Crude oil is looking fatigued after its breakneck run higher, failing for two consecutive sessions to break convincingly through the $88 per barrel level. With RSI sitting in overbought territory and headlines boasting oil is on the longest wining streak in years, the technical and contrarian indicators are starting to flash warning signals about a potential near-term pullback. But with fundamentals underpinning this latest bout of strength, any pullback will provide an opportunity for traders to add or establish fresh longs.

Crude oil in beast mode

There’s no doubt about it; crude oil has been in beast mode since the start of July, and for good reason. Supply is being constricted by the world’s largest exporters – Saudi Arabia and Russia – who committed to maintaining the status quo until the end of the year earlier this week. Saudi will reduce production by one million barrels per day until December. Meanwhile, Russian exports will be cut by 300,000 barrels per day over the same period.

At the same time, demand is strong despite all the negativity about the global economy, especially in relation to China. According to data from the International Energy Agency, world fuel usage hit a record high 103 million barrels per day in June, boosted by air travel, power generation and petrochemical production in China. The agency forecasts demand for crude oil will lift by 2.2 million barrels per day this year, 70% of which will come from China. Meanwhile, global supply is tipped to increase by just 1.5 million barrels per day.

As a result of the mismatch, oil inventories in developed nations have fallen to around 115 million barrels below their five-year average. In the United States, the largest consumer globally – stockpiles have fallen to lows not seen since late 2022 ahead of fresh data from the US Energy Administration on Thursday.

Fundamentals suggest crude oil dips will be shallow

With strong fundamentals underpinning the market, it comes as no surprise that US crude prices have surged over 30% in a little over two months, including 13% over the past two weeks, leaving it at the highest level since November. It also means that in the absence of a sharp deterioration in the US economy, or a reversal of the OPEC+ restrictions on supply, pullbacks are likely to be limited in the near-term.

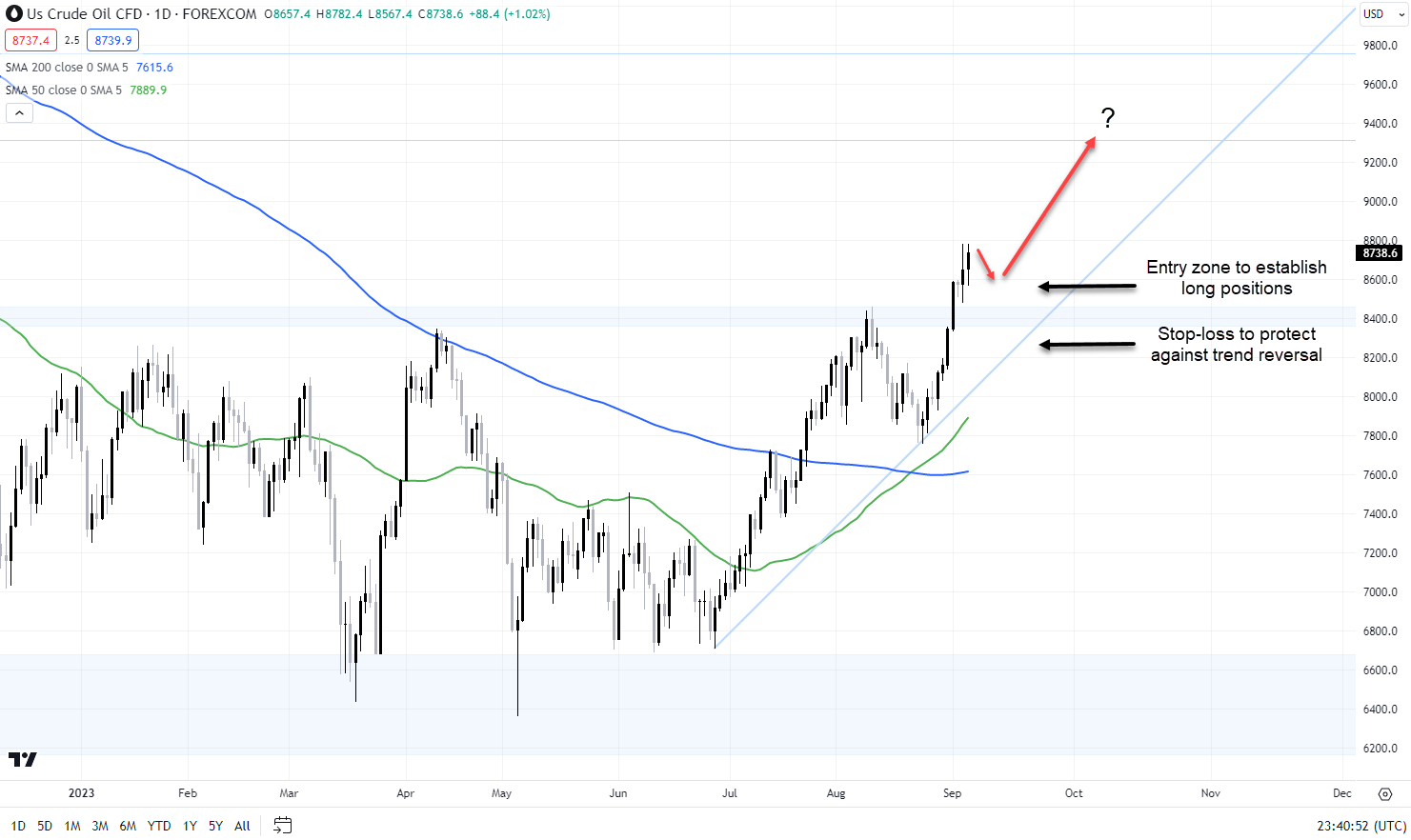

But we may be on the cusp of one right now. It’s moved a long way fast and everyone seems bullish, creating an opportunity to lean against stretched positioning. However, the risk-reward does not favour meaningful downside, but nor does buying right now given the run we’ve had. As such, if we do ease lower, it will offer an attractive entry point to establish long position.

Dips towards $86 per barrel or even slightly below may be suitable for such a trade given it sits above a meaningful support zone beginning at $84.50 per barrel. A stop below the bottom of that zone at $83.50 will offer protection against a trend reversal. On the topside, $88 per barrel is a level that must be overcome after two consecutive failures. A break there puts crude on target to move towards $93 per barrel.