Is there any correlation? as i noticed that whenever DJ30/SP500 is bullish. Same goes for EURO side Indexes…

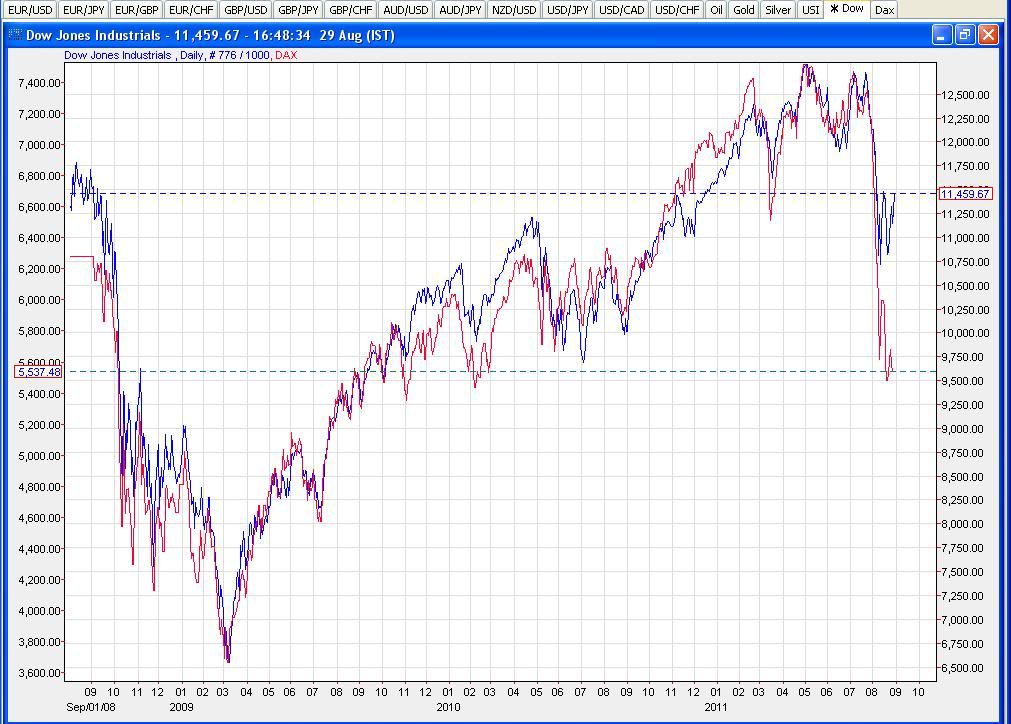

Here’s an overlay of the Dow (blue) and Dax (red) on a Daily chart over the past 2 years:

Here’s the same overlay on a Weekly showing the past 14 years:

As you can see there’s a pretty decent correlation between the two Indices.

thanks for the insight pipbandit. Now i understood why when the market rallied upwards even Euro tagged along. Even though it seems that euro is still in crisis over their laden debt.

It’ll tend to do that as you can see in the daily Dow / EURUSD overlay below as money flows out of USD cash and into riskier assets around the world plus various other factors. You can also see there was a period when the correlation was blown out of the water once the EZ debt crisis really kicked off in Nov '09. Then the correlation resumed as QE2 took off to prop up equities and USD took a hammering as a result. Then it broke down again during the recent stock market plunge where E/U pretty much just consolidated while the Dow fell sharply. Probably various Asian and ME countries as well as Russia diversifying some of their very large reserves out of USD into other currencies such as EUR helped prop it up.

You can see the inverse happening with the Dow overlayed with the US Dollar Index. Often when the DXY is dropping the Dow is rising and vice versa but there are times when the correlation breaks down for various reasons.

How calculate the correlation?

what is correlation …?

pleas say something more…