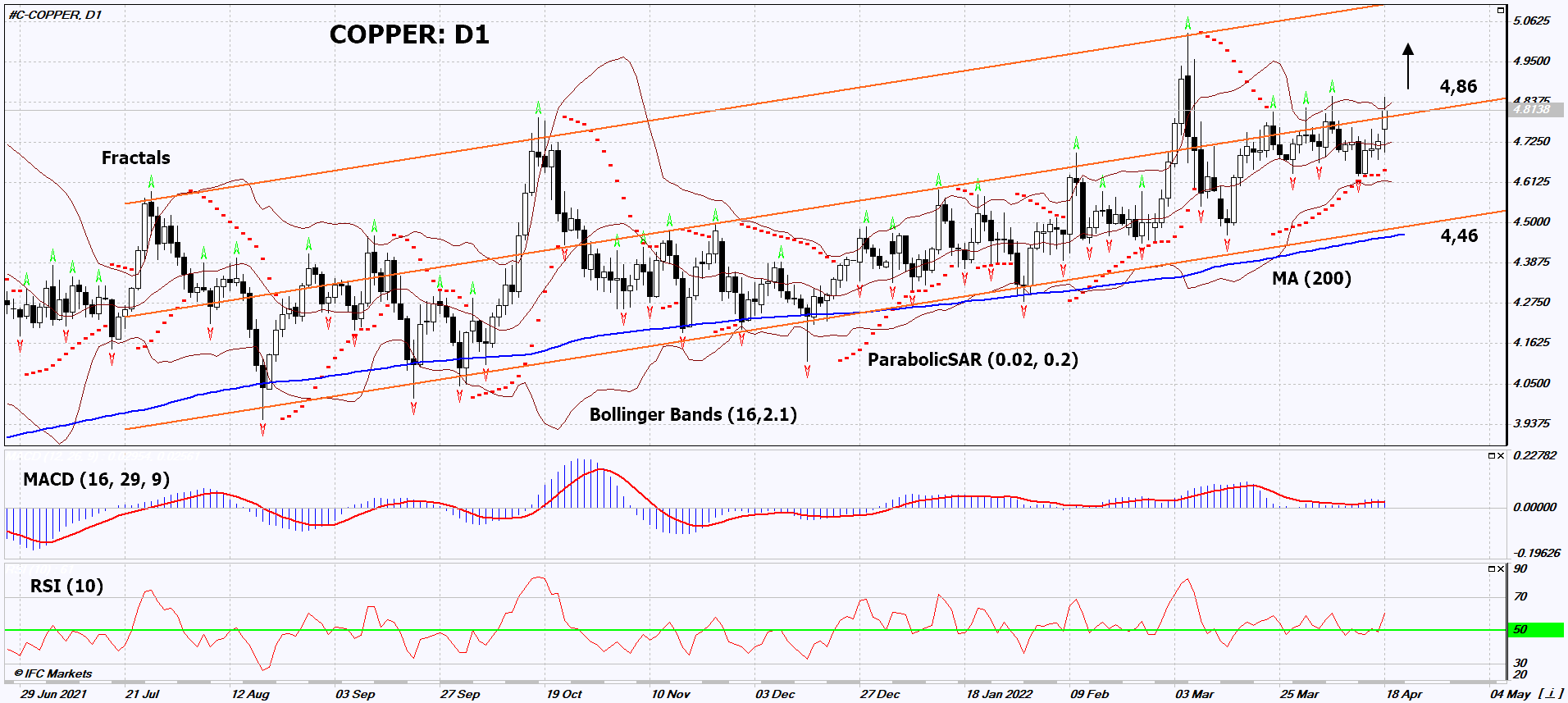

Copper Technical Analysis Summary

Buy Stop։ Above 4,86

Stop Loss: Below 4,46

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Copper Chart Analysis

Copper Technical Analysis

On the daily timeframe, COPPER: D1 is moving towards the upper border of the growing price channel. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if COPPER rises above its latest up fractal and upper Bollinger band: 4.86. This level can be used as an entry point. Initial risk cap possible below Parabolic signal, latest down fractal, lower Bollinger band and 200-day moving average line: 4.46. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we are changing the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (4.46) without activating the order (4.86), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Commodities - Copper

China released good economic data. Will the increase in COPPER quotes continue?

Chinese GDP in the 1st quarter of 2022 grew by 4.8%. This is more than expected (+4.4%) and more than the growth in the 4th quarter of last year (+4%). China consumes more than half of all copper in the world. Its economic growth usually leads to an increase in demand for non-ferrous metals. We note that copper inventories at the Shanghai Futures Exchange fell by 8.2% over the week. In addition to signs of an increase in global demand, an additional positive for copper may be the emerging lack of supply. Last week, Canadian company Barrick Gold reported a 19.8% decrease in the production of this metal in the 1st quarter of this year compared to the 4th quarter of 2021. The reason for this was the problems at the Lumwana mine. In Peru, because of the protests of the population, the work of the Las Bambas copper mine was again suspended. The Chilean Copper Commission (Cochilco) raised its 2022 global copper price forecast to $4.4/lb from $3.95 in January.