Futures for WTI Crude Oil showed a downward trend during the Asian session, shedding 0.74% in value, and are currently trading in the 103.3 area. Investors open short positions on the instrument, reacting to the negative statistics on the excessive growth of stocks of raw materials in the US against the backdrop of a reduction in global consumption.

According to the US Energy Information Administration (EIA), energy stocks rose by 9.382M barrels last week, although analysts had forecast an increase in 863K barrels. The sharp move is partly due to a sudden decline in US refining capacity utilization, which has also caused gasoline and distillate inventories to shrink, and inventories are on the rise due to the release of “black gold” from the country’s national strategic reserves. It is worth noting that initially, this statistic was ignored by traders, and on Wednesday, the asset strengthened, but now you can notice the delayed impact of the news and the decline in energy quotations.

However, the market situation remains tense due to possible disruptions to global supplies. Investors are watching the development of the military conflict in Ukraine and sanctions against the Russian economy, including possible restrictions on the transportation of hydrocarbons. The US and UK authorities have already abandoned Russian fuel, but the EU has so far refrained from an embargo on oil and gas imports. On Wednesday, the International Energy Agency warned that the market would miss about 3M barrels of oil per day since May due to prohibitive measures. Major global trading houses also plan to cut fuel purchases from Russian state-owned companies. In particular, one of the largest oil traders in the world, the Swiss-Dutch company Vitol Group, intends to stop trading in oil and oil products from Russia until the end of 2022.

A temporary decrease in demand for “black gold” in China due to anti-COVID restrictions smooths out problems with the supply of raw materials globally, but as demand recovers, quotes will grow. WTI Crude Oil above 100 dollars per barrel is a sound long-term target.

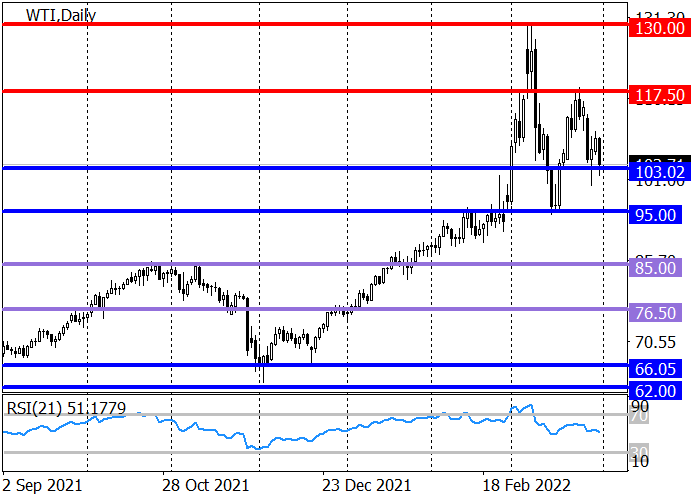

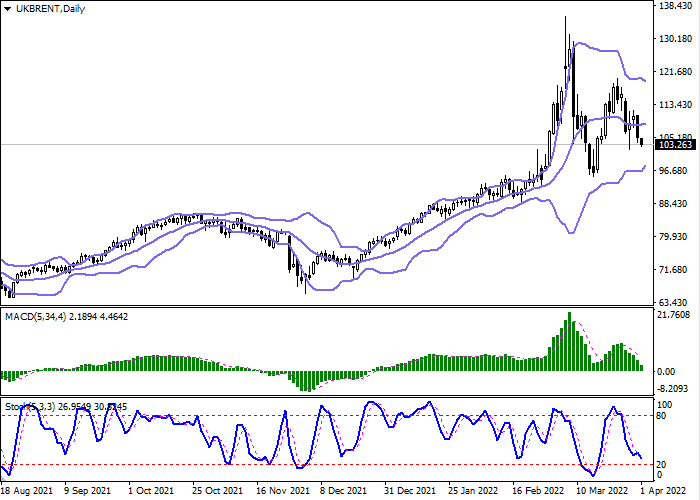

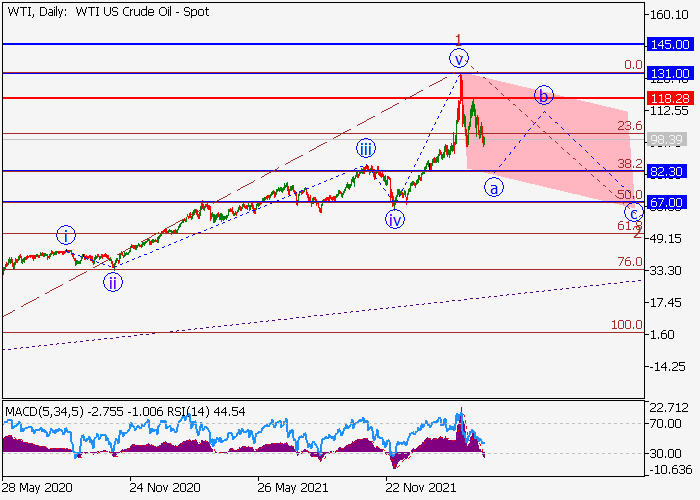

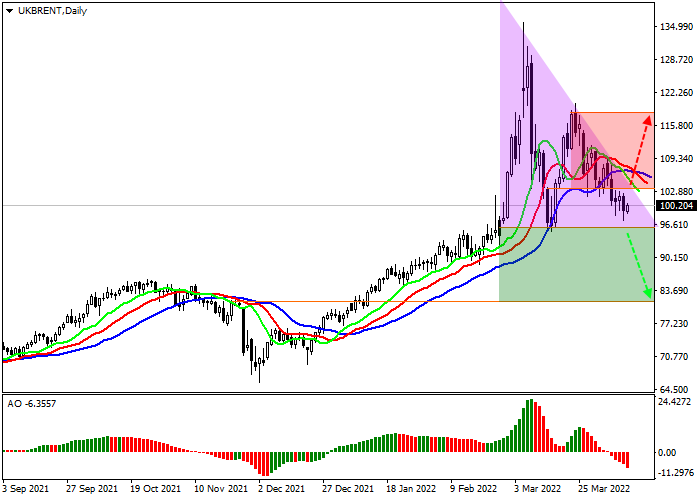

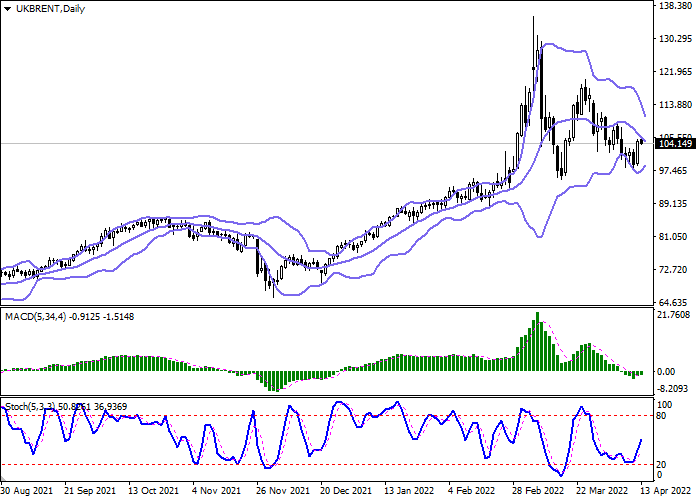

The long-term trend is upward, and its key support is 95. Last week, the “bears” unsuccessfully tried to reverse the trend, but as a result, the rate is approaching the resistance of 105.75, in case of a breakout of which, the next growth target will be 117.5.

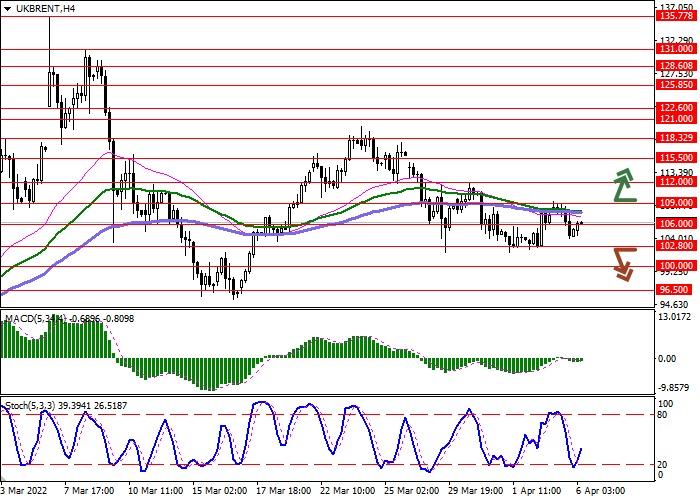

The medium-term trend is downwards. This week there was a price correction to the area of key resistance 103.71–102.76. As long as sellers hold this area, short positions can be considered with the target at the current week’s low. If the key resistance is broken, the trend will reverse upwards, and zone 2 (113.21 - 112.26) will become the target for long positions.

Resistance levels: 105.75, 117.5 | Support levels: 95, 85

Trade with a True ECN Broker

Solid ECN Securities