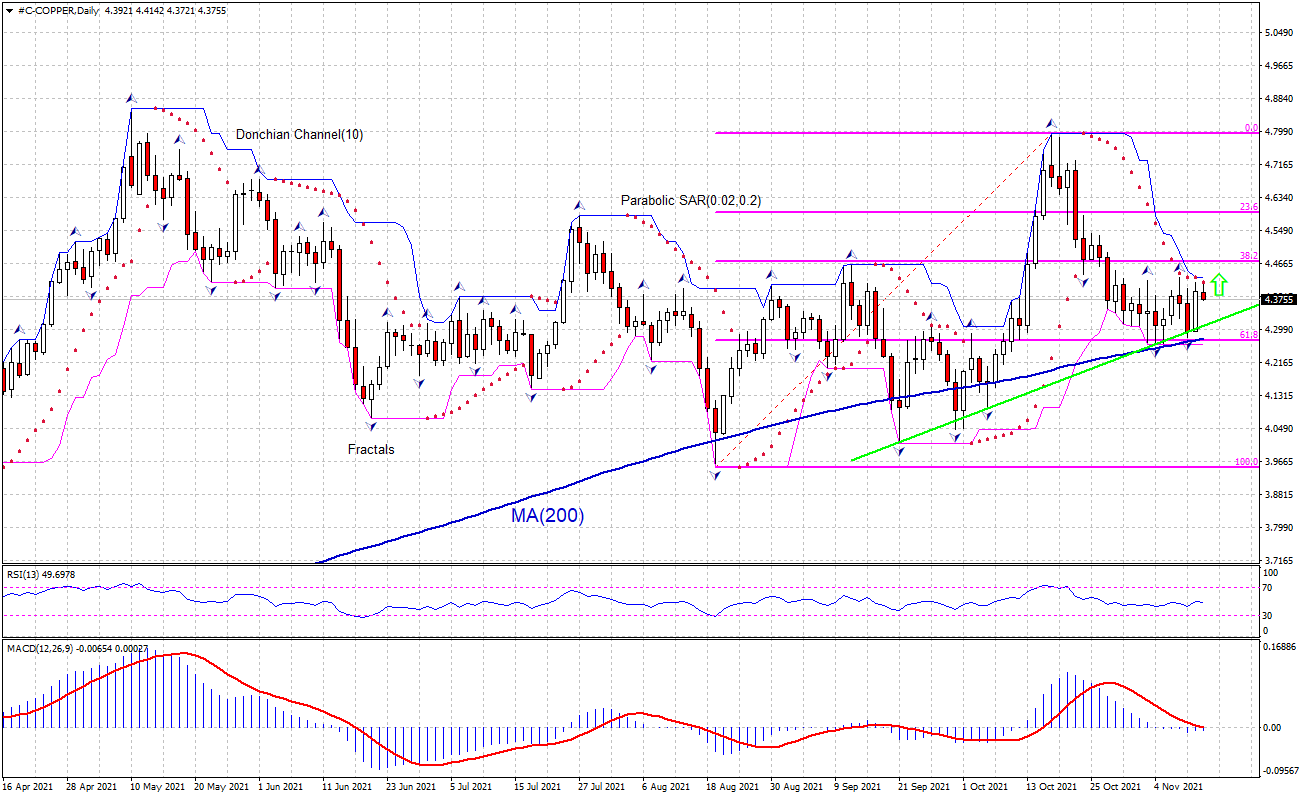

Copper Technical Analysis Summary

Buy Stop:Above 4.4314

Stop Loss:Below 4.2263

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Neutral |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Sell |

Copper Chart Analysis

Copper Technical Analysis

The technical analysis of the COPPER price chart in daily timeframe shows #C-COPPER,Daily has reflected off the 200-day moving average MA(200) which is rising. The COPPER price has failed to breach the support too. We believe the bullish momentum will continue as the price breaches above the upper Donchian boundary at 4.4314. A pending order to buy can be placed above that level. The stop loss can be placed below 4.2263. After placing the order, the stop loss is to be moved every day to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Commodities - Copper

China’s copper import rose in October. Will thecopper price rebound continue?

China is world’s top consumer of refined copper - China accounted for 51% of the global copper consumption in 2019. China copper imports rose for a second month in October. Arrivals of unwrought copper and products into China were 410,541.3 tons last month, up from 406,015.6 tons in September according to the General Administration of Customs. World’s top copper consumer’s rising imports are bullish for copper. However unfolding crisis in China’s real estate sector may negatively impact demand for copper and is a downside risk for copper price. Evergrande, China’s top real estate company, paid bondholders overdue coupon payments yesterday, easing concerns about a potentially destabilizing default. However reports of other developers’ liquidity issues weighs on investor sentiment - Kaisa Group Holdings, which ranks second among high yield bond real estate issuers, suspended trading in its Hong Kong-listed shares last Friday before the stock market opened. Moody’s ratings agency wrote in late October that the rated developers will need to pay or refinance tens of billions of dollars’ worth of debt in the coming 12 months: $33.1 billion of onshore bonds listed in mainland China, and $43.8 billion of offshore U.S.-dollar denominated bonds.