Well, let’s see the latest COT report.

BTW…yeah FE, MM, I belong to Barchart (pay up a good monthly fee to them). I’ve looked at those charts. I’m aware of it. I think the comparison is a little difficult, but that’s just me. I like to do the comparison myself.

You got to remember that all you’re doing is comparing each currency to the US Dollar. Sure, that’s fine. Most traders and analysts do that. Can’t disagree. I just like the bigger picture regarding the currency’s. Their aggregate. The sum total of their 7 pairs. That’s all. A bit of difference.

That’s how I look at the market. And analyze it. Like what I’m about to do now. But if you see something different or similar then come on in and bring it.

I’m gonna try to get more simpler here.

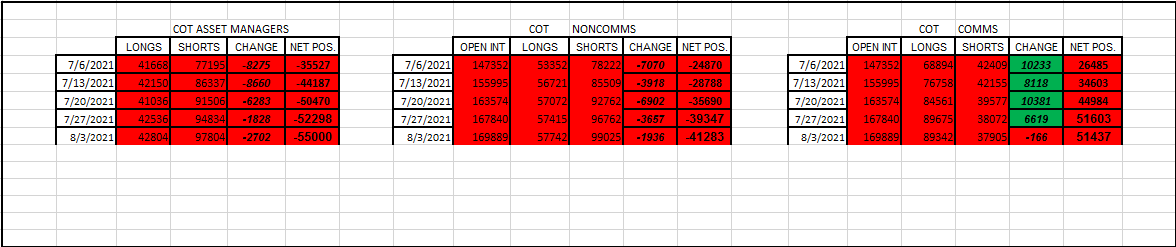

USD.

Looks like the trend is continuing. Although the Asset Managers have been more bearish than the Non Comms.

Here’s the trend.

The uptrend is still intact.

This week they were riding on a support level. Couldn’t fall below it. NFP boosted it.

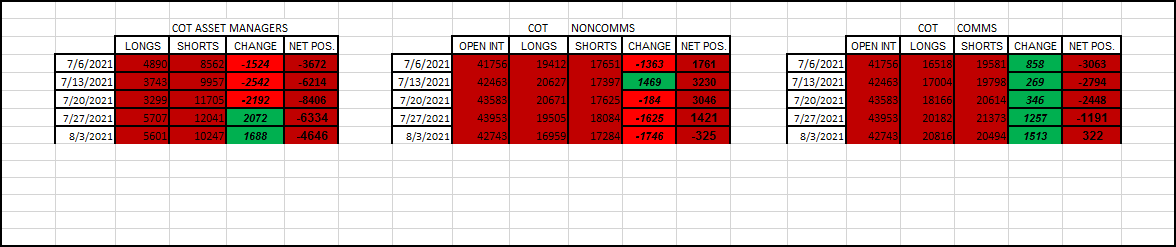

EUR.

Well, I just see the EUR getting stronger lately. I see that in the weekly change column.

The EUR continues on their bull trend, since like most of the year now. No changes being indicated.

GBP.

Same thing. Becoming more bullish as the weeks go by.

Their bull trend has continued since the year started.

No changes are being indicated.

The CHF.

Little disagreement between the 2 speculators. It’s fair to say that the sentiment has been mixed lately.

A big fall this past week. But I consider the Swiss still on a bull trend.

JPY.

Same story here with the other safe haven. It’s been back and forth. Mixed lately.

The trend is definitely slipping back into doing what they do best.

Move lower.

AUD.

The bearish theme continues with the speculators.

The big picture tells it. If your a trader, you would want to be short than long. I’m just saying…the trend is continuing.

Oh, and no indication of a change to that either.

NZD.

This weeks been bearish from the Non Comms, but a bit more bullish from the A.M.'s. But to look at the Commercials, they seem to be getting more bullish, which in my mind should be the complete opposite of the speculators. So maybe they are becoming more bearish for us speculators (like the AUD).

Big jump this week. No doubt. But I’m not calling it enough to change their trend. We got to see what happens next week.

CAD.

More bullish coming from the speculators, and more bearish coming from the commercials lately.

But in this context, you have to see that their trend is broadly for down. They surely fell from grace lately. It’s like their starting the year all over again from 0 now.

And that’s all of them.

You do not need to be a genius to see which currencies have been the easiest to trade this year. I would say this would be that order.

- The EUR

- The GBP

- The JPY

- The USD

- The AUD

And these trends will continue.

Until they change.

When they do, I’ll give you heads up.

Mike