Costco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States, Puerto Rico, Canada, United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China & Taiwan together with its subsidiaries. It offers branded & private-label products in the range of merchandise categories. It also operates e-commerce websites in the US, Canada, UK & many other countries. It is based in Issaquah, Washington, comes under Consumer Defensive sector & trades as “COST” ticker at Nasdaq.

COST is trading at all time high, suggesting further upside as the part of I of (I) of ((III)). It expects short term upside in 3 of (3) of ((3)) & remain supported in 3, 7 or 11 swings at extreme areas.

COST - Elliott Wave Latest Daily View:

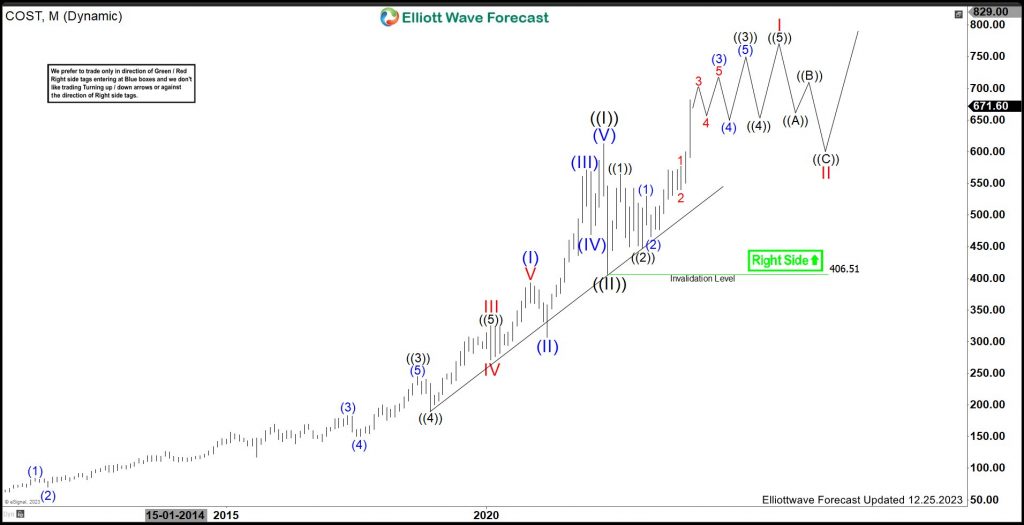

In Monthly sequence, it finished (I) at $393.15 high in November-2020 & corrected in (II) at $307 low in March-2021. It extended higher in (III), which ended at $571.49 high in December-2021. It corrected in (IV) at $469.01 low as 0.382 Fibonacci retracement. Finally, it ended (V) at $612.27 high as ((I)) as bullish sequence since 1986 low. It corrected lower in ((II)) which, ended at $406.51 as sharp pullback.

COST - Elliott Wave Latest Monthly View:

Above ((II)) low, it already broke above ((I)) high, confirmed upside to be I of (I) of ((III)) sequence. It ended ((1)) of I at $564.75 high & placed ((2)) at $447.90 low. Above that, it favors upside in (3) of ((3)) of I. It ended (1) of ((3)) at $530.05 high & (2) at $465.33 low. It already broke above (1) high, ended 1 of (3) at $576.19 high & 2 as flat correction ended at $540.23 low. Currently, it favors upside in ((iii)) of 3 & expect one more push higher to finish it before pullback may start in ((iv)) of 3. It expects any pullback in 3, 7 or 11 swings towards extreme areas to find support to resume higher.